While the S&P/TSX Composite Index is up nearly 20% year to date, the iShares S&P/TSX Global Gold Index ETF is down by nearly 20%. The price of gold tends to move inversely with the stock market. That is, when the stock market goes up, gold falls. Plus, gold prices rise when inflation picks up, as is the case now. Since gold stocks tend to rise when gold prices rise, you might want to hedge your portfolio by buying gold stocks.

Many quality golds stocks are trading at very low prices and could go up sharply in the coming months. Barrick Gold (TSX:ABX)(NYSE:GOLD), Agnico Eagle Mines (TSX:AEM)(NYSE:AEM), and Kinross Gold (TSX:K)(NYSE:KGC) are three gold stocks that you might consider buying to protect your portfolio from a market downturn. Let’s look at these three gold miners in more detail.

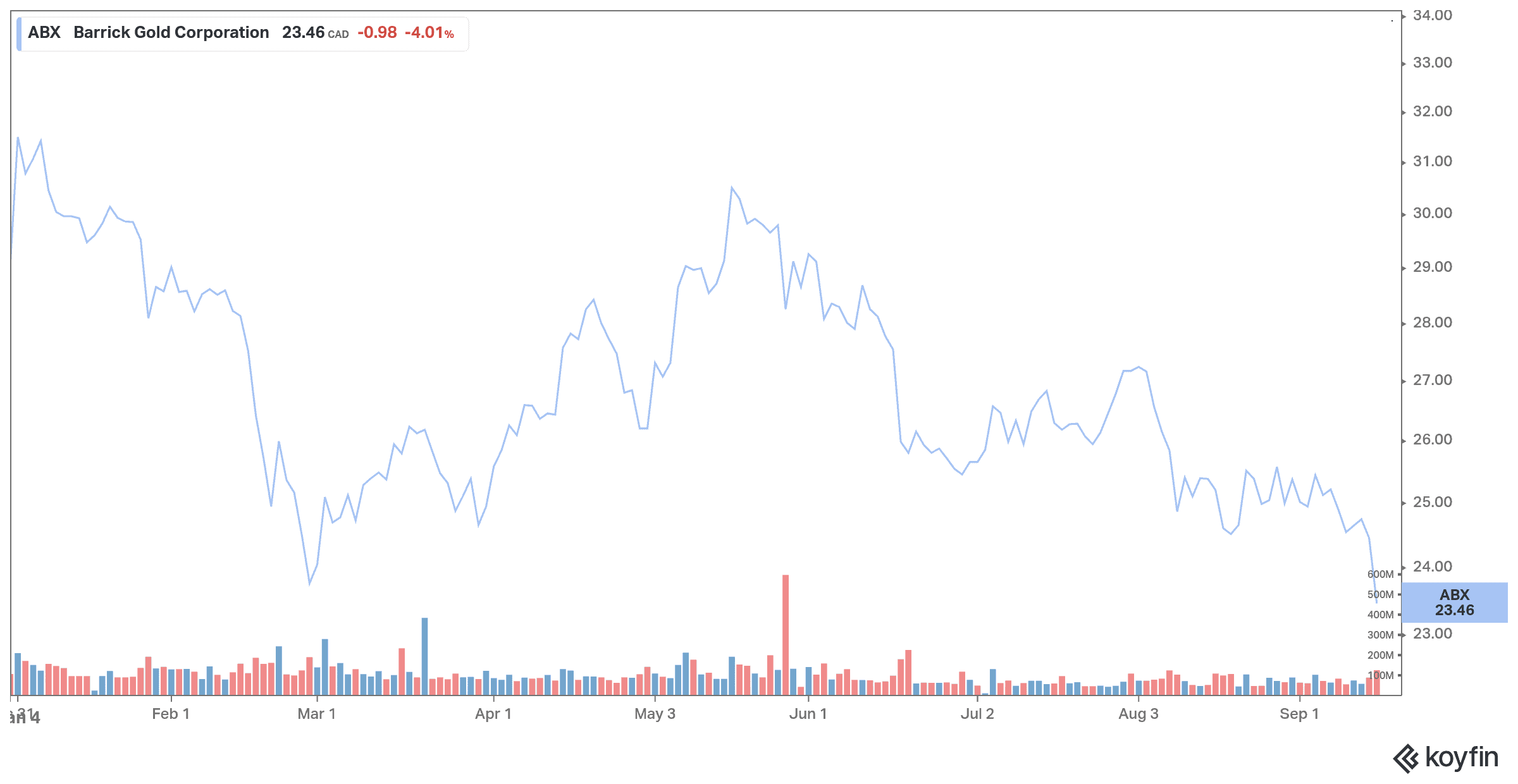

Barrick Gold

Barrick Gold is a Canadian mining company that extracts gold and copper. It has reserves located all over the world, particularly in North and South America, Africa, and the Middle East.

The company recorded profits exceeding US$411 million in the second quarter of fiscal 2021 — a significant improvement over its earnings of US$357 million in the same quarter last year, even though prices of gold were higher during this period.

