Cenovus Energy (TSX:CVE)NYSE:CVE) is the third-largest Canadian oil and gas producer. It’s also the second-largest Canadian-based refiner and upgrader. But why has Cenovus stock rallied so much in 2021? And should you buy after blow-out Q3 results? Motley Fool readers, let’s explore.

Cenovus Energy stock: A solid Q3 as the oil and gas bullish cycle continues

This oil and gas company released its Q3 results this morning. Certainly, these are results that have gotten investors excited. They reflect the riches that are being made in the oil and gas sector. They also reflect that the oil and gas boom has only begun. Comments from management on the Q3 earnings call were bullish. In fact, I haven’t heard this optimistic tone in oil and gas CEOs for a very long time. The positive fundamentals in oil and gas keep building. In short, the momentum is strong.

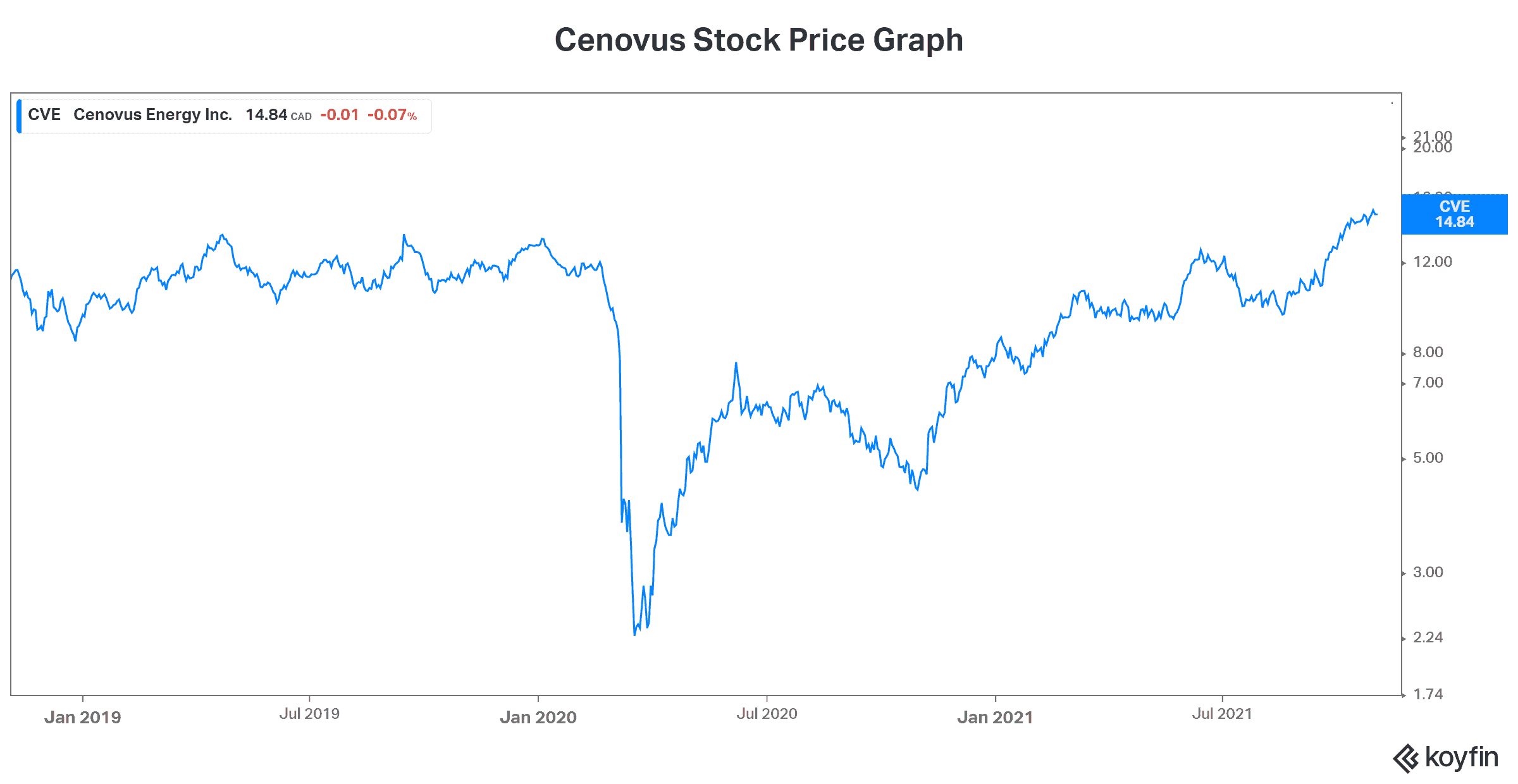

Take a look at Cenovus’s stock price over the last few years. Essentially, the stock has risen from a severely undervalued state in 2020. But it’s only beginning to reflect the positive reality that it is enjoying. The third quarter of 2021 was positive on all fronts. For example, cash flows are soaring. In fact, cash flow from operations increased almost 200%. More importantly, adjusted funds flow increased 475%. This comes as oil and gas prices continue to soar.

Cenovus stock looks good as its dividend doubles

For Motley Fool investors who are looking for dividend growth, Cenovus stock has that too. Along with the Q3 earnings release, Cenovus announced that its dividend will be doubled. This brings its annual dividend to $0.14 per share, which translates into a dividend yield of just under 1%. Not a high yield, but certainly moving in the right direction.

Cenovus is pumping out cash flow at an impressive rate — free cash flow of almost $2 billion in Q3. With this, debt is being slashed and shareholder returns are rising. Clearly, this $30 billion oil and gas company is finally seeing its day in the sun. The fundamentals of the oil and gas industry are very positive at this time. And with the energy shortages we have seen in Europe, I think it’s becoming clear that we will need oil and gas for many years to come.

Given Cenovus’s long-standing record of operational excellence, this company will clearly take good advantage of these booming times.

Booming cash flows will get the attention of investment managers

The reality is that everything oil and gas has been severely undervalued for a long time. I mean, the world has been focusing on environmentally friendly sources of energy. And this is a great thing. But underinvestment in traditional oil and gas energy sources is playing out as it always does. Falling supply coupled with increasing demand are sending these commodity prices soaring.

What we have now is energy companies that are awash in cash. This is boosting shareholder returns in all energy stocks. What we also have is an investment community that’s probably underweight oil and gas stocks. I’m guessing that this won’t last for much longer. I mean, how long will these managers accept underperformance? I think we will soon hear of them re-establishing oil and gas positions at least to come degree. This will create demand for oil and gas stocks like Cenovus stock. And we know how this demand spikes up stock prices.

Motley Fool: The bottom line

If you have not already gotten the message, my answer to the article title’s question is a big “yes.” Investors should buy Cenovus Energy stock as the good times are only beginning. Oil and gas cycles last years, not months. Therefore, Cenovus stock still has good upside.