The stock market has continued to show strength through the pandemic crisis. Truth be told, this has been a surprise to many investors — a nice surprise, of course. This resilience is a testament to the strength of Canada’s economic policies and financial system. When we speak of resilience, no better example comes to mind than Canadian banks — banks like Toronto-Dominion Bank (TSX:TD)(NYSE:TD).

They survived the financial crisis in 2008 and many crises before. The banks have even continued to thrive through the pandemic. Remember, at one point, the banks’ loan-loss provisions were soaring, as they feared accelerating loan defaults. But in the end, Canadian banks have not only survived this latest crisis, but they have continued to thrive. Some, like TD Bank stock, are even hitting new 52-week highs.

TD Bank stock: A top Canadian bank

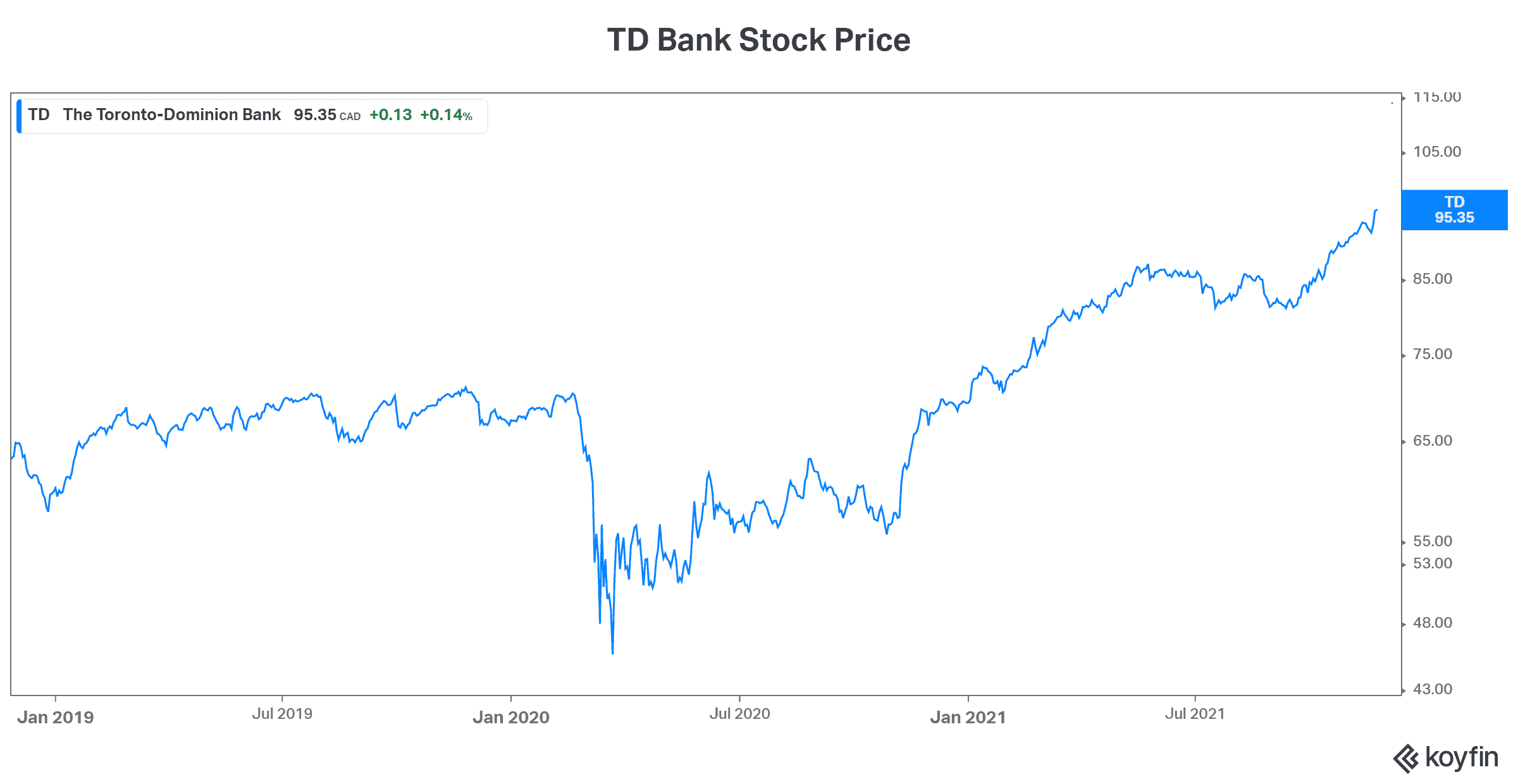

The first bank stock that’s hitting new 52-week highs is TD Bank. TD is one of the largest Canadian banks. It’s also the fifth-largest North American bank. Through it all, TD Bank stands out for its strength south of the border, and for its success in driving efficiencies. TD Bank stock has a market cap of $170billion and a 3.3% dividend yield. The stock has soared 32% so far in 2021.

While this chart is a sight to behold, it also makes me nervous. TD is not only trading at 52-week highs, but it’s also trading at all-time highs. And while I believe that long-term economic trends support this, I also know that there are problems brewing in the shorter term, such as slowing loan growth and inflation. Also, TD’s valuation is at all-time highs.

