A stock market crash is a real risk today and we should therefore position ourselves for this possibility. We can do this by buying quality dividend stocks. The best dividend stocks to buy all have a few things in common. They’re reliable, dependable, and resilient. They’re also the best at what they do. Fortis (TSX:FTS)(NYSE:FTS) has all of these qualities. According to many of us at Motley Fool, this is what makes it one of the best dividend stocks to buy today.

Dividend stocks for the good times and bad

The last year has been exceptional for the stock market. At Motley Fool Canada, we have covered this every step of the way. In fact, the market’s performance seems to tell us that everything is just fine. But is it? The losses have been real. The risk of inflation is real. Elevated valuations are real. In my view, the expectations that are priced into the stock market are overly optimistic. There’s simply a lot of money to be made in chasing stocks (and Bitcoin) higher!

Dividend stocks are always a great way to provide some protection and income. They can provide this in the good times and in times of economic and stock market weakness. Today, stock markets are still holding up after one of the most difficult years in recent history. The pandemic has taken a huge toll on many companies. Most have held in there with the help of government programs.

Now that the vaccine rollout is rapidly unfolding, what will a return to normal mean? Can the stock market continue to outperform? Are we headed for a crash? These are all relevant questions. Much uncertainty remains. And with valuations still at elevated levels, we should consider fortifying our portfolios with the best dividend stocks.

Stock market weakness can’t bring Fortis stock down

So if a stock market crash is in the cards, we won’t know it until it’s actually upon us. The TSX Composite Index has rallied 13% so far in 2021. There has been a massive shift in the economy, but it’s clear that the money is still there. But is it really justified for the market to be trading at all-time highs today? I think there’s an element of overly optimistic expectations playing a role here.

After lock downs and a stressful year-and-a-half of a pandemic, people are looking for hope — hope that things will get back to normal – which they will very soon. And hope that the economy will pick up right where it left off, which it probably won’t, in my view. Government programs have really blunted the impact of the pandemic. But perhaps many of the problems have just been put off until tomorrow. And guess what? Tomorrow is fast approaching.

Government help can’t last forever. It can’t sustain the record amounts of spending. It’s coming to an end, at which point, the economy will be left to fend for itself. I recommend buying the best dividend stocks to position yourself for this. I also recommend setting some money aside so you can be ready if and when the stock market crash happens. This is where we at Motley Fool come in.

Best dividend stock to buy for protection from a stock market crash

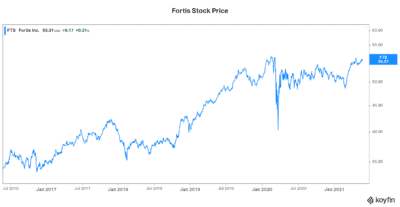

Fortis is a leading North American regulated gas and electric utility company. It’s also a leading dividend stock yielding 3.65%, with 47 years of dividend growth under its belt. Fortis’s earnings and cash flow are highly predictable due to its defensive business. It’s a highly regulated and essential business (80% regulated or residential). This means that Fortis will be okay.

In fact, the company expects a 6% dividend growth rate through to 2025. This is not a company that just throws out an expectation. It’s backed by real evidence. It’s backed by its highly defensive business. It can thrive despite economic troubles and a stock market crash.

The bottom line

So the bottom line here is simple. I think the risk of a stock market crash is real. I also think that buying the best dividend stocks like Fortis stock will protect you from any future stock market vulnerabilities.