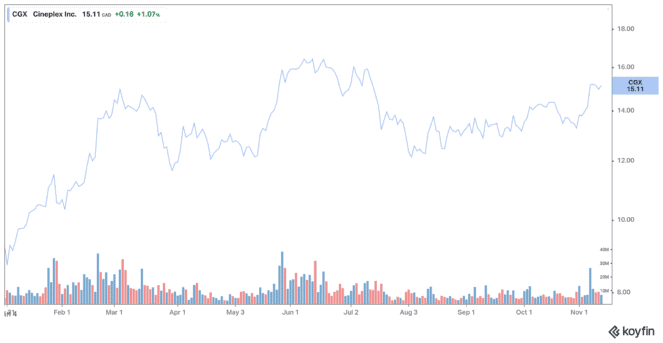

Cineplex (TSX:CGX), Canada’s largest movie theatre chain, reported third-quarter financial results on November 11 before the opening bell. Its revenues rose sharply, and its loss declined year over year, as audiences increased with the reopening of all theatres across Canada. Cineplex stock rose more than 2% in early trading Thursday. Shares are up more than 75% year to date. Let’s look at the quarterly results in more detail.

Revenues and earnings

Revenues for the third quarter of 2021 were $250.4 million, an increase of 310.3% over revenues of $62 million reported in the third quarter of 2020. Box office revenues increased by 547.7% to $94.1 million, as Cineplex was able to reopen all of its 161 theatre locations as of July 17, 2021. In addition, the release of Shang-Chi and the Legend of the Ten Rings was strong. Revenues from theatre food services increased 515.9% to $70.9 million in the quarter.

Meanwhile, cinema media revenue doubled to $6.6 million, while amusement revenues rose 302.8% to $53.3 million. Other revenues increased to $8.9 million from $5 million a year ago. Other revenues include Cineplex store revenue, promotional activities, screenings, private parties, corporate events, breakage on gift card sales, and management fees revenues. Total theatre occupancy increased $0.7 million or 4.8% in the third quarter of 2021 compared to the same period last year.

Cineplex reported adjusted earnings before interest, taxes, depreciation, and amortization after leases (EBITDAaL) of $10.8 million for the quarter as well as positive quarterly adjusted EBITDAaL across all lines of business for the first time since the start of the pandemic. Adjusted EBITDAaL changes adjusted EBITDA to deduct current period cash rent paid or payable related to lease obligations net of quantified savings negotiated with landlords following COVID-19 closures, including savings negotiated after the end of the period.

Meanwhile, Cineplex reported a net loss of $33.6 million, or $0.53 per diluted share, in the quarter ended September 30, compared to a net loss of $121.2 million, or $1.91 per diluted share, in the prior-year quarter.

The company said it continues to have a prudent approach to cost management. It reduced its average monthly net cash burn to $2.9 million in Q3 2021, down from $24 million in Q3 2020.

CEO comment

Cineplex’s president and CEO Ellis Jacob said, “Looking ahead, we remain confident in our solid financial position and disciplined cash management processes supporting the continued recovery of our businesses. We are encouraged by the strong pipeline of upcoming film product and the signs of a return to normalcy that we are all craving. Canadians want to reconnect and recharge with family and friends, and we will continue to capitalize on that pent up demand.”

During the quarter, Cineplex introduced CineClub, a new subscription program that give its members benefits accessible across Cineplex’s businesses nationwide including Cineplex theatres, the Cineplex Store and LBE venues. The company also launched Where Escape Begins, a brand-new platform to remind Canadians about the magic of the cinema experience.

Cineplex is expected to go back to profitability in 2022 with an estimated EPS of $0.12 and revenue of $1.47 billion. Thanks to improved market conditions and growth initiatives, Cineplex is one of the best growth stocks to buy.