The best Canadian stocks to buy today strengthen investors’ portfolios. They do this by providing important benefits. For example, they add resiliency. They also add predictability and diversification. These are all qualities that can help us accumulate wealth and prosper in the good times. They can also help shelter us in the bad times. At Motley Fool Canada, our goal is to help you, our reader, identify which stocks to buy.

This article is for those of you who want to strengthen your portfolio. Maybe you’re worried about the next market crash. Or maybe you just want some solid and dependable anchors to your portfolio.

Without further ado, here are the three top stocks to buy today to strengthen your portfolio.

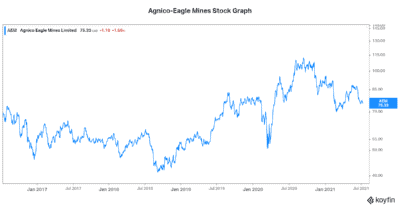

Agnico-Eagle Mines stock: The best Canadian stock to hedge against risk and inflation

Gold stocks like Agnico-Eagle Mines (TSX:AEM)(NYSE:AEM) are good places to turn for protection from inflation and general risk. These stocks offer diversification and downside protection. And as far as gold stocks go, Agnico-Eagle Mines stock has a very attractively company profile. You get the general benefits that the gold sector provides, along with other perks.

For example, Agnico-Eagle Mines is a top gold stock for dividend growth and cash flow generation. This is evident from the fact that Agnico has paid out a dividend since 1983. And since 2015, Agnico has grown its annual dividend per share from $0.32 to the current $1.40. That’s a very impressive compound annual growth rate of 34%.

Record production and soaring gold prices are driving cash flows significantly higher. Cash flow from operations skyrocketed 120% in the latest quarter. This is due to rising gold prices, which have settled above US$1,800 per ounce. They will head even higher if inflation heats up. They’ll also head higher if investors start looking for a safe haven again.

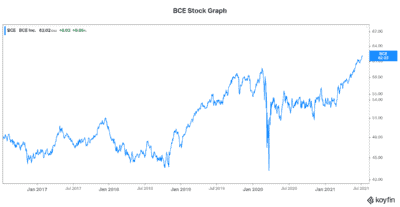

BCE stock: A Canadian top stock for stability and income

BCE (TSX:BCE)(NYSE:BCE) is another top stock to turn to for stability and income. It is, after all, Canada’s largest telecom services company. Its position is backed by the company’s extensive reach. Its world-class wireless and fibre networks are second to none. It’s also backed by BCE’s financial health and financial strength. This is what we at Motley Fool Canada like to see. It’s what makes BCE a top stock to buy to strengthen your portfolio.

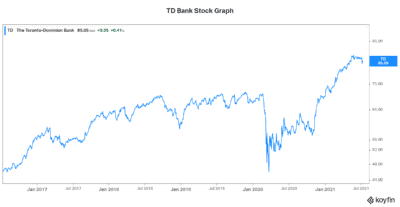

TD Bank stock: A bank stock for long-term growth and income

Bank stocks are the pulse of the economy. Canadian bank stocks are also the best place to turn to for dividend income. These stocks have stood the test of time. I mean, Canadian bank stocks have survived and thrived, despite the many hurdles that were put in their way. For example, the 2008 financial crisis was a big threat. But today, this is just a distant memory for banks, like Toronto-Dominion Bank. Not only is the bank stronger than ever, but its stock is 160% higher.

TD Bank is one of the largest Canadian banks. It’s also the fifth-largest North American bank. Through it all, TD Bank stands out for its strength south of the border and for its success in driving efficiencies. This bank has proven itself. Today, it’s benefitting from its scale, diversification, and financial strength. It is these competitive advantages that will enable TD Bank to continue to be a top stock to buy to strengthen investors’ portfolios.

Motley Fool: The bottom line

Times are highly uncertain. Stock markets are trading near all-time highs. While the COVID-19 pandemic is coming to an end, stock valuations are high — some would even say overvalued. For this reason, it would be wise to strengthen your portfolio. Consider adding the three best Canadian stocks discussed in this article.