While the TSX Index has had a very strong run up in 2021, many Canadian small-cap stocks have been left behind. This is one segment that could be due for a rebound in the second half of the year.

You can find income, value, and growth in the small-cap space. Consequently, investors can swipe some fairly attractive stocks trading at or below $10 per share today.

Canadian small-cap stocks are volatile, so you have to think long-term and be patient for their investment thesis to come to fruit. If you don’t mind taking on some extra risk for larger returns, here are three top small-cap stocks that look intriguing right now.

A top real estate stock

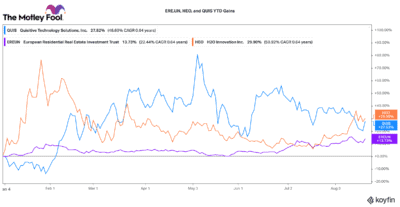

Given concerns about inflation, real estate has traditionally been a good asset class to own. European Residential REIT (TSX:ERE.UN) is really well positioned right now. It gets the benefits of very low European interest rates (sub 1%) but has the potential for solid rental rate growth due to inflation.

The REIT owns and manages 6,184 multi-family rental suites across the Netherlands. This is an attractive jurisdiction because of its strong rule of law, low rental vacancy rates, low rental supply, and high, consistent demand. Despite even the pandemic, this real estate investment trust enjoyed +98% occupancy and strong collections.

This Canadian stock is cheap. It only trades for $4.60 per share, which is below its net asset value. Despite a very solid growth profile, it is among the cheapest apartment REITs in North America and Europe. It also pays an attractive 3.5% dividend!

A top Canadian ESG stock

If you believe ESG will continue to be an important trend, then you may be interested in H2O Innovation (TSXV:HEO). It only has a market capitalization of $215 million and a share price of $2.65. However, this Canadian stock has some potential.

H2O supplies industrial grade water filtration technologies and solutions for municipalities, utilities, and businesses. Fresh water is one of the most scarce (and most important) resources on the planet. Just look up “California water shortage,” and you will recognize how important water management is across the world.

H2O supplies essential equipment and services that capture software-as-a-service-like recurring revenue (around 87% of revenues). This company has a great balance sheet and strong growth tailwinds (organically and through acquisitions).

It has a solid plan to essentially double its business over the next three years. Yet this stock only trades with a price-to-sales ratio of 1.5 times and an enterprise value-to-EBITDA ratio of 15 times. It looks pretty attractive today.

A top up-and-coming Canadian tech stock

Quisitive Technology Solutions (TSXV:QUIS) trades for only $1.39 per share. It has a market cap of $446 million. It provides solutions that help clients integrate into the Microsoft cloud ecosystem.

Alongside this, it also has its own growing IP portfolio of solutions for human resources, e-commerce, manufacturing, and community development. In particular, the company is commercializing a one-of-its-kind payments and data analytics platform that could significantly bolster sales in the back half of the year.

Many medium-sized corporations still need adopt and integrate the cloud into their operations. Consequently, Quisitive still has a large market to capture. The company grew revenues by over 160% last year. It did hit a net loss of $0.07 per share, but adjusted EBITDA increased 523% to $8.1 million.

This Canadian stock has a good balance sheet with around $9 million in net cash. It is in a good position to add further acquisitions and expand its solutions portfolio. This stock isn’t cheap today, but given the growth potential, it is interesting here on any share weakness.