Barrick Gold has increased production, and the company continues to streamline spending. Despite a decline in the company’s revenue year over year, Barrick Gold’s higher profits in the second quarter of 2021 indicate that the gold producer’s cost-cutting strategies are paying off.

The next quarter could be very good for the company. Gold prices are expected to stay higher due to increasing volatility and inflation rates. The stock has a dividend yield of close to 2%. With its stock price down more than 25% year to date, this could be the perfect time to buy Barrick Gold stock before its price begins to appreciate.

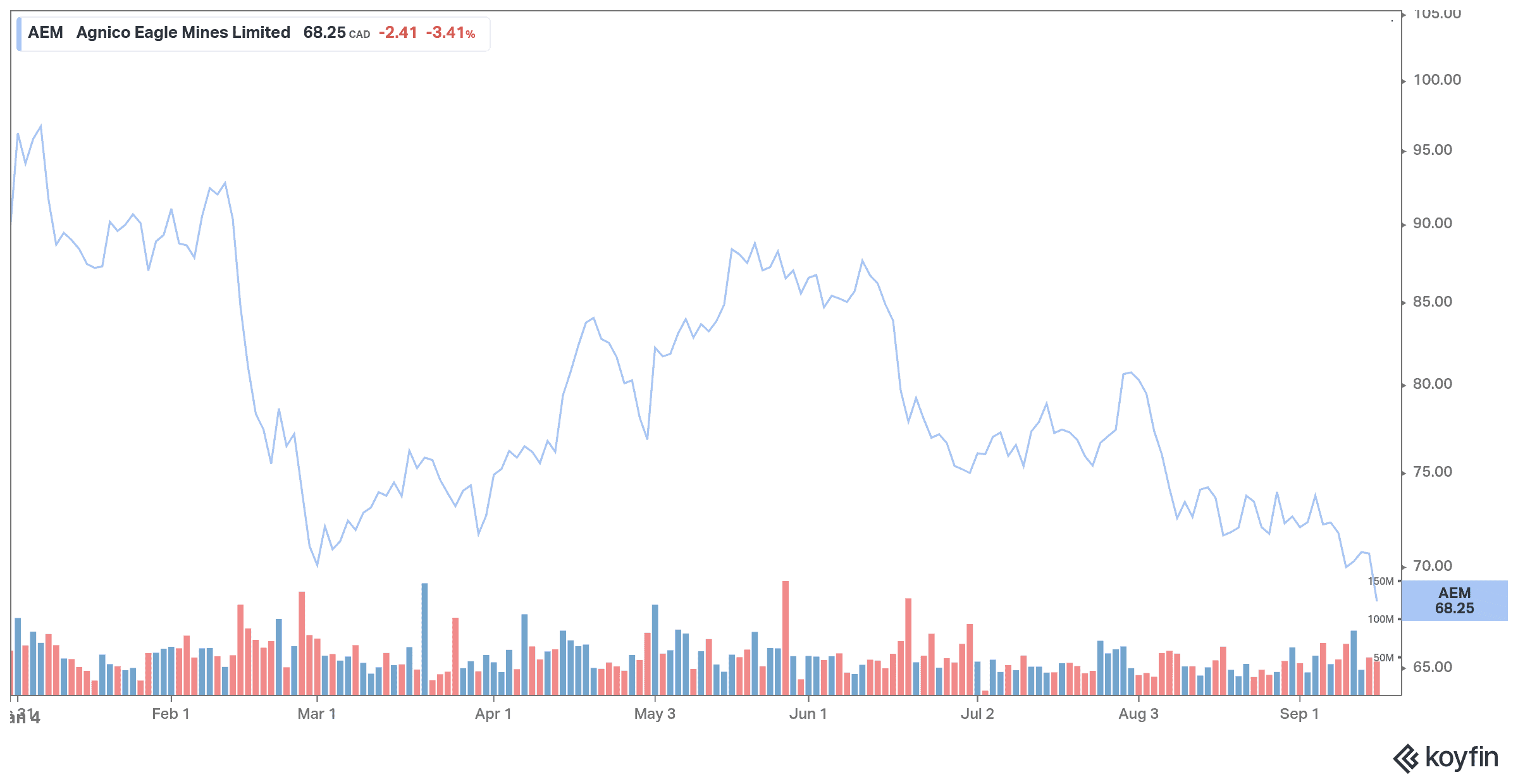

Agnico Eagle Mines

Agnico Eagle Mines is engaged in the exploration, development, and production of mineral properties in Canada, Sweden, and Finland. The company operates through the Northern Business and Southern Business segments. It mainly produces and sells gold deposits and explores silver, zinc, and copper deposits.

Agnico Eagle Mines saw its second-quarter profit rise on the back of higher sales volumes and higher realized metal prices.

The Toronto-based mining company posted a net profit of US$189.6 million compared to a net profit of US$105.3 million for the same period in 2020.

Revenue from mining activities reached US$966.3 million in the quarter ended June 30, up from US$557.2 million in the second quarter of last year.

