Hot stocks are defined by winning streaks. As the year comes to a close, I would like to set myself up with that type of stock. So in this Motley Fool article, I would like to discuss three hot stocks. These stocks are hot for many reasons. But the biggest reason is their exceptional dividend growth over the last five years and more.

Without further ado, here are the three stocks to buy in October to set you up for a winning streak of your own.

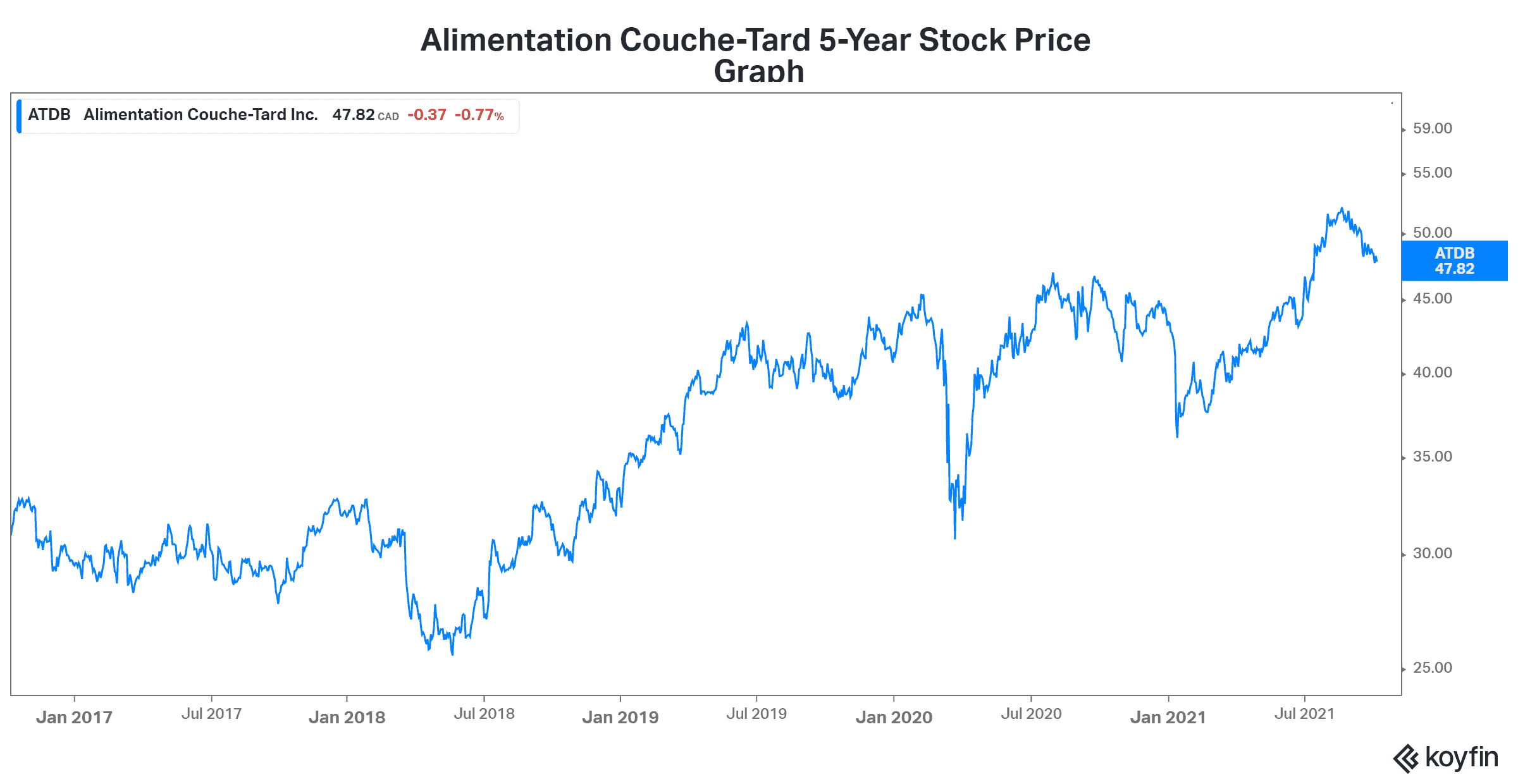

Alimentation Couche-Tard: A hot stock with a 96% dividend growth rate.

In the last five years, Alimentation Couche-Tard (TSX:ATD.A)(TSX:ATD.B) stock has grown its dividend by 96%. This bears repeating. It’s a real money-maker. But if you think that’s impressive, read on. Alimentation Couche-Tard stock has also had a phenomenal run over the last five years. In fact, it’s up almost 50% in this time frame.

And that’s no surprise. I mean, this company has shown tremendous capital discipline. It has good governance. As a company that has grown through acquisitions, this is not an easy thing. We have seen far too many situations where debt got out of control amid bad acquisitions, ultimately destroying shareholder value. But Alimentation Couche-Tard does not play this game. This is a characteristic of a stock to buy. Right now it’s one of the best stocks to buy.