In short, TD Bank stock is still a good investment. Since 1995, TD Bank has delivered an 11% annualized dividend growth rate. In the longer term, this dividend growth shows no signs of stopping. Actually, booming profits would indicate that this growth rate might even accelerate.

I would choose my entry point wisely, but this stock is definitely a long-term keeper.

National Bank stock: A Canadian bank that’s a niche player

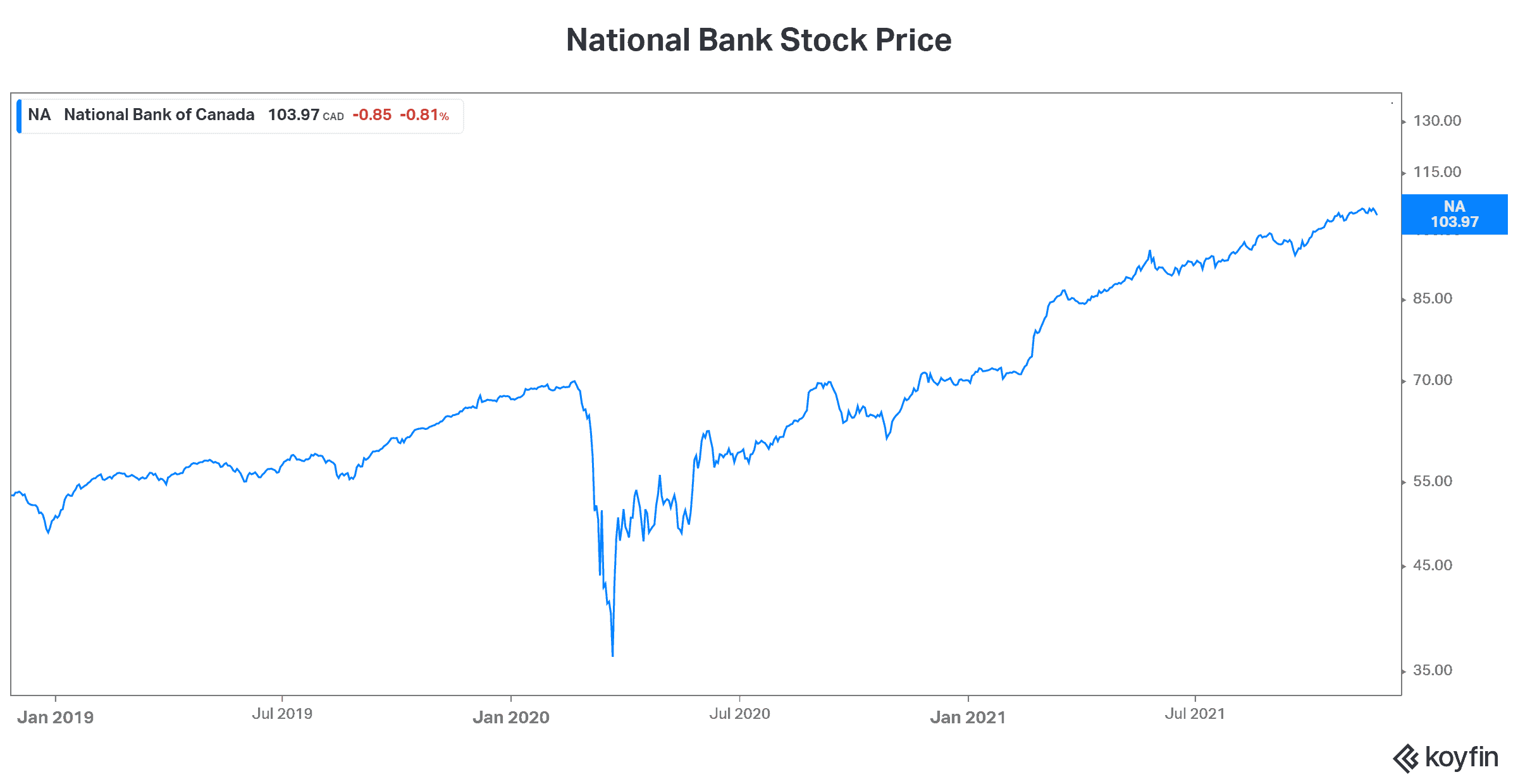

National Bank of Canada (TSX:NA) is very different from TD Bank. The first difference is its size. National Bank stock has a $36 billion market capitalization — 20% that of TD Bank’s. Also, National Bank is very heavily focused in the province of Quebec. But what National Bank lacks in diversification, it has made up in its financial performance.

In fact, this bank has worked hard in closing the gap with the larger Canadian banks. This has translated into many things. For example, it has brought about big efficiency gains. It’s also translated into significant earnings growth of almost 20% and dividend increases.

Today, National Bank stock is yielding a respectable 2.7%. Its stock price is hitting new all-time highs. Take a look at the graph below, which shows the stock jutting higher.

This is a reflection of the bank’s restructuring program, which is achieving dramatic cost cutting and efficiency gains. It’s also a reflection of National Bank’s moves to expand its wealth management division into Central and Western Canada, serving to give the bank greater diversification.

Motley Fool: The bottom line

Canadian bank stocks like TD Bank stock and National Bank are flying high and breaking new ground. They remain solid stocks to own for long-term capital appreciation and dividend income.