With the S&P/TSX Composite Index hitting new highs on almost a daily basis, it is becoming more challenging to find cheap stocks to buy today. Ever since November last year, Canada’s financial, energy, materials, and industrial stocks have been enjoying a well-deserved recovery.

Consequently, value stocks are not so cheaply valued anymore. Yet, if you are willing to think long-term and be patient, there are still some bargains to buy. Here are three relatively cheap TSX stocks you can still swipe up today.

Enbridge: A top TSX pipeline stock

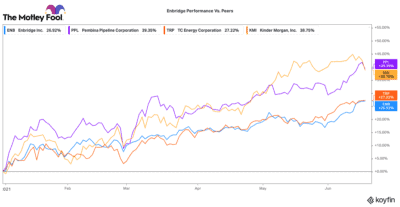

While Enbridge (TSX:ENB)(NYSE:ENB) stock has had a good recovery this year, it has still lagged other energy-related peers. But today, this stock still pays a 6.7% dividend. That is one of the highest yields on the TSX!

Now, this stock is not without its risks. It still faces a legal battle over its Line 5 pipeline in Michigan, as well as its Line 3 replacement project. Fortunately, just this week, the Minnesota top courts affirmed Line 3’s construction/regulatory approvals. Clearly, pipelines are almost impossible to build these days. Consequently, Enbridge’s current pipeline network should become increasingly valuable.

Enbridge transports 25% of North America’s oil liquids and 20% of the natural gas in the United States. Its assets are essential, so it is able to garner strong pricing power and very stable, predictable streams of cash flow. While this TSX stock has lagged, it should continue to recover as energy markets tick up.

Calian Group: An under-appreciated growth stock

Calian Group (TSX:CGY) is a growth stock that TSX investors can buy at a pretty decent bargain today. It provides critical solutions for institutional clients like the Canadian military, NATO, and the European Space Agency. Over the past few years, this business has been working hard to diversify its product mix, customer base, and geographic exposure.

It targets organic growth of at least 10% a year. Yet, it is also getting a growth boost through a number of recent attractive acquisitions. In its second quarter of 2021, revenues grew by 33% to a record $138 million.

Similarly, it increased adjusted EBITDA by 39% to $14.2 million. This stock pays a 2% dividend and only trades with a forward price-to-earnings ratio of 16 times. Given its strong profitability and growth profile, that is a pretty attractive opportunity.

Intertape Polymer: A TSX industrial/e-commerce stock

For a more industrial-focused stock that should benefit from the pandemic recovery, Intertape Polymer Group (TSX:ITP) is an interesting pick. It produces and distributes tapes, packaging, and wrapping solutions worldwide. While this business does not sound overly “exciting,” it is enjoying growth rates that align with the overall e-commerce industry.

Over the past few years, the company has been working to expand its production capacity, reduce costs, and diversify its product mix. When the pandemic hit, it saw a massive surge in demand for e-commerce packaging solutions. The company was prepared and enjoyed one of its best years on record.

Already in 2021, this TSX stock has been enjoying strong growth tailwinds. Yet, the second half of the year is setting up to be even better. The company is implementing a number of organic growth projects and is hoping to accrete +20% after-tax returns on investment.

The company has a very good balance sheet and acquisition growth could be on the books as well. The stock trades a fair discount to its larger peers, despite having a stronger growth trajectory. Intertape is therefore a top value stock to buy right now.