Over the past few weeks, markets have started to get choppy again, leading some to wonder whether we might see a significant stock market correction soon.

Not only are we on the back of an incredible rally over the last year and a half as the economy has recovered from the pandemic, but now, new issues have presented themselves.

Investors have to take into account how a resurgence of cases can impact their investments, but also such things as surging inflation, the potential for increasing interest rates and now a supply chain crisis.

Some big American retailers have seen their stocks take a nosedive recently due to lost revenue as a result of missed or late shipments and slower growth compared to last year’s incredible recovery. And while this can be a concern, it’s important to keep in perspective how negative the developments are.

When a stock market correction materializes it will pay to keep a long-term mindset

When a stock or even the entire market is selling off, naturally, the first thing to do is figure out why. However, once you’ve figured that out, the next thing to do is determine whether that’s a major impact to the business being affected that could change its long-term trajectory or whether it’s just a short-term issue.

When stocks react in a significant way to issues that are likely to only be present for a quarter or two, it can be an excellent buying opportunity for investors.

That doesn’t mean it will always be the case, but often stocks are oversold on news that will have little impact on the company’s long-term potential.

So, whenever a stock sells off, before you decide to do anything, it’s crucial to figure out what kind of long-term impact the stock will face. And if it seems like the selloff in the short term is overblown compared to how badly the stock will be impacted over the long term, then this could be an excellent opportunity to buy.

A high-quality Canadian stock to buy today

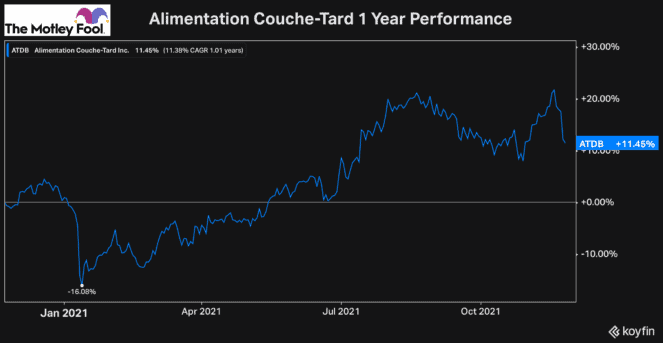

One top Canadian stock that’s been selling off over the last week, even before the widespread stock market correction began, was Alimentation Couche-Tard (TSX:ATD.B).

Couche-Tard reported earnings for its second quarter of fiscal 2022 earlier this week, and the stock sold off quite significantly as a result. The market didn’t like that Couche-Tard saw slower same-store sales as well as the fact that its operating expenses had been rising due to inflation.

However, while these issues are important, they likely will not impact Couche-Tard for very long. The company operates in an extremely defensive industry and should be able to pass higher costs along to its consumers through higher margins for fuel as well as the defensive goods it sells.

So, while the stock has sold off significantly and is now roughly 10% off its high, this is an excellent opportunity for investors to buy this incredible growth stock at a discount.

One of Warren Buffett’s best quotes, in my opinion, says, “Time is the friend of the wonderful company and the enemy of the mediocre.” What this means is that you can be confident buying wonderful businesses like Couche-Tard, because eventually, if you buy it cheap, with time, the wonderful business will be able to recover.

However, a mediocre business that’s struggling for profitability is not a good long-term investment. This is because over time, it will likely continue to struggle and only continue to lose investors’ money.

As you can see above, we already saw Couche-Tard fall out of favour earlier this year, creating an excellent buying opportunity for investors. So, with the stock down significantly again and the potential for it to fall further in the short run during this stock market correction, it’s one of the top investments you can make today.

Over the last 10 years, the stock has earned investors a total return of over 930%, showing what an excellent, long-term business it has and why it’s one of the best stocks to buy while it’s trading at a significant discount.