Many growth stocks have taken a hit in recent weeks. But please, don’t count them out just yet. Be selective in your selection, but now is the time to look for growth stocks to buy. After all, they’re much cheaper now than they were a few weeks ago. Today, Blackberry Ltd. (TSX:BB)(NYSE:BB) stock is a growth stock that I believe can take your portfolio to the next level.

Please read on as I take you through the signs that point to big returns for Blackberry’s stock price.

Blackberry stock begins its climb higher

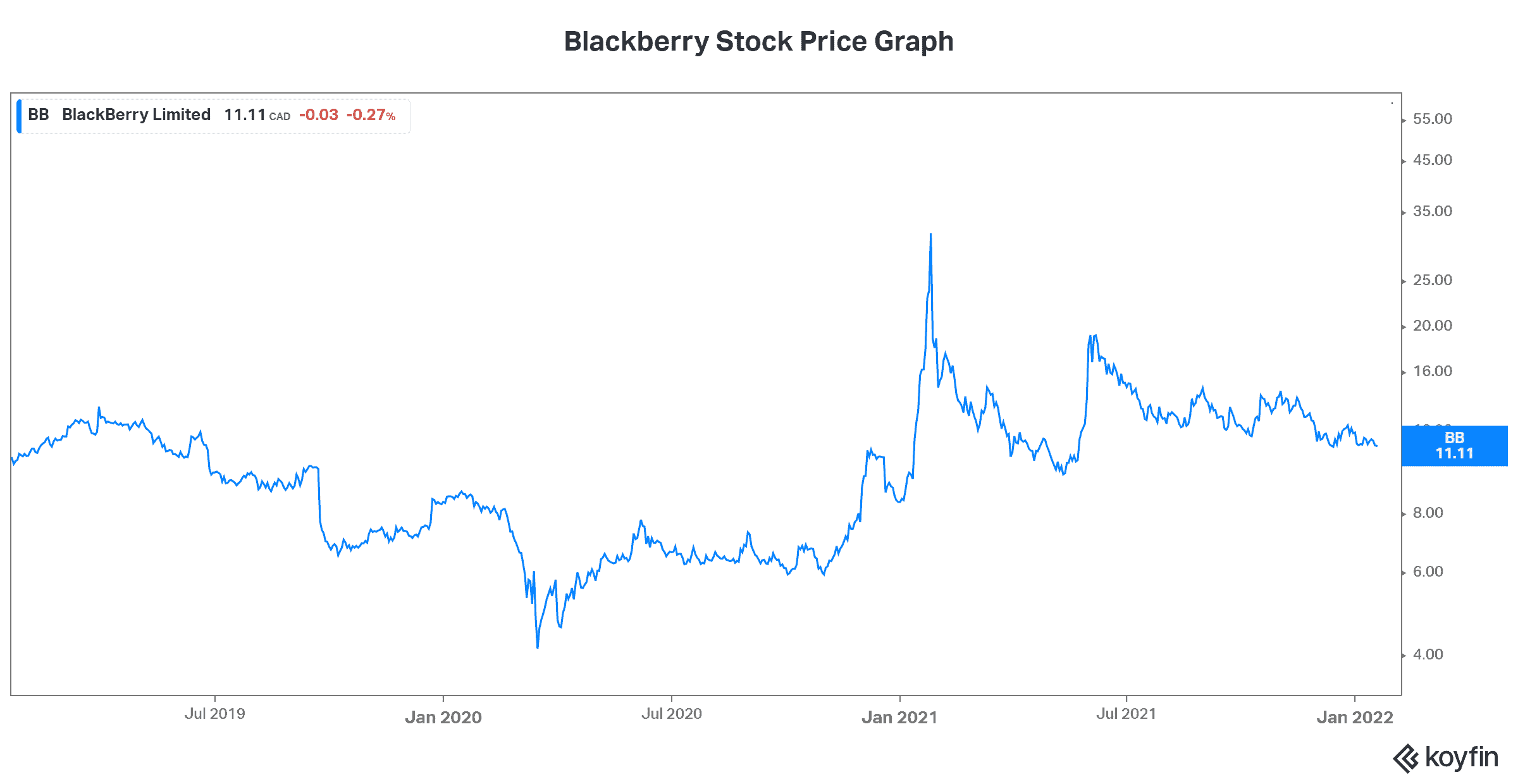

To start off, let’s take a quick look at Blackberry’s stock price performance over the last year.

The graph shows that it’s been a really volatile ride. But rather than letting that scare you away, let’s lift the hood and dig a little deeper. So what happened to cause such turmoil in Blackberry’s stock price? Well, the good news is that nothing dramatic changed at Blackberry despite the wild price swings. In fact, Blackberry’s business continued to chug along, building one step at a time and making slow and steady progress. The stock price action was a world of its own. It was caught up in the meme stock craze and Reddit investor games. It was neither a story of gloom nor a get-rich quick story, as its trading suggested.

In fact, Blackberry’s fundamentals were much steadier than its stock price implies. Heading full force into the embedded systems and cybersecurity industries, Blackberry is a high tech story of excellence. Blackberry is at the right place at the right time with the right technology.

Blackberry’s results show positive hints of what’s to come

In Blackberry’s latest quarter results, released on December 21, I saw a lot of good things. Yet, the stock is down 7% since then. I’ll chalk this up to holiday distraction. I don’t think investors noticed. I know they didn’t pay enough attention to it.

First of all, Blackberry’s internet of things/embedded systems segment reported a 34% revenue growth rate. This segment, which includes Blackberry’s connected auto business, the QNX division, is pretty much back to pre-pandemic levels. Design wins are coming in strong and recurring revenue continues to rise. All of this points to a successful building up of the business. As we know, design wins are a leading indicator of the health of the business. Needless to say, QNX is going strong. Blackberry’s reputation, partnerships, and technical know-how are driving strong demand. The CEO highlighted this strength in demand on the company’s latest earnings call. I could hear the excitement. The connected auto industry is expected to grow to $250 billion over the next few years.

Blackberry’s other segment, the cybersecurity business, is also going well. This business is estimated to be worth over $150 billion. It’s an increasingly relevant and high growth business. Revenue here just held firm versus last year. But once again, the story is in the new business that Blackberry continues to secure. In this segment, the company got numerous new customer wins again this quarter. For example, the IRS and the US Department of Homeland Security are new wins.

Motley Fool: The bottom line

The message that I’d like to get across is simple. I know that Blackberry has many doubters. Yet, the company continues to excel. It’s a long road ahead but I can see big potential for Blackberry and Blackberry’s stock price. I would not be surprised if this stock becomes one of the success stories that provide investors with 1,000%-plus returns.