I think that passive-income investors everywhere are looking for low-risk passive-income ideas to generate income. Of course, there’s always some risk involved. But the point is to take calculated risks that maximize your risk/reward trade-off most effectively. In this article, I will show you how you can make $120 per month by investing in a basket of high-quality, high-yielding stocks like Enbridge (TSX:ENB)(NYSE:ENB).

The stocks that make up my basket include BCE (TSX:BCE)(NYSE:BCE), Enbridge, and Northwest Healthcare Properties REIT (TSX:NWH.UN). These stocks have a few very important things in common. First of all, they are all defensive businesses. Secondly, they all generate predictable and healthy cash flows. And lastly, they’re all high-yield stocks.

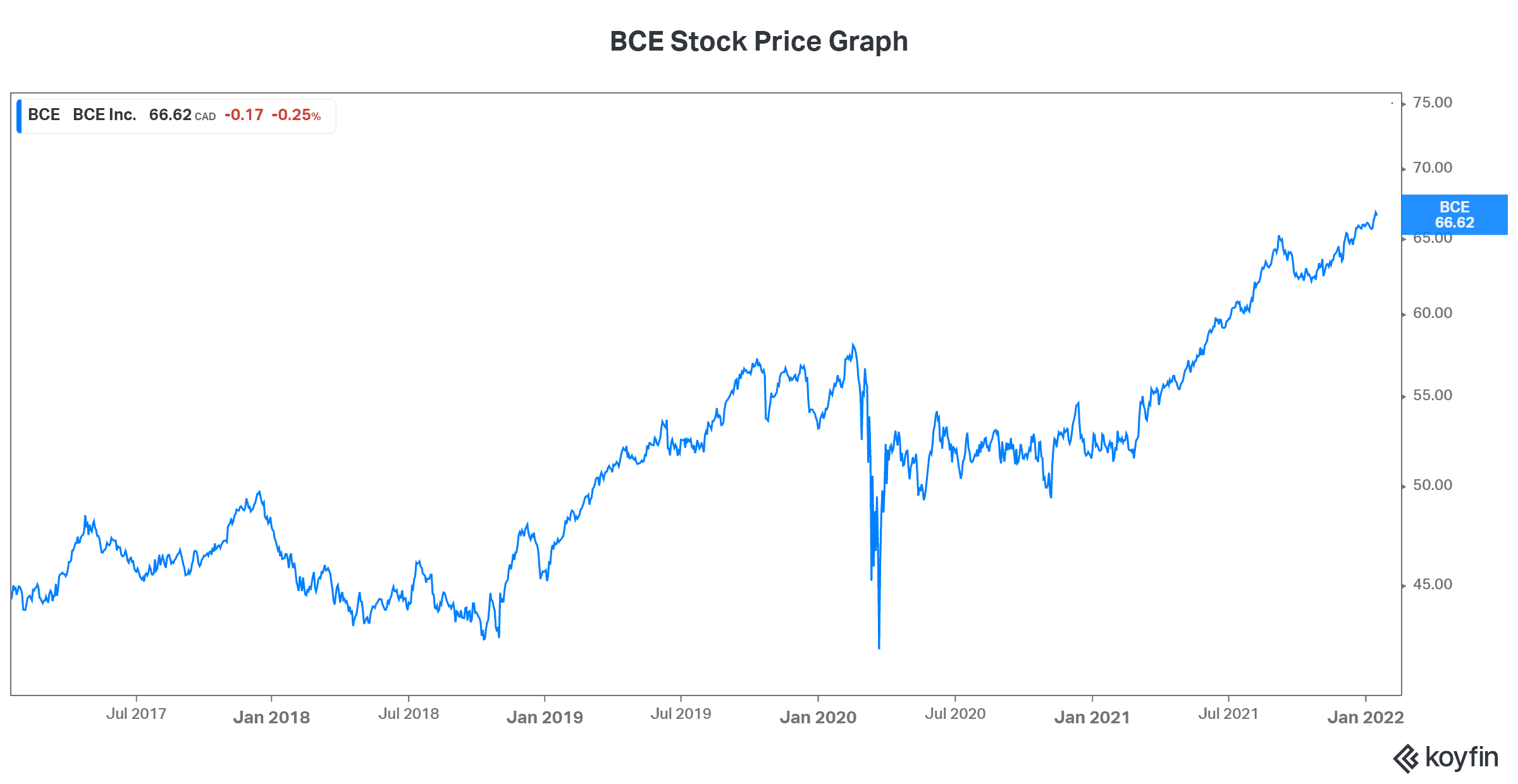

BCE stock: A passive-income stock to hold forever

When building a basket of stocks that will earn $120 per month, I started with one of the surest stocks: BCE. As Canada’s largest telecom services company, BCE has an enviable and un-moveable position. This is what also makes it one of Canada’s top dividend stocks.

So, BCE has a pristine balance sheet and a defensive revenue profile. In short, it’s one of the most cash flow-rich companies out there. Also, BCE’s business has proven to be extremely resilient. This has resulted in steadily growing dividends. In fact, 2020 was the 13th consecutive year of a 5% or higher dividend increase.

