No matter what stage of life you’re in, generating passive income is key to building long-term wealth. It’s income that you don’t have to work for. It’s income generated while you’re sleeping, while you’re awake, and while you’re just being. You just have to keep breathing, and it’s yours. So, how can you generate up to $215 in weekly passive income? You can turn to some of the best dividend stocks in Canada.

Read on and I’ll walk you through a pretty conservative way to secure this for life.

Invest big and invest often

To start you off, let’s assume that you have $50,000 that you’re ready to invest. How can you turn this into reliable passive income? Well, first you have to look for reliable dividend stocks. These are the stocks that some investors might call “boring.” They’re generally not the high flyers that you’ll hear talked about in the news day after day.

The stocks I’m talking about are the dividend stocks that are backed by a strong history. They’re also backed by strong, consistent cash flows, and solid fundamentals. It’s about being in the right industry. It’s also about being in the right company. In short, it’s about being the best of the best. It’s about buying the best dividend stocks in Canada.

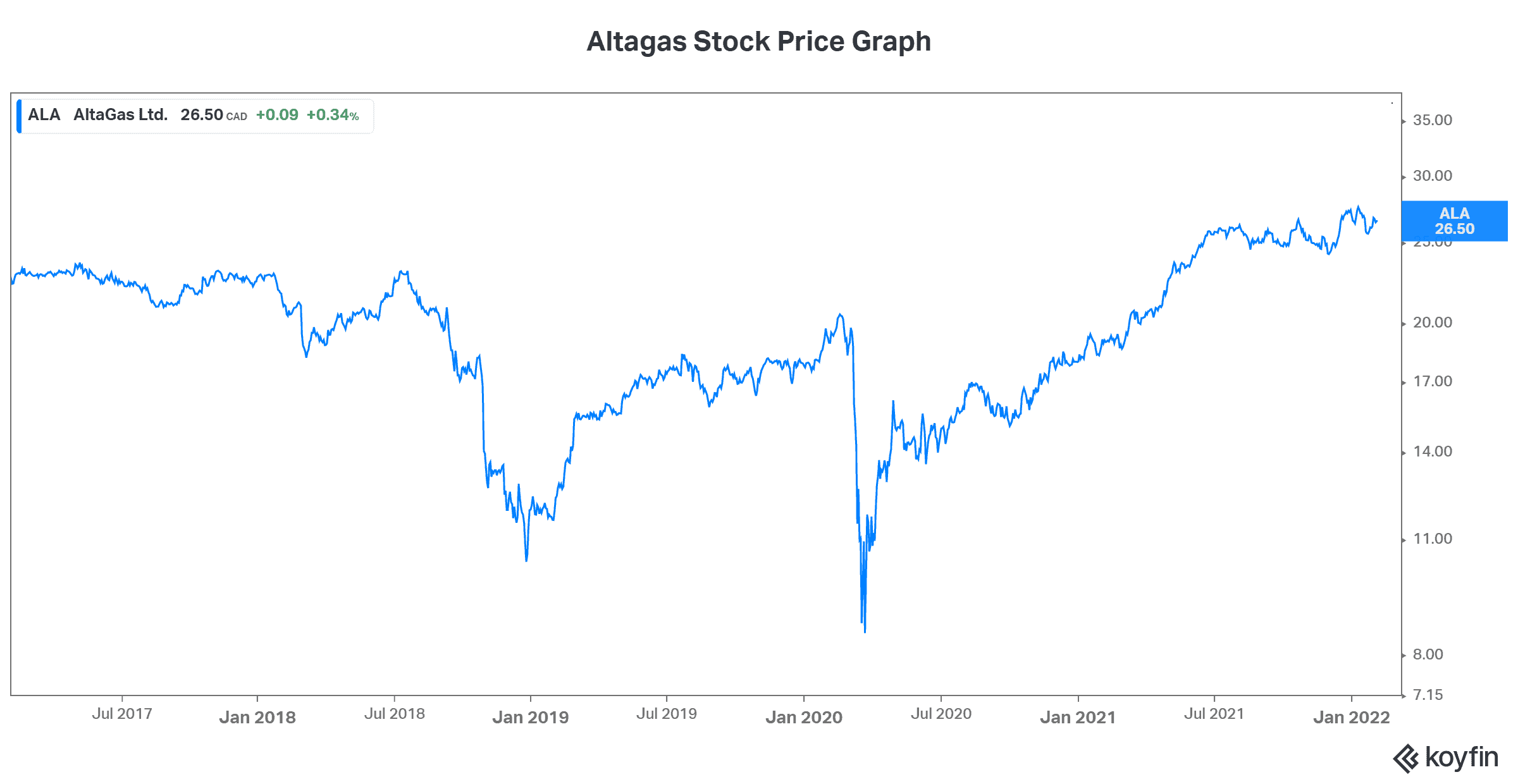

AltaGas: Invest $10,600 (400 shares) in this dividend stock for passive income of $35/month

AltaGas (TSX:ALA) is a dividend stock that can help you earn passive income. It’s an energy infrastructure giant with a strong position in two distinct areas. The first is the utilities business. This business is a stable one with consistent, steady growth. It’s the part of AltaGas’s business that’s regulated and defensive. The other business is the midstream business. This is the business with the rapid growth.

