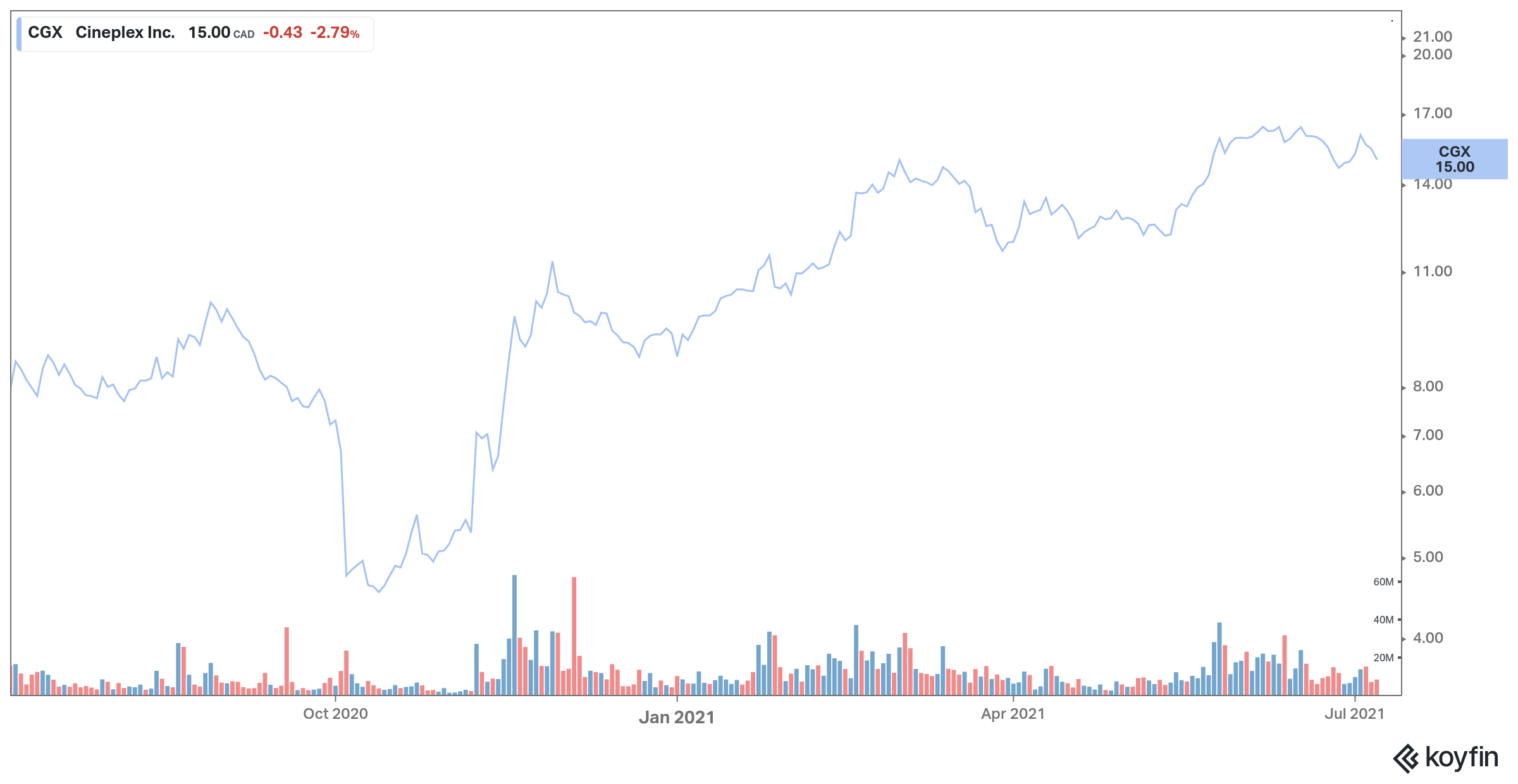

Cineplex (TSX:CGX) stock is up more than 75% over the past year and has hit a 52-week high in June. Investors appear to have a thing for the Canadian theatre and entertainment company following the easing of COVID restrictions across Canada. Is it a good idea to buy Cineplex stock this summer? You might want to think twice before buying shares of Cineplex.

Good news for movies lovers doesn’t mean good news for investors

Quebec got its second VIP cinema opening in Montreal on June 18, an attempt by the cinema chain to attract customers with plush seats and food service while you watch, albeit at reduced seating capacities in accordance with provincial COVID regulations.

British Columbia opened its doors to theatrical film screening the same week after six months in the dark, as vaccinations lowered the number of COVID cases and rekindled the promise of a relatively unrestricted summer.

While it’s good news for movies lovers, investors should not get too excited about Cineplex.

Streaming services like Netflix and Disney+ are a threat to the movie theatre chain. And reopening theatres isn’t an easy win for Cineplex, as pandemic restrictions of some form will likely be in place for some time, with no indication of when they will be lifted.

It will be a more difficult time for people to go back to traditional movie theaters in the next few months, as it is not clear how it all works. People aren’t sure whether they should be vaccinated or whether they should wear a mask or not. Not all people like to have to wear a mask at the movies for two hours. Things will take a long time to go back to normal.

Return to profitability is expected in 2022

Cineplex ended the 2020 pandemic year with revenue down 88% from 2019 to $52.5 million and a net loss of $230.4 million compared to a net income of $3.5 million for 2019. Before the pandemic, the company had managed to increase its revenues in 2019 by 3.6% compared to 2018 figures.

The first quarter of 2021 was significantly worse than the first quarter of the previous year. Cineplex reported revenues of $41.4 million, which is an 85.4% year-over-year decline. Box office revenue fell 96.6% to $3.8 million in the first quarter of 2021.

While it’s true that more consumers will attend theatres as they open up, it’s hard to believe that many people will be comfortable sitting in small, cramped rooms with strangers. In addition, the company has done nothing to address its issue of declining audience numbers.

For the second quarter, Cineplex’s revenue is expected to increase by 225% to $244.6 million, but a loss of $0.38 per share is expected. For fiscal 2021, revenue is expected to grow by 67.7% to $741.7 million but a loss of $3.21 is expected for the year. Profitability is estimated to come back in 2022 with an expected EPS of $0.22.

While a fourth wave of COVID-19 is unlikely, it’s a risk that we shouldn’t discount. Another wave could delay Cineplex’s return to profitability.

Cineplex stock is a risky bet

So, it’s probably wiser to wait until buying shares of Cineplex. There are much better places to invest your dollars this summer than into this high-risk stock.