All of this culminates into a stock today that is yielding 5.25%. It’s a great yield, especially when considering its low risk.

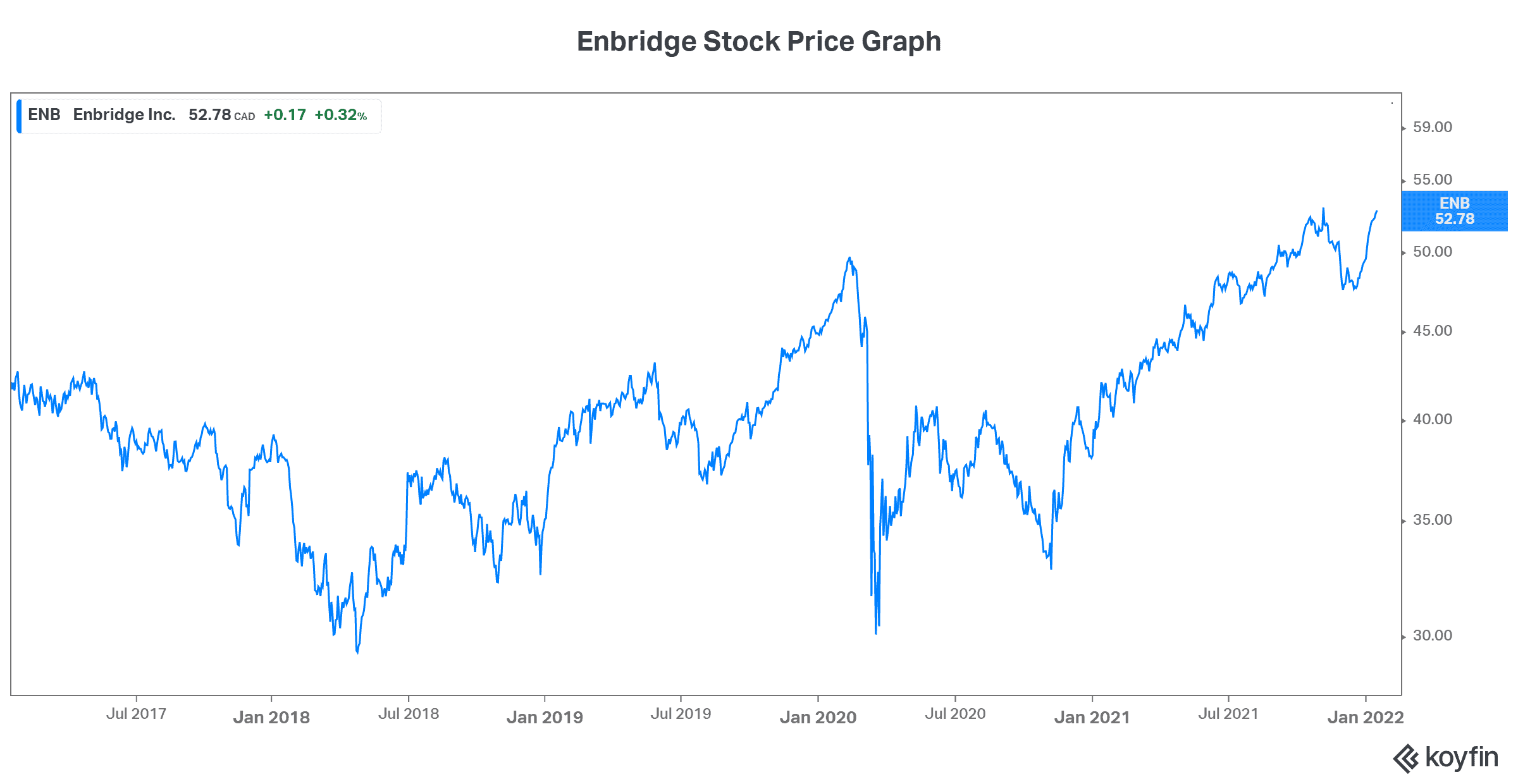

Enbridge stock: A passive-income idea that yields 6.5% with steady cash flows and a cheap valuation

Enbridge is one of Canada’s leading energy infrastructure companies. In fact, Enbridge’s assets are a critical piece of North America’s energy infrastructure. As such, this company is yet another highly defensive and predictable cash flow machine. And — you guessed it — it’s a great place to turn for passive income.

Today, Enbridge stock yields a very attractive 6.53%. This is due to two reasons. The first is the obvious one: Enbridge really does generate tonnes of cash flow, and it pays a lot of it out to shareholders. In fact, Enbridge’s 26 years of dividend growth at a 10% compound annual growth rate (CAGR) speaks volumes. But the other reason its yield is high is because the stock is pretty cheap. This probably comes as no surprise to you. I mean, energy stocks in general have been in the doghouse due largely to environmental concerns.

At this point, energy stocks are making a comeback, as investors realize that they will be a necessary part of life for the foreseeable future. Enbridge is yielding 6.5% today, and it makes a great addition to any passive-income portfolio.