In fact, it’s been three years since they’ve made an acquisition. And the pressure is on. Analysts are questioning whether the company will meet its goals of growth through acquisitions. But management is unphased. They simply stated that they will not buy if valuations aren’t right. And these days, valuations are lofty. So they are happily sitting on the sidelines until the time is right. This capital discipline is always rewarded in the market. It may take time. But it is always rewarded.

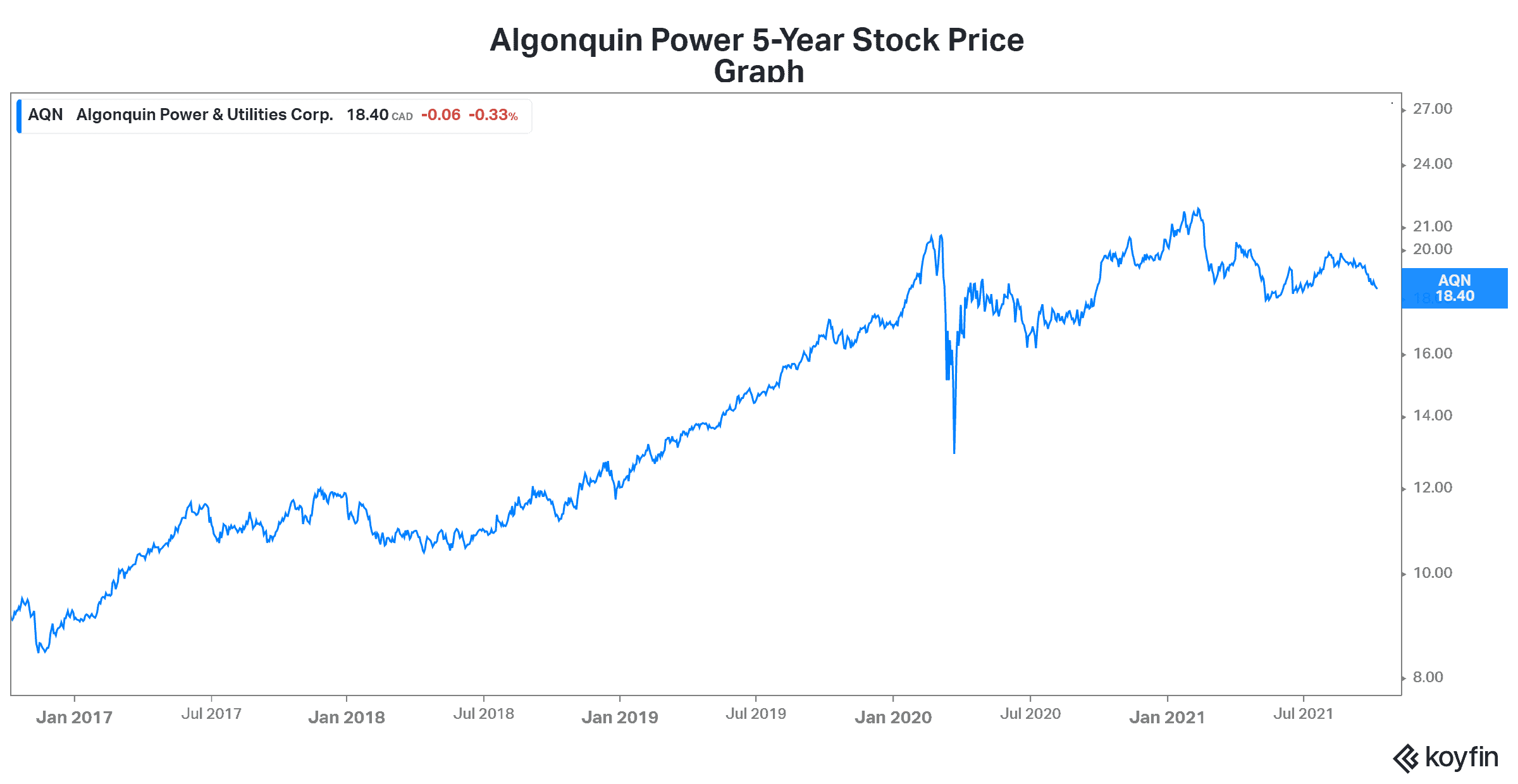

Algonquin Power: A generous dividend yield with good dividend growth

Algonquin Power and Utilities (TSX:AQN)(NYSE:AQN) is a medium-sized utility conglomerate that owns regulated electric and gas utilities and renewable energy assets. Today, Algonquin Power stock represents a solid investment opportunity. As we close off 2021, we may wish to position ourselves in the great dividend growth stocks. Algonquin is one of these. In the last five years, the company has grown its dividend by an impressive 50%. Today, its dividend yield is a generous 4.7%.

This utility stock is one of Canada’s best-kept secrets. It has industry-leading returns. Also, it’s undervalued. It’s simply underrated and underappreciated. But this is part of what makes it a hot stock to buy in October.

