Is Facedrive (TSXV:FD) stock a good investment? Are we just buying into the hype? In this article, I will discuss why I believe BlackBerry (TSX:BB)(NYSE:BB) stock is a much better investment than Facedrive stock.

Founded in 2016, Facedrive is a technology ecosystem that’s evolved since its early days. Its business verticals range from ridesharing to contact tracing to food delivery. It’s a veritable ecosystem that’s connected us to business through technology. But …

Facedrive stock: Too early and too volatile?

Clearly, Facedrive’s business is a sign of the times. It’s simply come at the right time. It addresses many needs that have been accentuated by the pandemic. This is evident when we look at the company’s revenue growth in recent quarters. Simply put, it’s skyrocketing.

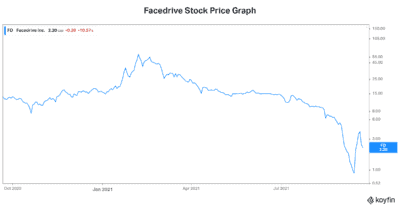

Facedrive’s stock, on the other hand, is not so attractive looking. The above graph illustrates the volatility. Clearly, this is a high-risk proposition. Facedrive is losing money, which is normal for a young company. But the stock seems to have caught on with investors. They recognize Facedrive’s timely and relevant business. But what does Facedrive offer to investors from a fundamentals point of view? Cash burn, net losses, and questionable governance. Also, the stock trades on thin volumes, which can become dangerous.

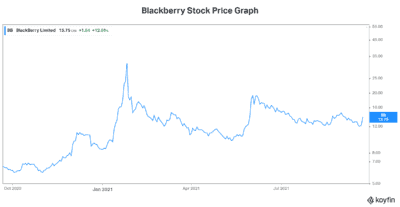

BlackBerry, on the other hand, is moving in the right direction. As a leader in the internet of things and cybersecurity industries, BlackBerry is backed by a lot. I would say that BlackBerry has definitely built itself a competitive advantage after years of struggle and stock price weakness. Today, BlackBerry stock is up more than 10% off of better-than-expected Q2 results. Facedrive stock is floundering again, down over 5%.

BlackBerry: Claiming its spot

Many of us Motley Fool investors have long followed BlackBerry stock. We’ve followed it through the death of their handheld business. We were intrigued by the then-new CEO John Chen’s plans to transform the company. And some of us made money off the Reddit craze that irrationally propelled the stock higher. The graph below illustrates BlackBerry stock’s wild ride.

Today, BlackBerry’s strategy is coming to fruition. While financial results are still much less than perfect, BlackBerry is making its mark. For example, BlackBerry has won numerous awards for its technology. Also, the company continues to secure contracts with the best of the best: the U.S. government, top Fortune 500 companies, and top auto-makers.

BlackBerry’s second-quarter beat expectations. That’s a good positive trend that’s hopefully starting. The company generated positive free cash flow, which is so important. And it has a healthy cash balance to fund growth. Facedrive’s business just can’t compare. So why is Facedrive stock trading at much higher multiples? It doesn’t sit right with me.

The bottom line

I hope that this article helps shift our focus away from Facedrive stock. It’s just hard to justify this stock’s valuation. In short, we must remain dedicated to finding the right price for a stock. Overpaying reduces returns dramatically – we don’t want to start off five steps behind. BlackBerry stock is cheaper and more fundamentally sound. In my view, it’s the better bet.