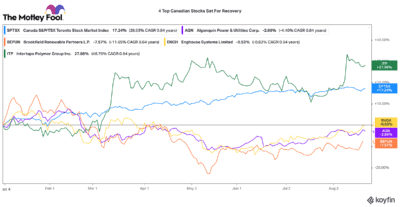

With a strong bounce back this week, Canadian stocks are once again seeing some good upward momentum. However, it begs the question: how should investors be positioned into the fall? Frankly, a balanced approach is likely best.

There are many variables (Delta variant, inflation, central bank tapering, geopolitical) that could derail markets. Owning a balanced mix of high-quality defensive, income, growth, and value stocks seem to be a good approach. Here are four you could consider buying this week.

A top Canadian defensive stock

Algonquin Power (TSX:AQN)(NYSE:AQN) is an ideal Canadian stock to own for defence in your portfolio. 70% of its portfolio is composed of regulated water, natural gas, and electricity utilities. And given the essential nature of these services, Algonquin collects a stable stream of baseline cash flows. This prevents a lot of long-term downside risk to the stock.

On the flip side, the company is investing heavily to expand its utility rate base and its renewable power operations. It has $9.4 billion of projects set for completion over the next five years. Management expects this could result in 8%-10% compounded annual earnings per share growth!

There are not many other regulated utilities growing at that same pace, so I think long-term shareholders have a lot to benefit from here. Not to mention that this Canadian stock pays a great 4.25% dividend. It has grown that dividend by a 10-year compound annual growth rate (CAGR) of 10%. It could likely continue this trend this going forward.

A top Canadian dividend stock

Another stock to own for attractive dividend income is Brookfield Renewable Partners (TSX:BEP.UN)(NYSE:BEP). This is perhaps one of the best Canadian stocks to buy if you want to participate in environmental, social, and governance (ESG) trends. BEP owns and operates 21,000 megawatts (MW) of hydro, wind, solar, distributed generation, and battery power across the world.

Year to date, this Canadian stock is down 8%. I would not call this stock cheap. However, the recent dip does present an attractive long-term entry point. The company has a large 31,000 MW development portfolio that should fuel 10-15% annual cash flow growth for many years ahead. The stock pays a 3.1% dividend today, but that will likely grow with its rising cash flows.

A top TSX growth stock

Like the above Canadian stocks, Enghouse Systems (TSX:ENGH) has underperformed the market in 2021. Yet, if you zoom back, this stock is one of the top-performing compounders on the TSX. Since 2011, it has delivered an average annual return of 29.4%. When stocks like this pull back below their historic valuation metrics, it is often a good time to buy.

Enghouse operates communications, networking, and asset management software solutions for clients across the world. This company prudently acquires software-as-a-service businesses. It integrates them into its operational platform and then milks them for free cash flow.

COVID-19 and high market valuations have slowed its acquisition strategy recently. In the meantime, it kicks off a ton of free cash flow. As a result, it has a great cash-rich balance. Be patient with this stock and I think investors will be well-rewarded over time.

A top value stock

For a value play on the Canadian stock market, investors could consider Intertape Polymer Group (TSX:ITP). It produces and distributes tapes, wraps, and packaging solutions and equipment. While this sounds like a pretty boring industry (it is), it gets a lot more interesting because it’s benefiting hugely from the rising e-commerce boom.

Many e-commerce packages now use specialized water/heat-activated tape to seal them. ITP is a leader in these products. As a result, over the past year and a half, it has been enjoying very rapid revenue growth and margin expansion.

The company now has the scale, operational efficiencies, and product assortment to really ramp up its growth plans. Despite this, this Canadian stock is one of the cheapest packaging stocks you can find. Also, it kicks out a nice 2.9% dividend right now. All of this makes it an attractive value stock to buy this week.