The best stocks to buy and hold forever are special stocks that have been featured often on fool.ca. They’re not all from the same industry, but they have many things in common. Toronto-Dominion Bank (TSX:TD)(NYSE:TD) and Fortis (TSX:FTS)(NYSE:FTS) are two such stocks. They’re very different, yet they’re the same in the most important ways.

Here at Motley Fool, many of us have, in fact, liked these two stocks forever. Let’s dig in.

The best Canadian stocks to buy and hold forever are long-term value generators

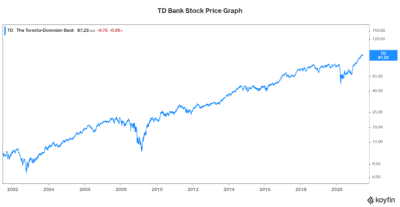

Let’s take TD Bank stock for starters. This Canadian bank has been a value generator for decades. It’s resilient, growth-oriented, and it has survived many crises. TD Bank is one of the two largest Canadian banks. It’s also the fifth-largest North American bank. In fact, TD Bank’s stock price reflects this reality. The following 20-year stock price graph pretty much says it all:

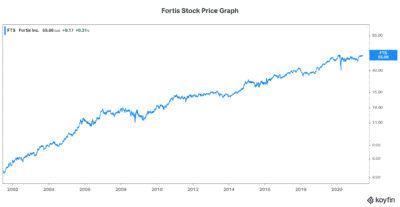

Fortis stock is another resilient value generator. This company has an impressive history and a bright future. This company is a leading North American regulated gas and electric utility company. It’s also a leading dividend stock that’s yielding 3.6%. Furthermore, it has 47 years of dividend growth under its belt! This is a significant and impressive track record. Fortis’s 20-year stock price chart also reflects this reality:

TD Bank stock: A bank stock that has made it through thick and thin

TD Bank’s resiliency was put on display once again last year. The pandemic was a highly risky situation that caused provisions for loan losses to spike. The bank’s customers were hurting, and it showed. But TD Bank dealt with this like the well-capitalized, diversified giant that it is. With the help of government support, the blow was manageable, and today, TD Bank is looking great.

TD Bank continues to stand out for its success in driving efficiencies. The bank has an industry-leading ROE. And it has a conservative approach that mitigates risk. TD Bank’s resiliency is clear. 2020 earnings fell dramatically relative to 2019. But the overall impact of this disastrous year was not as bad as one would think it would be. TD’s liquidity remained strong, and its capital ratios remained exemplary.

This Canadian bank stock is a prime example of a core long-term holding that many of us at Motley Fool are happy to hold forever.

Fortis stock: a utility stock that’s here to stay

Fortis’s earnings and cash flow are highly predictable. Its defensive business makes it so. It’s a highly regulated and essential business (80% regulated or residential). This means that in the good times and bad times, Fortis will be okay. In fact, this is highlighted by the fact that the company expects 6% dividend growth through to 2025. This is not a company that just throws out an expectation. It’s backed by real evidence and by its highly defensive business.

Fortis stock is another stock that many of us at Motley Fool think is a forever stock. When reliability, predictability, and resiliency matter most, Fortis is a clear stand-out winner. This is what makes it a top stock to buy and hold forever.

Motley Fool: The bottom line

TD Bank stock and Fortis stock are top stocks today. They are top stocks to buy and hold forever. I hope this article has given you a glimpse of the kind of money you can make by owning such stocks. Stick with them forever and reap the rewards.