Facedrive (TSXV:FD) is a technology ecosystem that’s evolved since its early days. Its business verticals range from ridesharing to contact tracing to food delivery. It’s a timely business that addresses the need for and the benefits of technology in this new age.

Why did Facedrive stock fall 5% this week?

Facedrive stock was falling long before this week. Actually, as far as Facedrive’s trading history goes, this week was quite tame. I mean, the price swings in this stock have been absurd. But let’s start at the beginning. As we know, Facedrive is building an ecosystem that’s equitable and responsible — theoretically, a very nice place to invest our money.

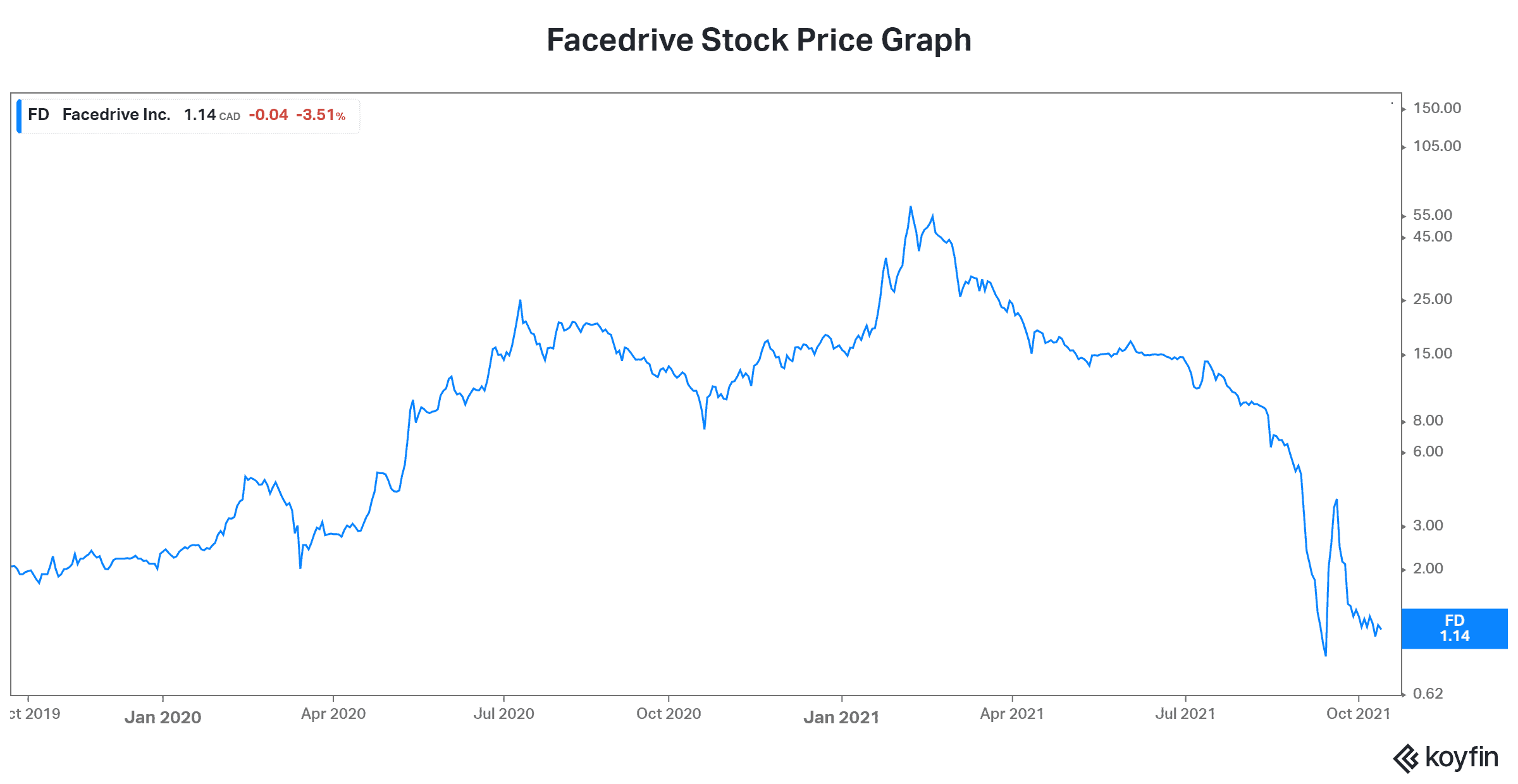

Facedrive stock started the year with a bang. In fact, it started the year with a 270% rise in just over a month. The meme stock craze hit this unsuspecting stock. Volumes soared, along with Facedrive’s stock price. And then, as meme stock mania faded, Facedrive’s stock price fell just as fast as it rose. Today, it’s down 98%.

This week, there wasn’t any real news on the company. I think the stock just continues to consolidate lower as investors regroup and reconsider it. I mean, does its 36% revenue growth rate last quarter really deserve a big multiple? It’s a nice growth rate, but it’s not really “blow the lights out” revenue growth. Also, net losses are piling up, and the cash burn is consistently bad.

Insider selling and management shake-ups have soured the picture for Facedrive stock even more

Beyond the obvious, insider selling of Facedrive stock and management turmoil have really gotten investors bummed out. As if the volatility and speculative nature of Facedrive stock weren’t enough. We now have, in fact, a multitude of negative factors to point to. I think this will keep the stock down for the foreseeable future.

Lastly, I think that market sentiment in general may be about to change. We’re currently experiencing a market that is characterized by “irrational exuberance.” The emergence of meme stock manias has served to drive this point home. Also, there are risks looming in the background that threaten to take the market lower. In this case, a stock like Facedrive stock would be the first to suffer an unpleasant fate. It’s too risky. When money becomes tight, and investors get fearful, their risk profile shifts. In short, risk tolerance declines.

Uncertainty is a stock’s worse enemy

It’s evident that uncertainty in the stock market deflates valuations. When investors feel that things are uncertain, they become afraid. When they become afraid, they sell, driving valuations lower. Here we are with Facedrive stock trading at around $1.00. This may cause some investors to step in and buy. But think twice.

Because Facedrive has stiff competition in its lines of business, such as in ridesharing. Some of these competitors, like Uber, have well-established businesses and clients. While it’s possible for a company to compete here, I think it would be very difficult for Facedrive. I mean, this company doesn’t have its act together. It’s struggling internally with management issues and insider selling. This simply doesn’t inspire confidence.

Motley Fool: The bottom line

In conclusion, I think the problems at Facedrive are too many. When I have money to invest in a more speculative idea, it will be one that’s more focused and confident in its future. I recommend that Motley Fool investors do the same.