Canadian bank stocks like TD Bank stock seem to come out of every crisis as examples of success stories. And this pandemic crisis appears to be no different. Canadian banks have fared well so far despite ratcheting up their provisions for loan losses last year. Their diversification and financial strength has saved the day once again.

Without further ado, here are the two top Canadian bank stocks to buy now.

Consistent top performance on efficiency

Currently yielding 3.8%, Toronto-Dominion Bank (TSX:TD)(NYSE:TD), is a top bank stock. For example, it’s one of the two largest Canadian banks. It’s also the fifth largest North American bank. Furthermore, TD Bank continues to stand out for its success in driving efficiencies. The bank has an industry-leading ROE. And it has a conservative approach that mitigates risk. For example, TD Bank adheres to strict controls with regard to lending practices. This pays off big, especially in the bad times. And these are bad times.

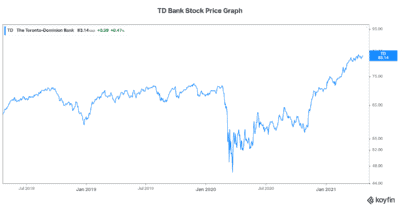

TD Bank’s resiliency is clear. 2020 earnings fell dramatically relative to 2019. But the overall impact of this disastrous year was not as bad as one would think it would be. TD’s liquidity remained strong. And its capital ratios remained exemplary. These are the key measures of a bank’s resiliency. TD gets top grades on both of these measures. The graph below shows the dip and recovery that TD Bank stock has endured this past year.

So back to the dividend, another reason to own TD Bank stock. Investors like you and I can always benefit from a dependable dividend-payer. And TD Bank is just that. Since 1995, TD Bank has delivered an 11% annualized dividend growth rate. This dividend growth history shows no signs of stopping.

TD Bank will be reporting its next quarterly result at the end of May. Canada is in the midst of the third wave of the virus. This will likely create another period of high uncertainty and rising loan loss provisions.

A dominant position

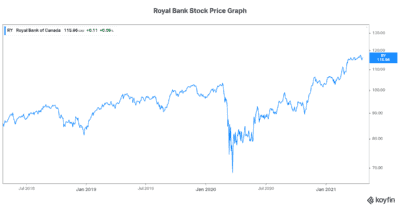

Royal Bank of Canada (TSX:RY)(NYSE:RY) is Canada’s largest bank, with a market capitalization of $119 billion. The stock has more than recovered from March 2020 lows, and it’s been an incredible ride. The graph below illustrates this.

This strong recovery is well justified as this Canadian bank enjoys leading operating efficiency and a dominant market share in many segments. Today, Royal Bank stock is yielding 3.74% and it remains well capitalized. It’s a bank stock of the highest quality.

Royal Bank will also report its next quarterly result In May. We should watch closely to see how the bank handles the effect of this third wave of the virus.

What’s ahead for Canadian banks like TD Bank?

Looking ahead, Canadian banks may be headed for some trouble as the third wave of the virus has hit us hard. Lock downs will once again take their toll. But even more significant is the risk of inflation. The massive amount of stimulus that has been pumped into the economy recently is unprecedented. This will likely cause inflation to rear its ugly head. And as we know, inflation is not good for banks. It will cause interest rates to rise, which will slow the economy, which can potentially weaken the banking business.

So what’s to come in 2021? Well, Royal Bank management had a very cautious tone on their latest earnings call. They are overweighting their most pessimistic scenarios for 2021. And they are expecting pain. TD Bank has also been cautious, recognizing the perilous environment.

The fact is that there are many struggling areas of the economy. And this third wave will just accentuate their problems. Also, government programs will end one day. Was all the damage simply delayed until another day? Will the mitigation only serve to delay the inevitable? This remains unclear.

The bottom line

Canadian banks are famous for their resiliency and for their financial strength. TD Bank stock is certainly a leader. As is Royal Bank stock. Although a difficult period may be ahead of us, I think that buying these bank stocks now is a good move.