The Tax-Free Savings Account (TFSA) is an amazing tool for any investor looking to truly compound their wealth.

Pay no tax in your TFSA

First, it keeps investing easy. You don’t need to report any earnings from this account to the Canada Revenue Agency (CRA). Second, and most importantly, you get to keep all interest, dividends, and capital gains in the account. As long as you follow the rules carefully, your hard-earned savings and investments are completely safe from the CRA.

The TFSA is the best way to compound wealth

That is why it is the perfect account to compound wealth. The more earnings you keep, the more you can re-invest. The more you re-invest in the market, the greater your chance to build significant wealth over long periods of time. If you are looking for some great stocks to quickly compound wealth in your TFSA, here are three that could double over the next five years.

Constellation Software

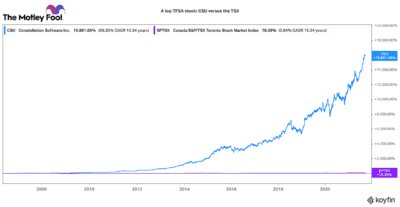

Constellation Software (TSX:CSU) is a great TSX stock to own in your TFSA. Nobody can argue with its track record of delivering outstanding returns. Over the past 15 years, it has delivered a mind-blowing 11,793% capital return for long-standing investors. That is compared to the S&P/TSX Composite Index, which has only delivered a 78% return in that period!

Constellation’s total return translates into a compound annual growth rate (CAGR) of ~39%. With a market cap of over $45 billion, it is substantially larger than it was five or 10 years ago. Yet, it has still produced between 35% and 40% total annual returns over the past few recent years.

This TFSA stock has a great management team, a very strong balance sheet, and a portfolio of highly competitive software companies. Likewise, it is expanding its strategic opportunities to accrete more shareholder value (i.e., through stock spin-outs, larger acquisition targets, and/or one day reinvesting the dividend distribution). All in, it still is a great stock to buy and hold for years to come.

Alimentation Couche-Tard

Another great compounding stock to buy and hold in your TFSA is Alimentation Couche-Tard (TSX:ATD.A)(TSX:ATD.B). It has had a bit of a rocky year in 2021. However, no one can argue with its 20-year, 7,777% total shareholder return (with dividends re-invested).

Certainly, its convenience stores and fuel-up stations are not as exciting as Constellation’s Software-as-a-Service businesses. However, this company is very, very good at execution and capital allocation.

Over the past 20 years, it has expanded its Circle K brand across the world. While returns have slowed recently, it has a cash-rich balance sheet. Consequently, it is primed for another large acquisition or further market consolidation.

While investors wait, this TFSA stock is aggressively buying back stock and investing organically. It makes for a fairly low-risk, long-term investment.

goeasy

While TSX banking stocks provide decent total returns over the past five years, the stocks dwarf compared to goeasy (TSX:GSY) stock. This top TFSA stock has delivered a 903% return over the past five years. Year to date, its stock is up 118%!

It is a leading provider of household products leasing and high-interest loans for the sub-prime market. Due to the higher risks, many banks have exited this market segment. Consequently, goeasy, with its great omnichannel loan platform, has been able to consolidate market share rapidly.

Despite the strong rise, goeasy still trades with a relatively cheap price-to-earnings (P/E) ratio of 17 times. The company has been growing its revenues by around 18% a year and earnings per share by over 30%. For a stock with a market cap of only $3.4 billion, goeasy is a TFSA stock that could double faster than you think.