The S&P/TSX Composite Index has always been stacked with energy stocks. I mean, Canada is certainly a resource economy, so this makes sense. In fact, energy stocks were the biggest constituents of the TSX Index years ago. In 2021, energy stocks, like Suncor Energy (TSX:SU)(NYSE:SU) stock, have been the brightest performers.

This may come as a surprise to many. Nonetheless, the questions we must ask ourselves are clear. Is it too late to buy energy stocks? If not, which ones should we buy? Please read on for more on Suncor stock and for two other top energy stocks that are in the midst of significant rallies.

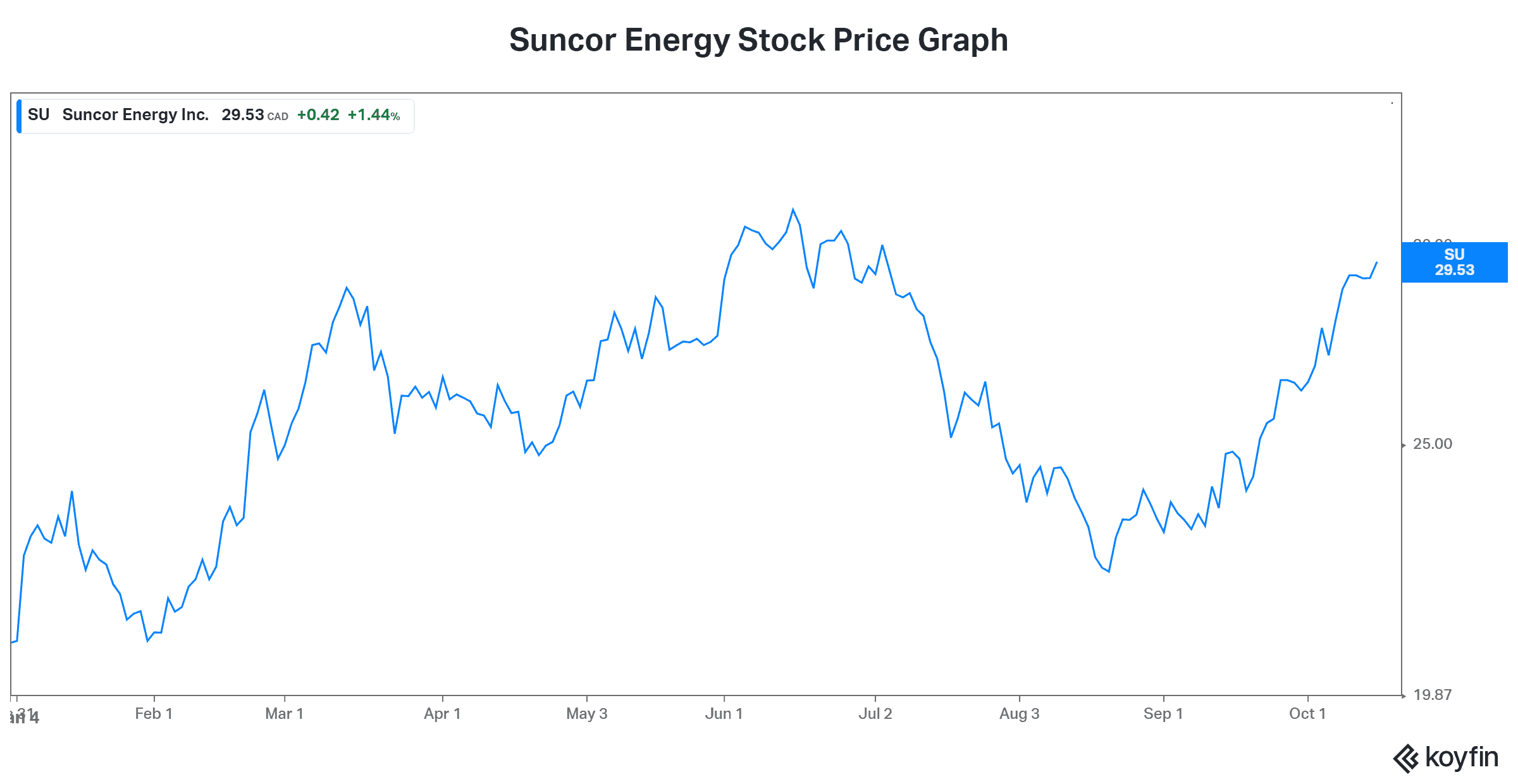

TSX stock: Suncor Energy’s stock price is up 30% in 2021

Suncor is a diversified and integrated energy giant. The benefits of its integrated business model are simple. Basically, it makes the company less vulnerable to the ups and downs of commodity prices. This means it has a steadier and more predictable cash flow profile. It also means that the downside and upside in Suncor’s stock price is not as big. In short, lower volatility is the name of the game. So, for those of you who would like to gain exposure to energy but want a lower risk profile, Suncor Energy is your stock.