According to Agnico Eagle, the increase in net income is mainly attributable to better margins on mining operations than in 2020, when gold production and sales were negatively affected by business cuts linked to the pandemic.

Agnico Eagle still expects to meet its production and cost forecast for 2021 and gold production to increase in the second half of the year. The stock is down approximately 30% year to date.

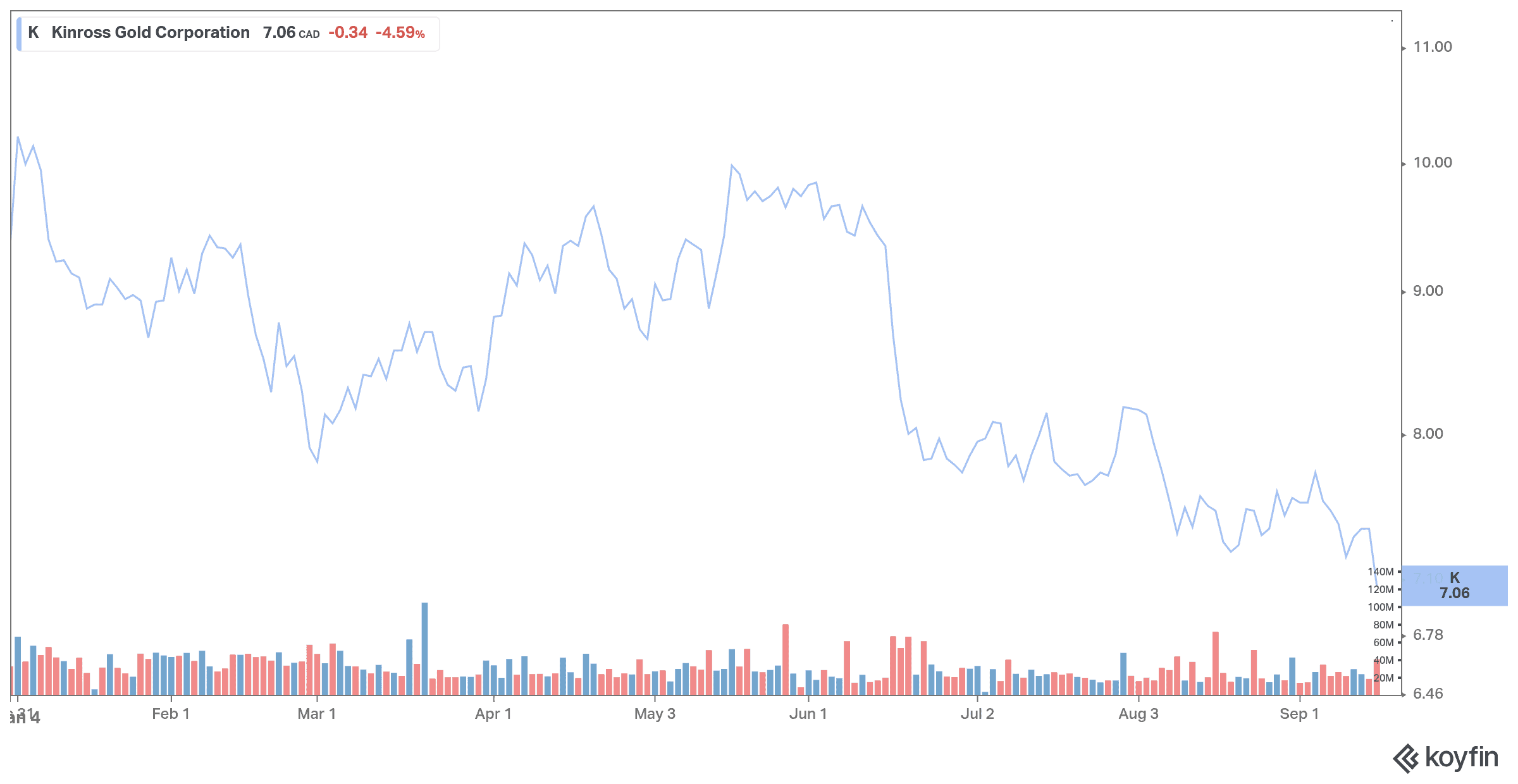

Kinross Gold

Kinross Gold, based in Ontario, is engaged in gold and silver mining in the United States, Russia, Brazil, Chile, Ghana, and Mauritania. The stock has lost around 30% year to date. However, with gold currently experiencing a strong rally, the stock is expected to experience a reversal.

Kinross Gold reported second-quarter 2021 net income of US$119 million, which is a sharp 40% year-over-year decline.

Kinross Gold management expects its gold production to increase by 20% over the next three years to 2.9 million ounces of gold equivalent by 2023. Its financial position also appears solid, with liquidity of $2.2 billion as of June 30. The company also pays a quarterly dividend of $0.03 per share for a yield of 2.2%. So, Kinross Gold is among the gold stocks to consider for your portfolio.