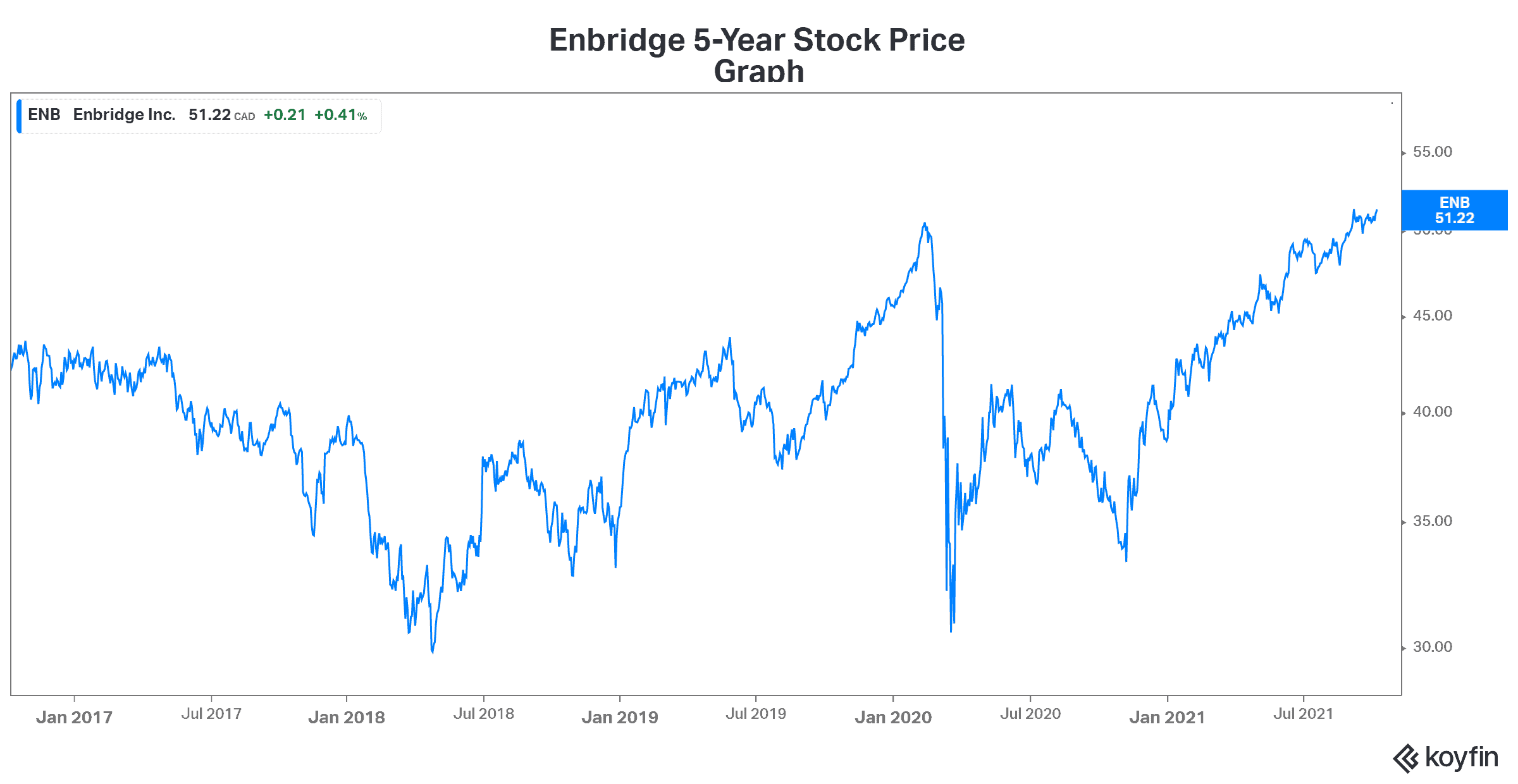

Enbridge: A hot stock with a 6.5% yield

Oil and gas prices are soaring. Enbridge (TSX:ENB)(NYSE:ENB) is no different. The stock has rallied more than 25% in 2021 and has grown its dividend by more than 55% in the last five years. This performance speaks to the cash flow generating power of Enbridge. It also speaks to the company’s stable and predictable earnings base.

Today, Enbridge stock is benefitting from a resurgence in oil and gas prices. The supply and demand fundamentals of the oil and gas industry are ideal for energy companies. What we have is low supply along with rising demand. It’s the perfect storm.

Enbridge is the ultimate energy stock. It’s for investors wishing to participate without assuming too much risk. Enbridge is one of Canada’s leading energy transportation and distribution giants. It has oil and gas assets and operations in North America. These operations are an integral part of our energy infrastructure. Enbridge also has renewable assets in North America and Europe. These assets ensure Enbridge’s long-term health and viability. Enbridge is recovering in 2021 and beyond. And with the recovery in oil and gas markets, I can safely say that this is just the beginning. It is, in fact, one of the best stocks to buy right now.

The bottom line

For those Motley Fool investors looking for dividend growth, you’ve come to the right article. Alimentation Couche-Tard, Algonquin Power, and Enbridge have all grown their dividends at an exceptional pace. They’re three of the best stock to buy right now for this reason.