Dividend stocks like BCE Inc. (TSX:BCE)(NYSE:BCE) have been portfolio anchors. These stocks are the stable ones that we can rely on. They provide consistent and growing dividends. They also provide stability and peace of mind. So, when BCE reported its fourth-quarter results today, it made me think. What better time to remind Motley Fool readers of BCE stock’s value than today?

Please read on as I go through three key points from BCE’s Q4 earnings and conference call that reinforce my positive view on the stock.

BCE institutes a 5.1% dividend increase

Once again, BCE has increased its dividend. While not unexpected, this is further confirmation of BCE’s value proposition for investors. So the dividend was increased by 5.1%. It’s the fourteenth consecutive year of a 5% or higher dividend increase. And it’s reflective of BCE management’s commitment to its dividend and dividend growth.

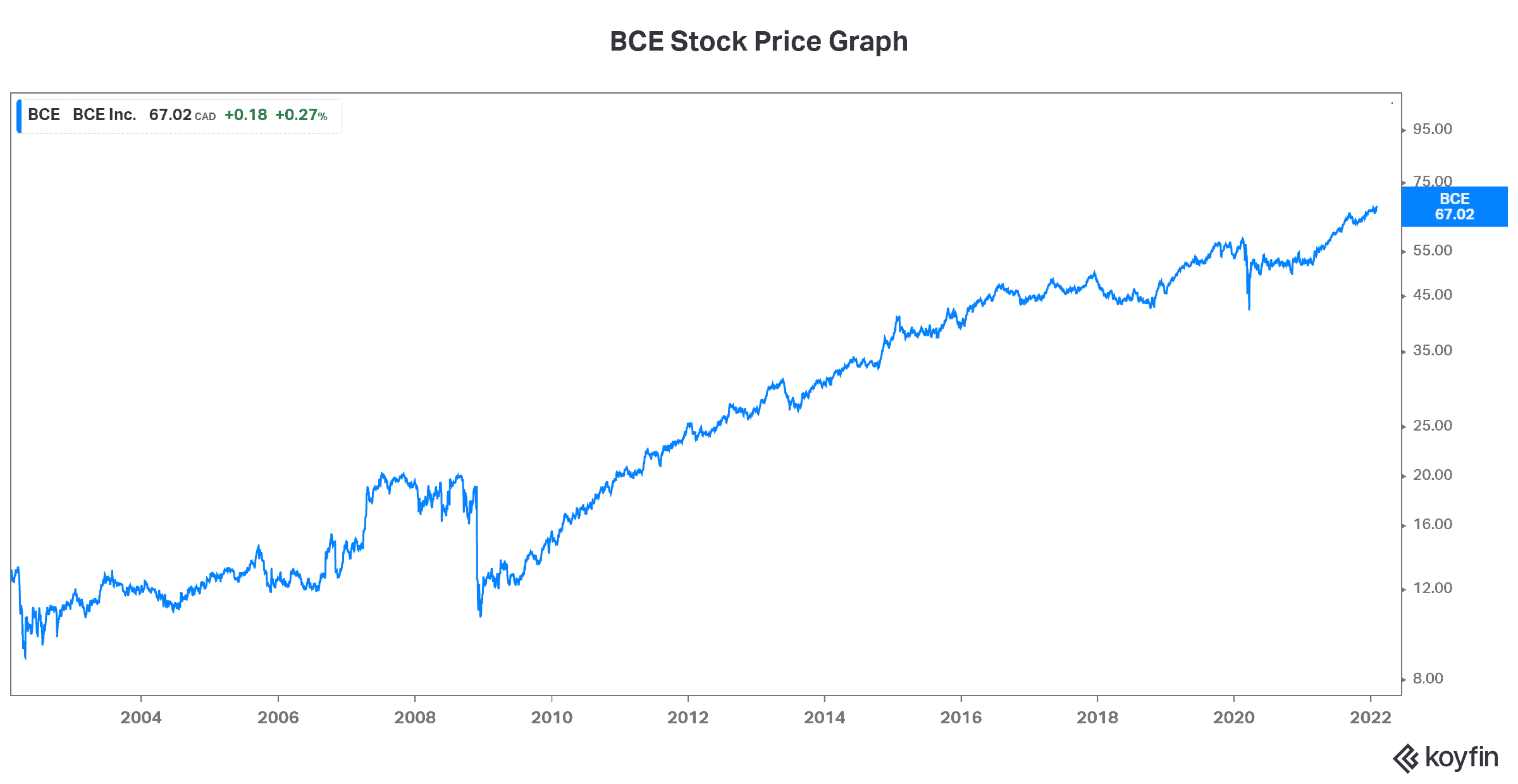

Today, BCE is a dividend stock that’s yielding a very robust 5.2%. It’s a dividend yield that you may not expect from such a stock. It’s a dividend yield that’s usually reserved for the more risky type of stocks. BCE, by contrast, is a cash flow machine with a strong competitive position in an industry that has high barriers to entry. It’s the picture of stability and visibility. In fact, take a look at BCE stock’s long-term stock price graph. It really is a picture that perfectly embodies this.

A dividend stock with a growth opportunity

It’s hard to miss the fact that BCE’s business can be a very capital intensive one. Understandably, this is something that might worry some of us. I mean, elevated capital expenditures often destroy a company’s ability to provide attractive shareholder returns. But BCE is a different beast. Its financial and operational discipline has enabled the company to manage this tug of war exceptionally well.

The telecom industry is rapidly changing. New advances such as fibre optics and 5G are changing the landscape. And BCE is committed to keeping up with these changes. BCE’s fibre plan build-out was accelerated earlier this year as the competitive advantages of it are undeniable. With this, BCE is laying the foundation for 5G and fibre optic networks. It has a leading competitive position in its quest to connect rural networks and to give all Canadians the fastest speeds. In short, fibre networks are the foundation for a better overall connectivity experience in households.

BCE achieves pension holiday

As a bonus today, we heard of BCE’s pension holiday. Essentially, the strong performance of the company’s pension fund has given BCE a contribution holiday. This means that BCE will save $200 million per year for at least the next five years. It’ll give BCE access to cash that it hadn’t expected. In total, the company is estimating that it now has an extra $1 billion of cash in order to fund its growth and, of course, its dividend.

These sizeable contribution holidays strengthen BCE for the foreseeable future. They will enable BCE to continue to strengthen its already significant lead versus its competitors in areas such as fibre and 5G. This will likely solidify BCE’s lead in “winning the household,” where fibre and 5G speeds are key. They’re essential in the new “multi-gig” world. A multi-gig household is one that’s interconnected – where multiple devices are connected at any given time. The fibre connection cannot be beat in this world.

Motley Fool: the bottom line

In summary, BCE stock is one of the best dividend stocks today. Investors have benefited from this stock for decades, and all signs point to this continuing.