Stocks that have the potential to make us millionaires don’t come around that often. But when they do, we should snatch them up. In this article, I’ll introduce Ballard Power Systems (TSX:BLDP)(NASDAQ:BLDP). Ballard is a fuel cell developer. It’s cleaning up transportation, and it has everyone’s attention. It’s about to see explosive growth. This makes it a top stock to buy.

Here’s why I believe Ballard Power stock has the potential to make you a millionaire.

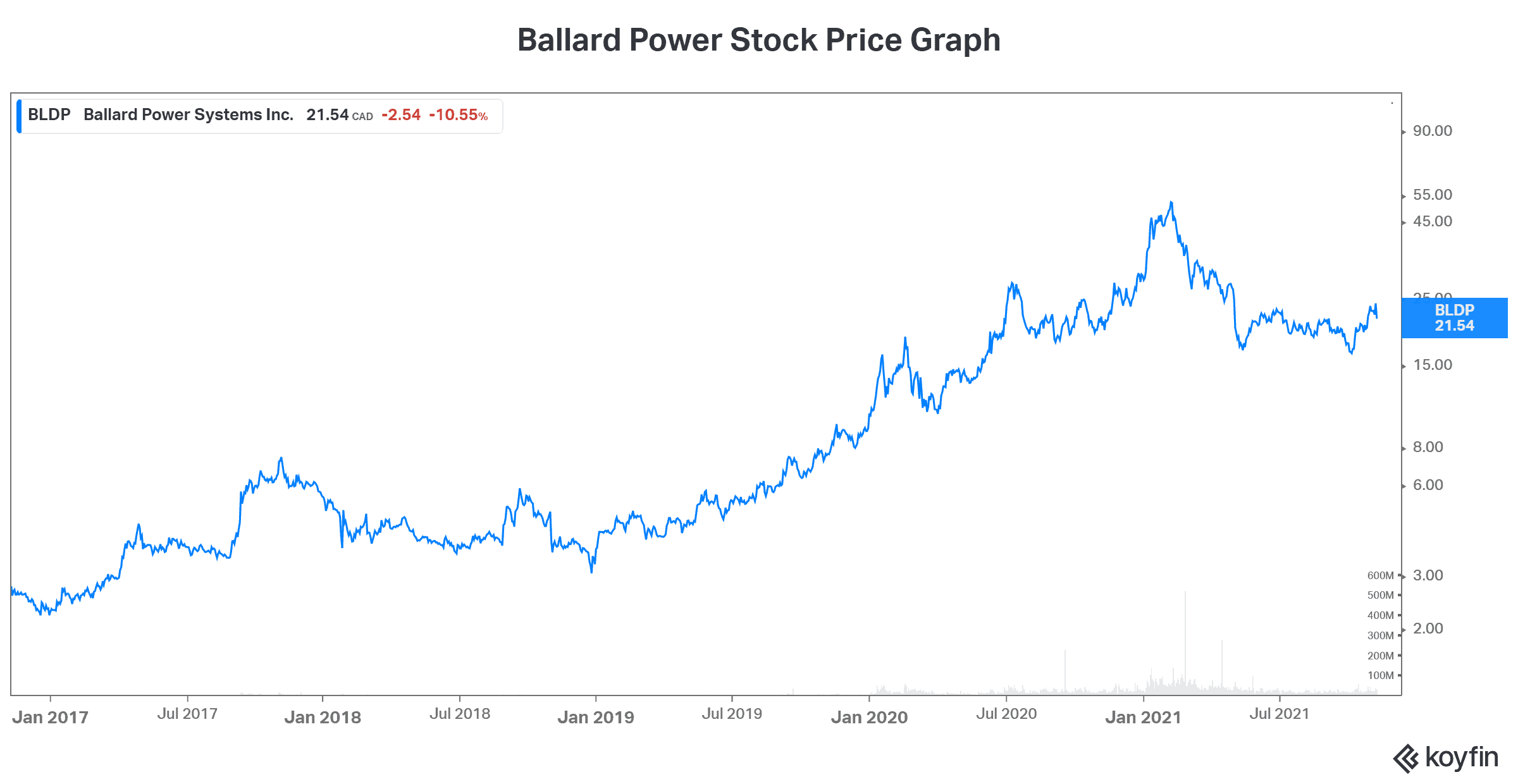

Ballard Power stock: A whopping 730% five-year return

Ballard Power is a leading global provider of innovative clean energy and fuel cell solutions. These fuel cells power transportation vehicles such as buses and trucks with zero emissions. So, you can see the growth potential here. It is, in fact, an exciting industry with explosive growth potential. But it’s also an industry that’s in the early stages.

Ballard stock has clearly been a winner in the last five years. Despite its many critics, this stock has pushed forward. But for those of you who have missed it, don’t worry. Ballard Power’s growth has not even begun yet. Right now, the stock is trading on potential.

Ballard Power stock: A stock to buy for long-term, explosive growth

The official market size that’s available for Ballard’s taking is currently $130 billion. That seems really high, right? Well, it’s about to get even higher. Over the last year, there’s been a tremendous surge in interest for Ballard’s fuel cells. For example, customers from Canada’s rail industry are interested. Also, there’s a lot of interest from the European commuter railway train industry. Lastly, there’s been a sharp increase in the interest for fuel cells in the stationary power market. We can look forward to an updated market estimate from the company early next year. In my view, this will be a catalyst for Ballard stock.

The fuel cell market is a new, emerging market, so things take time. With long lead times, it’s easy for us investors to lose patience. But I think we should hang on. In fact, I view today’s 10% drop in Ballard’s stock price as a good buying opportunity. Because the good news is that Ballard’s order book is currently up 30% since the beginning of the year. We’re seeing increasingly big interest from Europe and the United States. In short, this will translate to the order book and revenue in about a year.

Anticipation is building for Ballard Power

Ballard’s growth curve will start in 2023 and will continue strong. But right now, Ballard is investing in its business. It’s investing in order to ensure that it maintains its top leadership position. Ballard’s scientific expertise and its connections in the fuel cell industry are priceless. These must be nurtured in order for Ballard to have a strong future.

According to Ballard’s management, revenue will begin to show a hockey stick growth trajectory in 2022. This means sharp, spiky revenue-growth rates. In addition to this, as the orders come in and Ballard’s revenue starts growing, we’ll see costs coming down. Ballard is already reducing costs significantly. By 2024, its target is for a 70% cost reduction. With scale, this becomes totally achievable.

Motley Fool: The bottom line

If your patience for Ballard Power’s revenue growth is wearing thin, I understand. We’ve been waiting for a long time now. If you’re new to the Ballard story, take heart. No company in an emerging industry had an easy time establishing itself. It just doesn’t happen. That’s because these things are the opposite of easy. They take time, money, and patience. But once things click and the momentum takes hold, there’s no stopping them. Ballard is my top millionaire-maker idea — a top stock to buy now.