BlackBerry(TSX:BB)(NASDAQ:BB) is one of Canada’s leading technology companies. In fact, its expertise in the cybersecurity and “internet of things” industries is impressive. So why is this stock best known for its involvement in the Reddit meme stock craze? Are investors getting lost in the hype? How can we refocus on what we at Motley Fool know is important – fundamentals?

The answer to these questions is simple. Let’s remind ourselves of the basics. This means we have to focus on the business and not on the Reddit-induced stock price action. So here goes.

The disconnect between BlackBerry’s stock price action and fundamentals

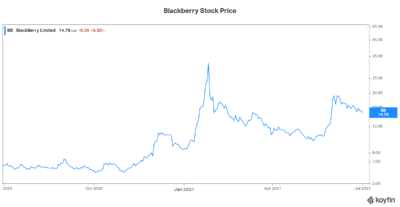

BlackBerry’s stock price has been on a wild ride in 2021. It started off the year below $10. By the end of January, it had rocketed up to $31. In May, it fell below $10. Today, BlackBerry stock stands at just below $15. But nothing fundamental really happened to justify this. In fact, revenues have been weak and disappointing.

Simply put, BlackBerry stock was part of the meme stock craze. While investors shouldn’t participate in this game, we can always find a way to benefit. I don’t invest like a speculator. We at Motley Fool are not about speculation. But I do take advantage of extreme moves.

In the case of BlackBerry stock, its quick rise to over $30 was clearly not sustainable. And its fall to $10 was also not sustainable. I mean, if you believe in the bullish fundamental story of BlackBerry, then you also see that the upside in this stock is huge. But it’s upside that should happen over time. It should have the backing of fundamentals.

We can trade around any extreme short-term stock price movements. Let’s just not lose sight of the bigger, longer-term picture.

Selling BlackBerry stock at $20

So when BlackBerry had its most recent surge due to the meme stock craze, I took advantage of it. I decided to sell my holdings at $20. But the key point here is that I fully intend to buy back at approximately $10. This is where the risk lies. I fully believe in BlackBerry’s business. I want to own the stock for the long term.

But now I have taken money off the table. I’ve taken advantage of a short-term price spike and I’ve monetized my gains. Hitting the reset button like this comes with its risks. What if BlackBerry stock doesn’t go back to $10? What if in the end, I risk losing out on far greater long-term returns?

Strong secular trends supporting it

So all I can say is that I’m betting on two things. First of all, I’m betting that BlackBerry stock will settle back as the meme stock craze fades. BlackBerry’s recent quarterly results have really demonstrated that the road ahead for BlackBerry is not quick or easy.

Second, I’m betting that the stock market in general is due for a pullback. I think we’ll be able to buy BlackBerry stock again closer to $10.

And this would be a fair price to get in on the massive opportunity that awaits Blackberry. The cybersecurity industry is expected to grow by at least 40% in the next two years. Furthermore, the automotive software industry is expected to grow by well over 200% in the next four to five years.

As a recipient of countless industry awards for its technology, BlackBerry is well-positioned to benefit from these significant growth rates.

The bottom line

Keep watching BlackBerry stock. It’s fast approaching $10 – a buy opportunity with this much upside and potential don’t come around often.