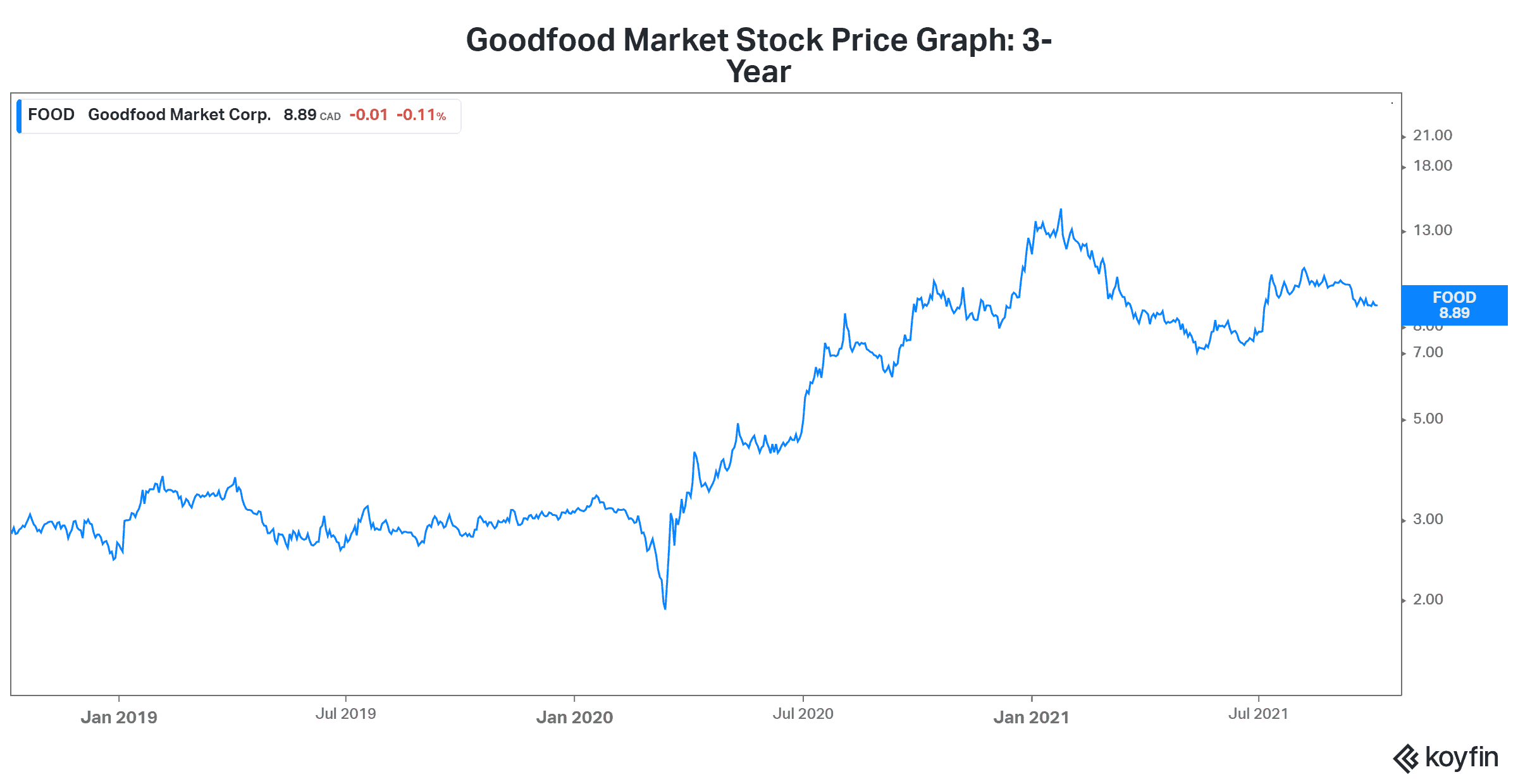

Goodfood Market (TSX:FOOD) is a leading online grocery company that’s proving to be a thorn in traditional grocers’ as well as restaurants’ sides. So, after exploding from $3 in 2020 to almost $15 at the beginning of 2021, why is Goodfood Market’s stock price languishing now?

Goodfood Market disrupts the food chain

It started off as a meal-kit company, but today, Goodfood is expanding. For example, the company has added same-day deliveries to its service. Also, it’s added grocery items. Finally, its offering includes ready-to-cook and ready-to-eat meals.

Clearly, the market for Goodfood is huge. But most of its competitors are also huge. That means they have more resources, more scale, and stronger brands. Goodfood is the David and traditional grocers are the Goliaths. Can Goodfood win this race to digitize grocery shopping? Will traditional grocers step up their game and improve their digital offering (by acquiring)? These are questions that investors are certainly asking themselves.

Competitive and low barriers to entry

Like restaurants, the meal-kit-delivery industry is a very competitive one. It’s also an industry with minimal barriers to entry. This means that gaining a sustainable competitive advantage is extremely difficult. Ultimately, consumers have so many options. And there’s not much that differentiates one from the next.

This is great for us, the consumer. It’s also great for those meal-kit companies that have managed to get a first-mover advantage, like Goodfood. But truth be told, this advantage is difficult to sustain. Just like restaurants and even retailers, meal-kit companies face a rough competitive landscape. This translates into low margins. For Goodfood, its gross margin is 30%. Currently, volumes are not high enough, and the company is spending big on growth. Therefore, the company continues to lose money.

In recent years, the meal-kit industry has exploded. Numerous meal-kit companies, like Goodfood, have come to life. This industry idea has been percolating for a long time. As lives have gotten busier, households have struggled with eating healthy. Simply put, many of us need help. We have a renewed desire to take care of our bodies, yet we’re so busy. These food-delivery companies support us. It’s an industry that’s seen explosive growth, and for good reason.

Goodfood Market stock: Growth mode means increased spending and share offerings

Needless to say, Goodfood Market’s growth has been good. But it was better. Revenue growth was explosive in prior years — well over 100% for many years. More recently, though, this is slowing. While it’s to be expected, because we’re working off a higher base, it’s something that affects valuation.

These days, Goodfood Market needs to invest in growth and expansion. The company already has a good first-mover advantage in Canada. In fact, it has the largest market share in Eastern Canada at roughly 40%. But an expansion to Western Canada is underway. And with this comes increased spending — hence Goodfood Market’s equity issue. These additional shares are a drag on existing shareholders, even though it’s for the greater long-term good of the company.

In short, increased spending on sales and marketing means lower margins. Share offerings mean lower per share income, at least in the short term. Ultimately, Goodfood Market stock represents a higher risk right now. And it’s being reflected in the stock price.

Motley Fool: The bottom line

In conclusion, Goodfood Market stock has been weak in 2021. Slowing growth and big spending to invest in future growth are the key reasons. Yet it remains a solid business. This company is disrupting the grocery industry by continually expanding its offering. This is redirecting grocery store dollars — effectively eating away at their revenue. The movement is small today, and grocery stores are doing what they can to claim their place in this digital revolution.