Passive income, or income received through minimal effort, is essential to long-term financial wealth. It ensures an income, even when we’re out of service. It also ensures a retirement of little effort or worry. That’s what passive income does best. So, our job is to set ourselves up while we still can. I’m a believer in steady and predictable income stocks. These stocks are key generators of passive income for life. I’m talking about dividend stocks like Fortis (TSX:FTS)(NYSE:FTS).

Please read on to find out why Fortis stock was downgraded and why it remains a top income stock.

Fortis is downgraded as valuations soar

It’s a sad (or happy) reality that whenever a company is doing everything right, its stock tends to become overvalued. This is a function of overoptimism as well as increased demand for the shares. While our investment philosophy at Motley Fool stresses a long-term focus, times of over- or undervaluation should still be taken into account. I mean, we should never put our heads in the sand or act without considering everything.

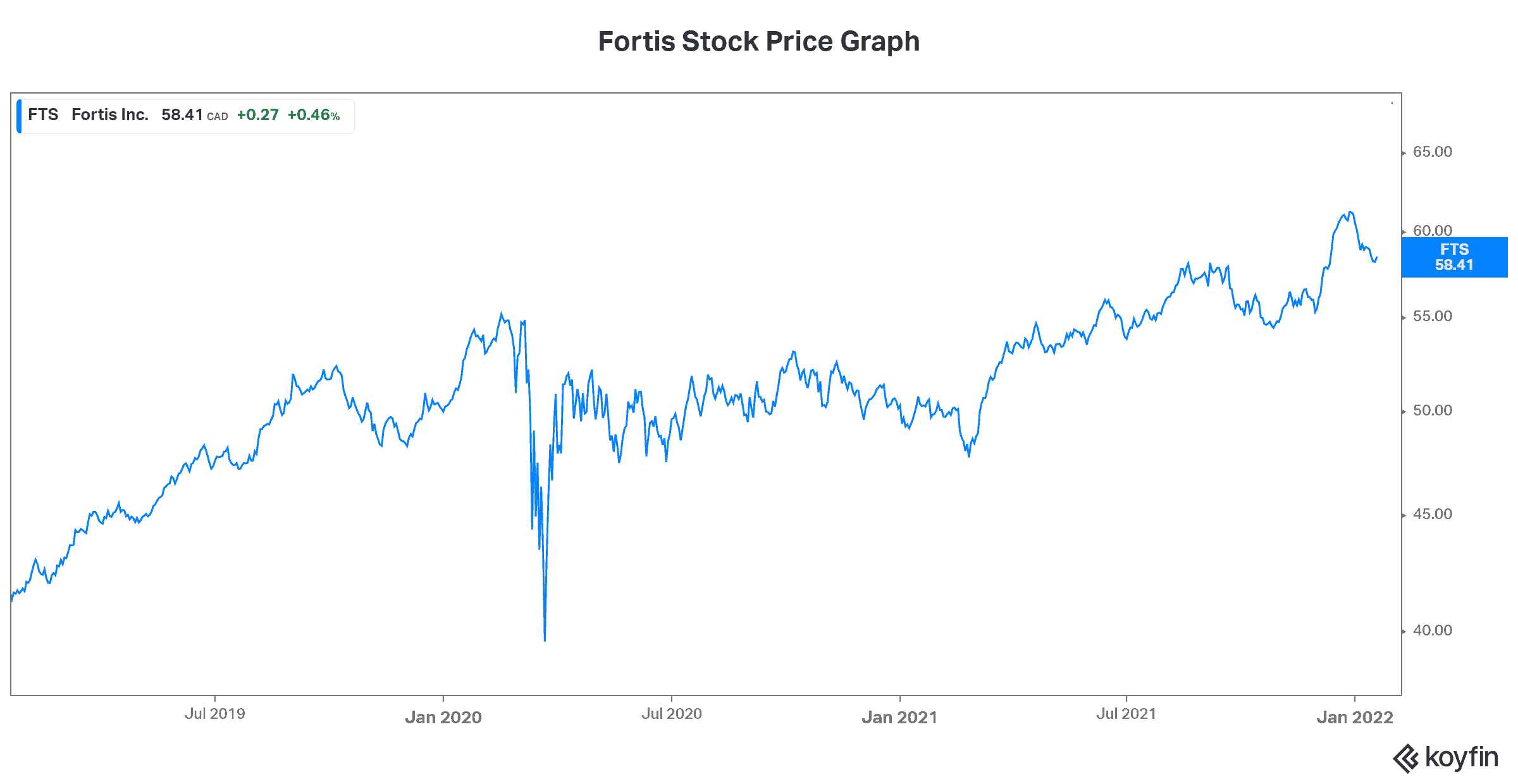

This brings me back to Fortis stock. For the last two years, Fortis has been a beacon of security for investors. It’s been the steady, predictable investment that we all yearned for in these crazy times. This has made shareholders happy. The stock has risen 12% in 2021 and 38% from its March 2020 lows. This is no small feat for a typically “boring” utility stock. And all the while, Fortis has carried on with its tradition of raising its dividend and creating shareholder value. You might say that it was totally unfazed by the chaos of the pandemic. So, it’s no wonder that it’s performed so well.

At the beginning of the month, Fortis stock was downgraded. Scotiabank and UBS now see the stock as fairly valued. As Scotiabank’s analyst said, “the recent share price outperformance has driven its valuation to what we view to be fair levels. In addition, its premium versus its peers has widened out.” I agree. And I hope that this will result in a better entry point for the stock soon, because I’m still eagerly waiting to buy.

This passive-income investor (me) is still waiting on the sidelines to buy Fortis

In recent years, I have been looking for some top passive-income stocks. I guess the focus in my portfolio is shifting a bit. I’m moving from having a portfolio consisting mostly of growth stocks — stocks that I believe will provide 10 times returns — to a more diversified portfolio that also includes a significant weight in passive-income stocks. I’ve therefore had my eye on Fortis stock since last year. After it fell to $42 in March, I became interested. The “problem” was that it recovered so quickly that I missed the chance to buy. So, I’ve kept waiting.

A dividend stock providing passive income for life

There are no better qualities that passive income can have than steady growth and predictability. Fortis stock has these in spades. Fortis is a regulated gas and electric utility company, and this defensive business breeds safety and predictability. But it’s also grown quite nicely. This is reflected in Fortis’s dividend. In fact, Fortis’s dividend has given its shareholders passive income that has consistently grown for 48 years. Fortis stock’s dividend income has not only combatted inflation, but it’s also provided more than acceptable returns on investment.

Motley Fool: The bottom line

Passive-income stocks like Fortis are core holdings in a passive investor’s portfolio. I will keep an eye on the stock and will be ready to pounce when its valuation falls under $50. Maybe now that the stock has been downgraded, this is closer to becoming a reality. Or maybe it’ll get there the next time we have some general stock market turmoil. In any case, this is the stock I will be watching the closest.