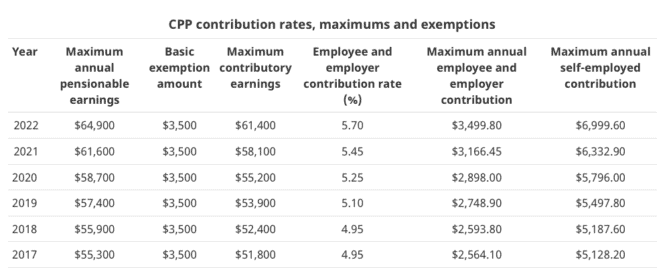

To add another weight on Canadians’ shoulders, the Canada Pension Plan (CPP) premiums are going up again. Notably, the CPP contribution rate has been increasing since 2019. If you’re over 18, working in Canada outside Quebec, and earn more than $3,500, you need to make CPP contributions. Since 2019, the maximum CPP premiums have increased at a compound annual growth rate of 7.8% with the hike for 2022 being 10.5%.

Image source: Getty Images

How much is your CPP contribution in 2022?

The first $3,500 income you earn each year is exempt from CPP contributions. The CPP earnings ceiling is $64,900 in 2022. Consequently, you only have to pay CPP premiums on at most $61,400 of your earnings in the new year. Thankfully, if you’re an employee, you get to split the CPP contributions 50/50 with your employer. Specifically, the rate is 5.70% each. So, if you earn exactly $64,900 from your job, both your employer and you will be paying CPP premiums of $3,499.80 in 2022.

If you’re self-employed, you’re making the full CPP contributions. So, the maximum you would pay in 2022 is $6,999.60. Notably, though, your CPP contributions are based on your net business income (after expenses). Additionally, let’s be thankful that investment income doesn’t count.

So, if your job’s income is $50,000 in 2022, the pensionable earnings is $46,500. You and your employer would make a CPP contribution of $2,650.50 each. A self-employed Canadian earning a net income of $50,000 would need to pay a CPP contribution of $5,301 for the year.

How you can combat higher CPP contributions

If you’re earning similar or greater income on your job in 2022 than in 2021, you’re making greater CPP contributions in the new year. Here’s how you can cater for the difference.

Make use of Canadian retirement accounts like the TFSA and RRSP. These tax-advantaged accounts either provide tax-free or tax-deferred benefits, which results in thousands of dollars of savings over time. The sooner you start investing in your TFSA and RRSP, the more taxes you save!

I highly recommend Canadians to consider investing in quality stocks supported by wonderful businesses. Dividend stocks like Royal Bank of Canada (TSX:RY)(NYSE:RY) are the most straightforward to understand. RBC has a diversified business mix, leading to high-quality earnings generation through economic cycles.

It enjoys operating in a regulated, oligopoly environment that ensures it remains highly profitable. In fiscal 2021, its net income was north of $16 billion, while it paid $6.4 billion of dividends to its stockholders. That was a sustainable payout ratio of 40%.

Currently, the Canadian banking leader provides a safe yield of nearly 3.6%. In the last decade, it has increased its dividend at a compound annual growth rate of 7.6%. It will probably be able to continue increasing its dividend around that rate given its solid position. Fairly valued RY bank stock should be able to generate long-term returns of about 11% per year, say, over the next five to 10 years.

If you’re an experienced stock investor, you might consider pure growth stocks, like Shopify or Alphabet, that could deliver even greater growth with their high-growth prospects.