Telus (TSX:T)(NYSE:TU) is a force to be reckoned with. After all, it is one of Canada’s leading telecommunications companies. No matter what you’re looking for as an investor, Telus probably has it. From dividend growth to innovation to stability, Telus stock keeps on giving.

Here are the three main reasons to buy Telus stock today.

Telus stock = dividend growth

This $34 billion telecom giant is also a dividend-growth king. In its latest quarter, Telus increased its dividend by another 8.6%. It translates to a healthy dividend-growth rate that has been sustained for many years. In fact, its dividend has grown at a compound annual growth rate of almost 9% in the last 10 years.

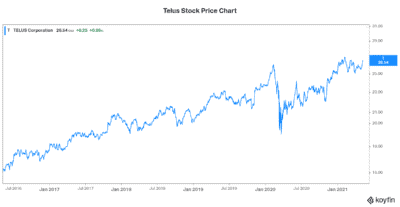

What can investors take away from this? Well, the obvious thing is that Telus is a stock that will deliver growing dividend income for years to come. But also, Telus’s dividend growth and reliability is a reflection of its underlying business. It’s a strong free cash flow-generating business that has proven to be quite reliable and resilient. Take a look at Telus stock’s price graph to see its exceptional five-year performance.

Telus accelerates its broadband expansion

Fibre networks are all the rage these days. The performance of these networks is second to none. And the payoff is becoming increasingly obvious. Fibre optics networks bring numerous advantages versus the traditional copper networks. For example, with fibre optic networks, average revenue per user (ARPU) is 50% higher. Also, operating expenses to support fibre are 20% lower. The benefits are clear.

And not only do the benefits accrue to Telus; they also accrue to the user in the form of a more complete and fulfilling offering. This can be seen in the fact that the number of products per household that has fibre networks is 25% greater. Also, the loyalty of fibre customers is stronger. This is evidenced by the ultra-low churn rate of fibre customers.

So, given all of this, it’s easy to understand why Telus is accelerating its investment in its broadband expansion. It will bring all of these aforementioned benefits. Finally, the fibre offering combined with Telus’s 5G offering will propel growth in Telus Health. It will, in fact, propel growth in all the digital verticals that Telus is pursuing. And it’ll drive Telus’s stock price higher.

Telus stock: High-growth, technology-oriented verticals will boost growth

Technology solutions is Telus’s area of growth. It’s Telus’s growth engine that is sparking innovation. Digitally led customer experiences saw a healthy double-digit revenue growth last quarter. This includes Telus Health and Telus International. The health vertical is the most advanced vertical today. It’s a preview of what Telus can achieve through these technology verticals.

Here are some statistics that might get you excited about the future of Telus technology solutions. Virtual care visits, facilitated by Telus, nearly tripled. Telus Health Services revenue increased 10%. Looking ahead, Telus Health will focus on three high-growth areas. The first is primary care services. This includes 16 healthcare centres across Canada with virtual care services and connected care such as home health monitoring. The second is healthcare provider solutions. This is the physician and pharmacy solution that shares patient information with clinicians that are using Telus records. Finally, Telus’s health insurance benefits management (HBM) solution covers a total of 17.5 million under its solution. Easy claims management and more have allowed HBM to thrive. This is a mature business that has achieved strong margins.

Overall, Telus’s technology verticals have room for significant growth. In the future, more verticals, like Telus Agriculture, will drive additional growth. Telus Agriculture is a connected tech solution that will improve connectivity and efficiency of food systems. From Telus’s website: “Telus Agriculture optimizes the food value chain by leveraging data in new ways to increase efficiency, productivity, and yields.” Telus is aiming to bring technology and all of its benefits into different industries. In my view, this will ensure that Telus’s stock price continues to outperform.

Motley Fool: The bottom line

Telus stock suits many investors. Strong dividend growth and innovation-fueled growth make Telus stock a top stock today.