When it comes to investing, finding Canadian stocks with an economic moat is one of the best ways to identify high-quality businesses that you can buy today and hold for years.

Having a moat protects a business from its competitors — much like the moats that you would regularly see around castles. The concept of an economic moat is not something new and was actually popularized by Warren Buffett.

In order to build a moat and protect your long-term profits and market share, you need to find competitive advantages that give a leg up on the competition.

Competitive advantages consist of anything that allows a business to perform better or earn more of a profit than its direct competitors. If you do something that no other company in your industry can do, and it gives you an advantage, it can be a powerful tool.

Therefore, the better the competitive advantage, the wider the stock’s moat. So if you’re looking for a high-quality Canadian stock to buy today, here are two wide-moat Canadian stocks to buy now.

A massive energy infrastructure business

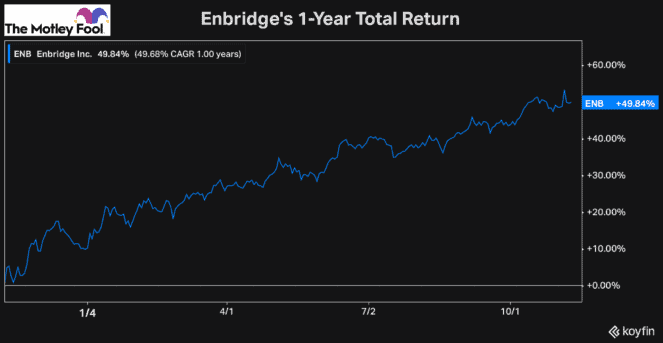

If you’re looking for a Canadian stock with excellent competitive advantages to buy today, Enbridge (TSX:ENB)(NYSE:ENB) is one of the top stocks to consider. I’d act soon, though. While the stock is still reasonably valued, it’s been on an impressive performance for the last 12 months.

One of the main reasons Enbridge is a top Canadian stock to buy today is that it’s a massive energy giant, which already gives it a tonne of stability and economic advantages. For example, because it transports a quarter of all the oil produced in North America and roughly 20% of the gas consumed south of the border, it’s a crucial component of the North American economy.

Furthermore, the industry as a whole has massive barriers to entry. These days it’s almost impossible to get pipelines built. And already, Enbridge’s pipelines run to some of the most popular destinations. All of this results in a significant competitive advantage for the stock.

And in addition to its core business, it has a tonne of other segments offering diversification — not to mention a rapidly growing commitment to renewable energy as it positions itself for the future.

This makes the blue-chip stock an excellent long-term investment. And with a forward price to earnings ratio of just 17.2 times, as well as a 6.3% dividend yield, it’s a top Canadian stock to buy today.

A top Canadian bank stock to buy today

Another high-quality Canadian stock that’s an excellent investment to buy for the long run is Toronto-Dominion Bank (TSX:TD)(NYSE:TD).

TD is the second-largest bank stock in Canada, worth an incredible $167 billion. The fact that the company is so large and operates in the highly safe and highly favourable Canadian banking industry is a significant factor in why it’s one of the best Canadian stocks to buy for the long haul today.

The Canadian banking system, which is dominated by the Big Five, is set up in a way that gives little incentive for customers to switch institutions. Many of the products are very similar, and one of the only driving factors for consumers to switch banks is customer service.

Because of this banking system and the fact that TD is so large and has such a massive market share, it has a significant competitive advantage.

So if you’re looking for a high-quality Canadian stock to buy today, TD is the perfect wide-moat Dividend Aristocrat that you can hold for years.