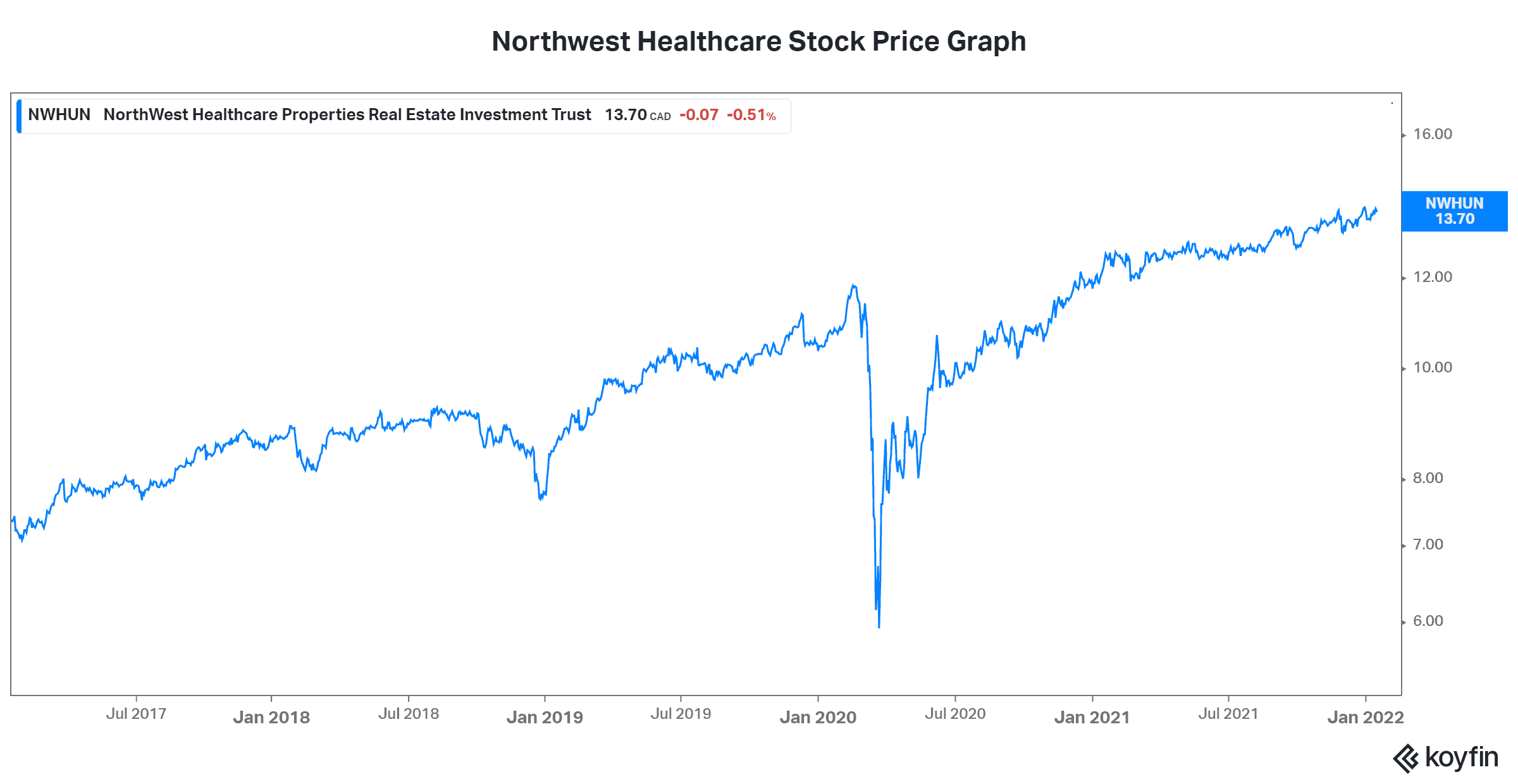

Northwest Healthcare REIT: Some passive-income ideas benefit from the aging population

Northwest Healthcare Properties is a real estate investment trust (REIT) that owns and operates a lucrative portfolio of global healthcare real estate. The healthcare industry is also steady and defensive with solid long-term growth drivers such as the aging population. This is reflected in the fact that Northwest Healthcare Properties is a defensive holding — cash flows generated are steady and stable.

This is all very attractive for passive-income investors. But there’s even more. Northwest’s revenues are inflation-indexed. This is another level of security that should really appeal to those of us looking for passive income.

How to make $120 per month in passive income

These stocks form my $120-per-month passive-income portfolio. Now, let’s talk about the details. In order to generate this income, you would have to invest approximately $25,000. This money would be split as follows: buy 100 shares of BCE, 200 shares of Enbridge, and 500 shares of Northwest Healthcare.

The result would yield 6%. The key here is that this yield is one that you can secure without taking too much risk. As I’ve pointed out at the beginning of this article – these stocks are defensive and cash flow-rich. This makes them strong and steady. Effectively, this basket of stocks presents a very attractive risk/reward profile.

Motley Fool: The bottom line

I hope that this article has given you some good passive-income ideas and a clear way to build low-risk, monthly passive income for many years to come.