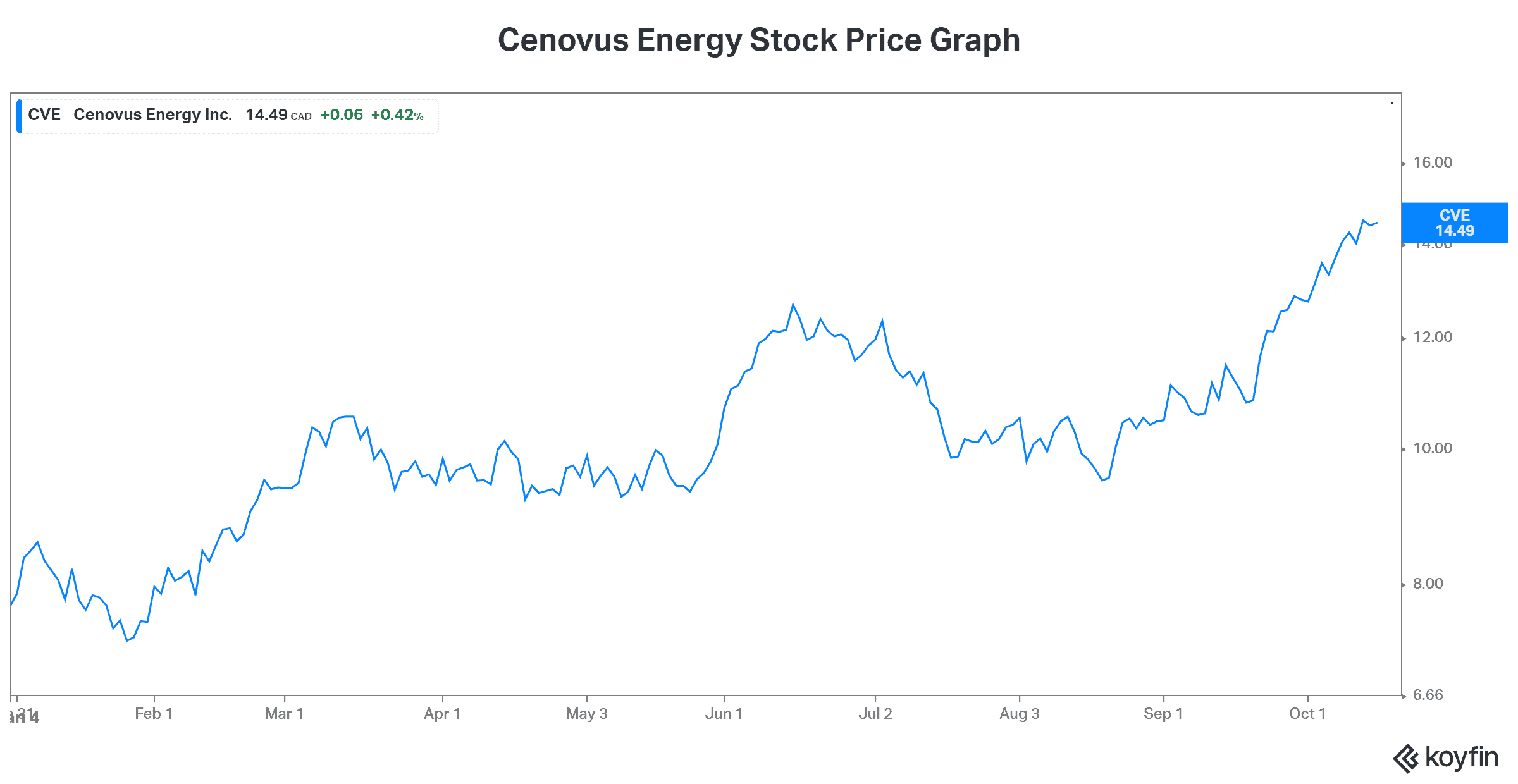

Cenovus Energy stock: Up 87% in 2021

An energy stock that had been in the doghouse for many years is Cenovus Energy (TSX:CVE)(NYSE:CVE). It was overlooked and undervalued. But beneath all the problems in the oil and gas industry, Cenovus was always an example of excellence. This year, its stock price is finally beginning to reflect this. In fact, all energy stocks on the TSX are booming.

Cenovus Energy is the third-largest Canadian oil and gas producer and the second-largest Canadian-based refiner and upgrader. It’s a company that has a history of strong and relatively stable cash flows. It has been a victim to weak oil and gas fundamentals for many years. But today, things are very different.

Oil and gas prices are soaring. As a result, Cenovus’s cash flows are also soaring. And to top it all off, Cenovus has made one of the most well-timed acquisitions I have seen in a long time. I’m referring to its Husky Energy acquisition. Husky Energy’s downstream assets have diversified Cenovus’s business. Like Suncor stock, Cenovus now also benefits from its integrated status. Also, total synergies will be more than $1.2 billion. It’s an acquisition that was completed when the energy sector was trading near its lows. This means that Cenovus has done what we all hope to do every day. It bought Husky at its lows, and now it’s benefiting from rising energy stock valuations.

