Although legendary investor Warren Buffett’s Berkshire Hathaway changed its stance on gold and sold off its Barrick Gold (TSX:ABX)(NYSE:GOLD) stock holdings before the end of last year, insiders have amassed significant stakes in the leading precious metals miner’s shares recently. Should we read much into their share purchases?

Directors and senior officers at Barrick Gold actively bought their company’s stock during the past three months. To be exact, insiders “purchased” an aggregate of 453,330 shares in late February and March this year.

Almost everyone was buying — and insiders sold zero shares during the period.

Why do insider trades matter?

In one investment strategy, investors monitor and mimic what corporate insiders are doing. If insiders sell stock in droves, investors read into that “market signal” and take hid. If insiders are buying massive amounts of their company’s stock, investors take that as a bullish signal and buy shares too.

The main idea is that corporate insiders have a better understanding of the business and expert knowledge about the company’s operating environment. Insiders have a better understanding of the industry, industry economics, and other evolving dynamics that may affect the company’s financial performance. Following their lead in buying or selling a company’s stock could therefore result in better investment returns.

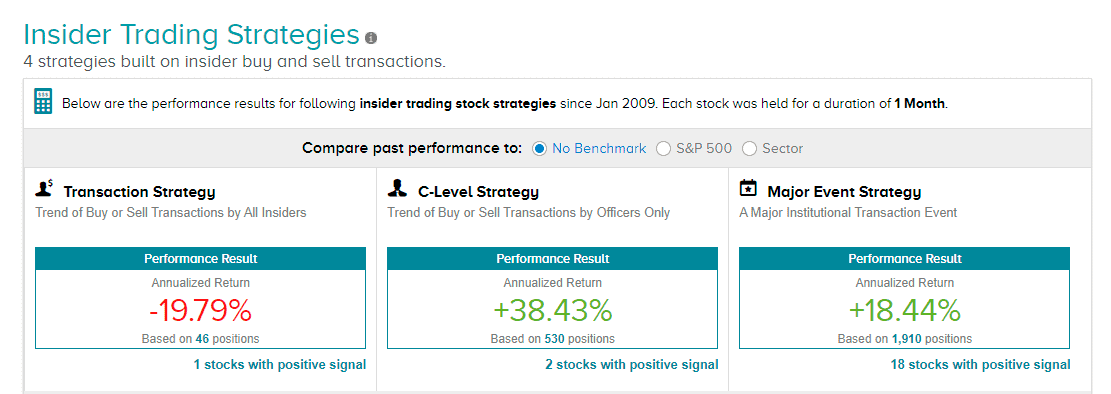

Data from TipRanks shows that replicating corporate insiders’ trading activity — and specifically officers — is a strategy that has produced 38.4% in annualized returns since January 2009.

Insiders may sell their company’s stock for several reasons, including portfolio allocation, child education, or when buying that long-desired yacht. But they usually buy for two reasons, both of which are bullish. They either buy to show solidarity with shareholders (this applies mostly to new senior leadership) or they will be very bullish on what they see the company achieving in the near future.

With that said, I strongly believe that investors shouldn’t read too much in Barrick Gold insiders’ recent stock “purchases.”

Barrick Gold insiders’ stock buying spree not an investment signal

The SEDI database highlights that Barrick Gold officers’ and insiders’ common shares mostly purchased following the vesting of “one-third of PGSU award.” The company has a standing Performance Granted Share Unit (PSGU) plan that motivates staff to perform harder and meet targets.

Under the PSGU, insiders may not sell acquired shares until they leave employment. And insiders may not sell the shares two whole years after leaving employment.

Investors shouldn’t read into insider trades at Barrick Gold during the past three as stock purchase signals. That said, the fact that insiders are earning performance-linked equity awards should be a positive highlight. It’s evidence of the fact that the mining house achieving its long-term strategic targets.

Is Barrick Gold stock a buy today?

Although revenue for 2021 could decline marginally by 1.5% to $12.4 billion, analysts expect the company to report a further expansion in its gross margins this year and further contain its operating costs. According to data from the Tikr Terminal, Barrick’s normalized net income is could grow by 15.8% year over year in 2021. Most noteworthy, the company’s normalized earnings per share could increase by 12% year over year to $1.29 this year.

The precious metals miner has a much stronger balance sheet right now, and managed to turn around its balance sheet in eight years from an $11.6 billion net debt position in 2012 to a net cash position of $33 million by 2020. Analysts expect Barrick to generate nearly $3 billion in free cash flow this year. The dividend could grow by 9%.

In summary, Barrick Gold is more profitable, more financially secure and becoming more cash flow rich in 2021 and beyond.

I would buy such a stock any day.