Passive income is “income earned with little or no effort.” It’s pretty much every Foolish investor’s goal. Maybe you want to allocate all of your money to generate passive income. Or maybe you want to save only a portion of your portfolio for that. Either way, it’s an important concept that we at Motley Fool cover frequently. It’s a vital way to get your money working for you. Here are three passive-income ideas. The first one is Fortis (TSX:FTS)(NYSE:FTS). The second one is Enbridge (TSX:ENB)(NYSE:ENB). Lastly, we have Northwest Healthcare Properties REIT (TSX:NWH.UN).

Let’s take a closer look at Enbridge stock plus the two other top stocks that will support you through the years. And you? Well, you can relax and do whatever else you like to do.

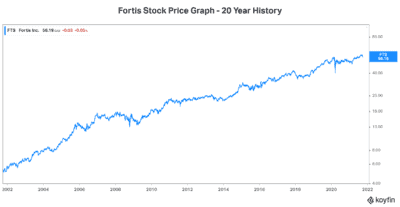

Passive-income idea: Fortis stock

Fortis is a leading North American regulated gas and electric utility company. Fortis’s earnings and cash flow are highly predictable. Its defensive business makes it so. It’s a highly regulated essential business (80% regulated or residential). This means that in the good times and bad times, Fortis will be okay.

These are the qualities you want in a stock that you’ll rely on for passive income. In fact, Fortis is the ultimate passive income idea. This stock has 47 years of dividend growth under its belt. It is the epitome of stability, predictability, and reliability. It’s an unbeatable track record.

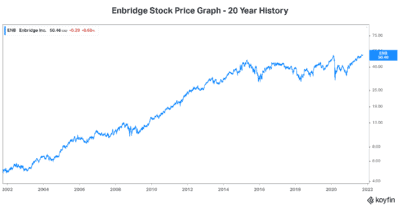

Enbridge stock for passive income

Enbridge’s assets are a critical piece of North America’s energy infrastructure. The company is, in fact, one of North America’s leading energy infrastructure companies. It transports about 25% of the crude oil produced in North America. It also transports nearly 20% of the natural gas consumed in the United States. And to top this off, Enbridge Gas is North America’s third-largest natural gas utility.

This is another predictable and stable business. The results speak for themselves. For example, predictable and growing cash flows have been a hallmark of Enbridge’s results. These cash flows have allowed the company to invest in its business. They’ve also allowed Enbridge to return capital to shareholders. In fact, Enbridge has an exceptionally strong dividend history. In the last 26 years, Enbridge’s dividend has grown at a compound annual growth rate of 10%. Plus, Enbridge’s stock price has soared. How’s that for a passive-income stream?

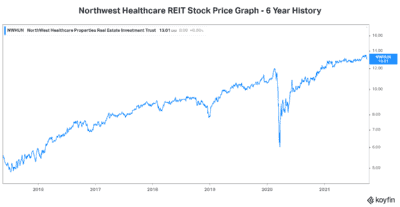

Northwest Healthcare Properties provides steady dividends for the long haul

Northwest Healthcare Properties is an owner/operator of a diversified portfolio of healthcare assets. Its assets are located in Canada as well as globally. This means that it has exposure to a highly defensive global stream of revenue. It also means that Northwest Healthcare stock will be less sensitive to stock market and economic weakness. These are all qualities to look for in a passive-income stream.

Today, Northwest Healthcare continues to chug along successfully. Its dividend yield remains high, at just above 6%. And it’s primed to continue to benefit from one of the most powerful trends today — the aging population. Check out Northwest REIT’s stock price graph below.

Motley Fool: The bottom line

Passive income: it’s a comfortable way to make money — that is, if you choose the right stocks. The stocks listed in this Motley Fool article are top stocks for passive-income investors. Fortis stock is a stable utilities giant. Enbridge’s stock price is reflective of an undervalued energy infrastructure giant. Lastly, Northwest Healthcare stock gives you exposure to the defensive healthcare sector. Consider investing in them to build up your passive-income stream.