Real Estate Investment Trusts (REITs) seldom enjoy double-digit unit-price gains in a day, but when they do, the gains are usually sticky for longer. This appears to be the case at diversified Canadian real estate giant Cominar Real Estate Investment Trust (TSX:CUF.UN) after its 12% rally on Monday.

TFSA Income Investors: The TSX loses a giant REIT

Units in Cominar REIT surged 12% from a previous close of $10.36 on Friday to trade as high as $11.66 per unit early morning on Monday’s trading. The sharp move followed news on Sunday that Cominar will be taken private in a $5.7 billion transaction that valued the trust’s equity at $2.2 billion or $11.75 per unit.

The deal’s cash price of $11.75 per unit represents a 13.4% premium to Cominar units’ closing price during Friday’s trading session, and a 63% premium to Cominar’s closing unit price before announcing a strategic review process in September 2020.

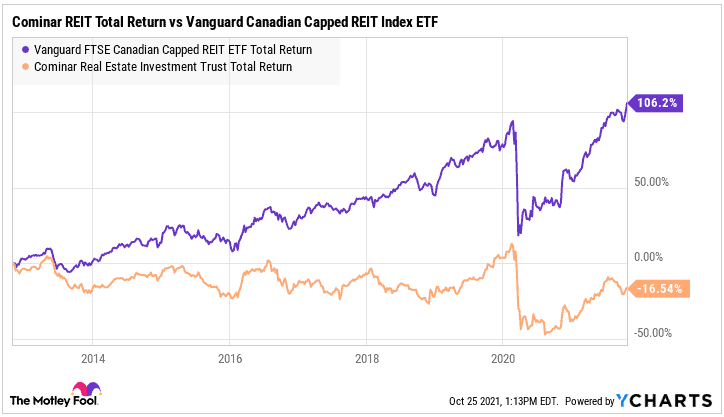

Cominar is one of TSX’s largest diversified REITs an asset class that generates great income yields in Tax-Free Savings Accounts (TFSAs). After a decade of underperformance, restructuring efforts, and the COVID-19 pandemic that disrupted the real estate giant’s retail properties portfolio, Cominar be acquired by Iris Acquisition II LP in a transaction expected to close during the first quarter of 2022 — a big loss to the TSX Real Estate Capped Index.

Cominar REIT has underformed peers by a wide margin over the past decade. Source: YCharts.com

Cominar’s being broken up!

The acquirer is a consortium led by Quebec’s leading property owner Canderel Real Estate Property. Other notable consortium members include Artis Real Estate Investment Trust, FrontFour Capital Group, and partnerships led by private equity firm and activist investor Sandpiper Group, which was instrumental in launching recent changes that took place at Artis REIT.

Blackstone will acquire the trust’s promising industrial portfolio. Some of the REIT’s retail and office properties valued at $1.5 billion will be snatched by Group Mach Acquisition. The remaining office and retail properties will be retained by Cenderel and the consortium.

Cominar’s property portfolio is effectively being dismantled.

Distributions to be suspended

As part of the acquisition transaction, Cominar is suspending its distributions, starting with the October distribution that was payable in November. However, “If the Transaction has not closed by January 15, 2022, Cominar intends to reinstate the distribution in respect of the second half of January 2022 payable in February 2022 to unitholders of record on January 31, 2022, and for each month thereafter,” Sunday’s news release explains.

Takeaways for income investors: Sell Now!

It’s so unfortunate that Cominar units will probably sell at more than a 20% discount to their pre-pandemic price of over $15 a unit last seen in February 2020. The coronavirus pandemic has left a lasting scar on some long-term oriented Cominar REIT’s investors’ portfolios.

That said, the upcoming transaction, if approved by investors, could trigger an immediate liquidity event in every portfolio invested in CUF.UN right now. With a few months available to liquidate their investment positions, investors have to find an alternative diversified REIT into which to deploy the freed-up capital.

Given Monday’s surge, there is little reason to wait for the transaction to close in 2022 — and even more so considering that the trust’s 3.5% yielding monthly distributions payable in November, December, and January 2022 are being suspended. It’s definitely time to start evaluating potential options to redeploy capital.

Unless you’re confident that a higher bidder could emerge for Cominar’s portfolio, I see no other reason to buy units now. The upside is just too little given the suspended distributions.

It’s definitely time to move on after Cominar REIT agrees to be acquired at $11.75 a unit. No more distributions from next month unless the deal falls apart.