Many Canadian energy stocks have faced a tough bear market for the past many years. Obviously, oil prices going negative in March last year didn’t help. Yet, if anything, the pandemic has forced many energy businesses to become more efficient, more competitive, and more shareholder friendly.

Now, as the world recovers from the pandemic, energy demand is increasing. Yet supply has, for the most part, remained stagnant. Consequently, oil prices and energy demand should, at least in the short term, remain near pre-pandemic levels (i.e., above US$60 per barrel). Combine stronger, more efficient business models with stable, higher pricing, and you get a recipe for some very solid cash flow returns.

A Canadian energy stock without the oil price risk

Undoubtedly, energy stocks are incredibly volatile simply due to their reliance on the price of oil/gas commodity pricing. If you want to play the oil recovery with limited commodity risk, Enbridge (TSX:ENB)(NYSE:ENB) is an attractive Canadian stock to consider. Its pipeline network transports 25% of North America’s crude and 20% of natural gas consumed in the U.S.

As oil producers grow more comfortable with increasing production, Enbridge should start to return to normal transportation volumes. That should present a nice boost to earnings in 2021. Yet, should that not transpire, 98% of its assets are contracted or regulated. Regardless of commodity prices, cash flows from its pipelines and storage assets have a baseline of predictability.

Right now, the stock pays a very attractive 7.2% dividend. As the energy sector sentiment starts to return, this stock should bounce back to its pre-pandemic levels. While you wait, you get to enjoy a very attractive rate of steady cash payments into your pocket.

A Canadian favourite energy stock

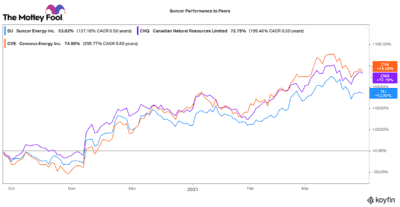

Suncor (TSX:SU)(NYSE:SU) is another Canadian energy stock that looks like it could be set for a nice recovery. Over the past six months, Suncor has significantly underperformed peers like CNQ and Cenovus.

Yet, the company has been making significant progress operationally. During the pandemic, management reduced costs (about $1.3 billion), created operational efficiencies, and improved its balance sheet. Consequently, this business is free cash flow positive (after dividend payments even) at US$35 per barrel.

While this Canadian stock has slightly higher debt than say CNQ, it should be producing significant amounts of free cash flow at +$60 per barrel oil. Excess cash flows can go towards paying down debt, share buybacks, and new investment initiatives (such as in green energy). All this means that Suncor has an attractive path to its pre-pandemic levels, and that makes it a nice buy today.

A green energy alternative

If you just aren’t comfortable with oil-related stocks (I understand; it’s been a tough sector), one green energy stock I like today is Brookfield Renewable Partners (TSX:BEP.UN)(NYSE:BEP). This stock is not “cheap” like its oil-producing peers, but it is trading around 15% lower than its highs set in February.

This stock is consistently more expensive, simply because it has some of the best and most diversified renewable energy assets in the world. It has an enviable portfolio of hydro power assets that are impossible to replicate. These are complemented by a growing portfolio of wind, solar, distributed generation, and storage assets.

I like this stock because it has a great management team, a solid balance sheet, and both organic and acquisition/development growth opportunities ahead. This Canadian stock pays a nice 3% dividend. Yet, given its internal growth metrics, that dividend should continue to rise by 6-9% per annum for the conceivable future. It’s a great risk-off take on some of the slightly more risky energy assets above.