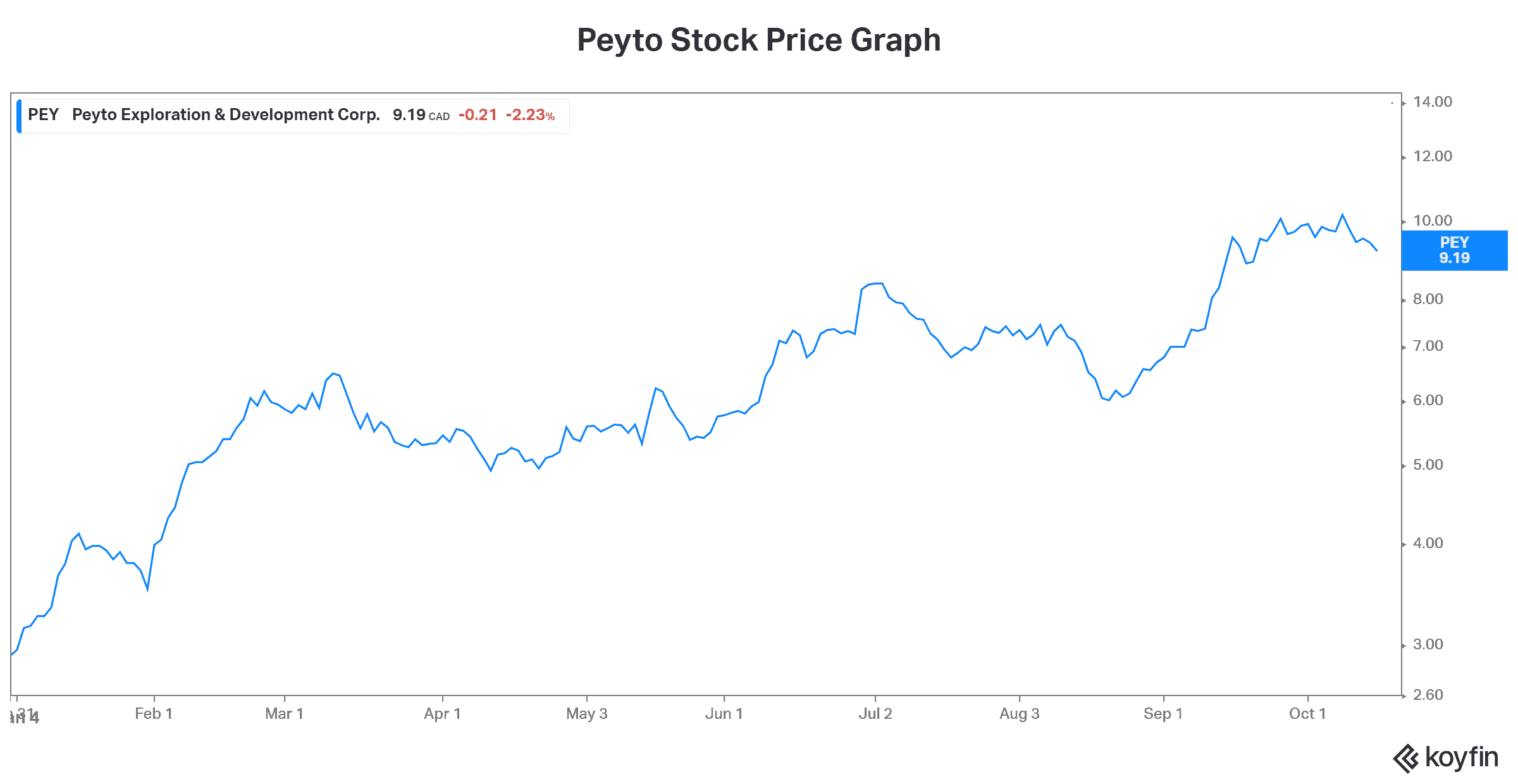

Peyto stock: A best-in-class natural gas stock that’s up 200% in 2021

Peyto Exploration & Development (TSX:PEY) is one of Canada’s lowest-cost natural gas producers. It operates in a very prolific resource basin that’s characterized by predictable production profiles, low-risk exploration, and a long reserve life. The stock has rallied 200% in 2021. Its upside is much higher than Suncor stock’s. But, to be fair, its downside risk is also greater. This is just the nature of oil and gas producers.

This natural gas producer has enjoyed rallying natural gas prices this year. Its next quarterly report will be in early November. And it’ll be a good earnings report. I mean, rising earnings estimates are a sign of the good times. Also, natural gas prices are now above $5.00. All of this bodes well for Peyto’s earnings release. It also bodes well for Peyto’s stock price.

Motley Fool: The bottom line

Energy stocks are on the move in 2021. While these stocks come with a whole host of environmental concerns, they are nonetheless top performers this year. The reality is that oil and gas prices should keep rising, as they remain key in meeting our energy needs.