The company’s midstream business is located in Western Canada. It includes natural gas-processing and export facilities. Recent demand for natural gas and its by-products is soaring. Cash flows are therefore up big and growing, as we enter a new phase where natural gas is the affordable fuel of choice in many parts of the world, as we attempt to stop climate change.

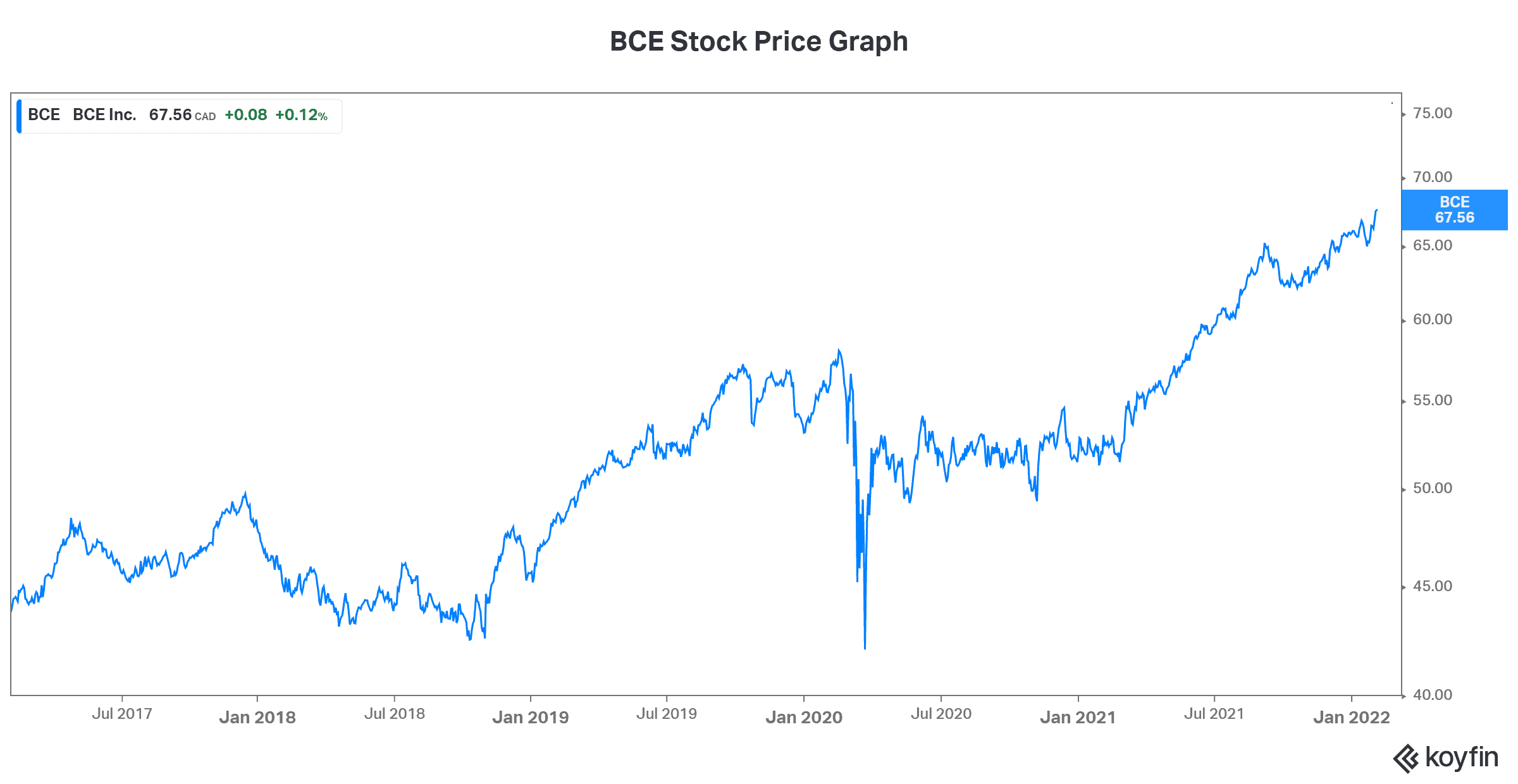

BCE: Invest $20,300 (300 shares) for passive income of $92/month

BCE (TSX:BCE)(NYSE:BCE) is another cheap dividend stock that belongs in your passive-income portfolio. It’s Canada’s largest telecom services company. And it’s one of the best dividend stocks in Canada. BCE’s business is steady, stable, and defensive. This has resulted in steadily growing dividends. In fact, BCE has 13 consecutive years of a 5% or higher dividend increase under its belt. It’s reflective of BCE’s strong business. It’s also a reflection of BCE management’s commitment to its dividend and dividend growth.

If history is any indication of the future for BCE stock, as I believe it is, investors will be able to rely on it for years to come.

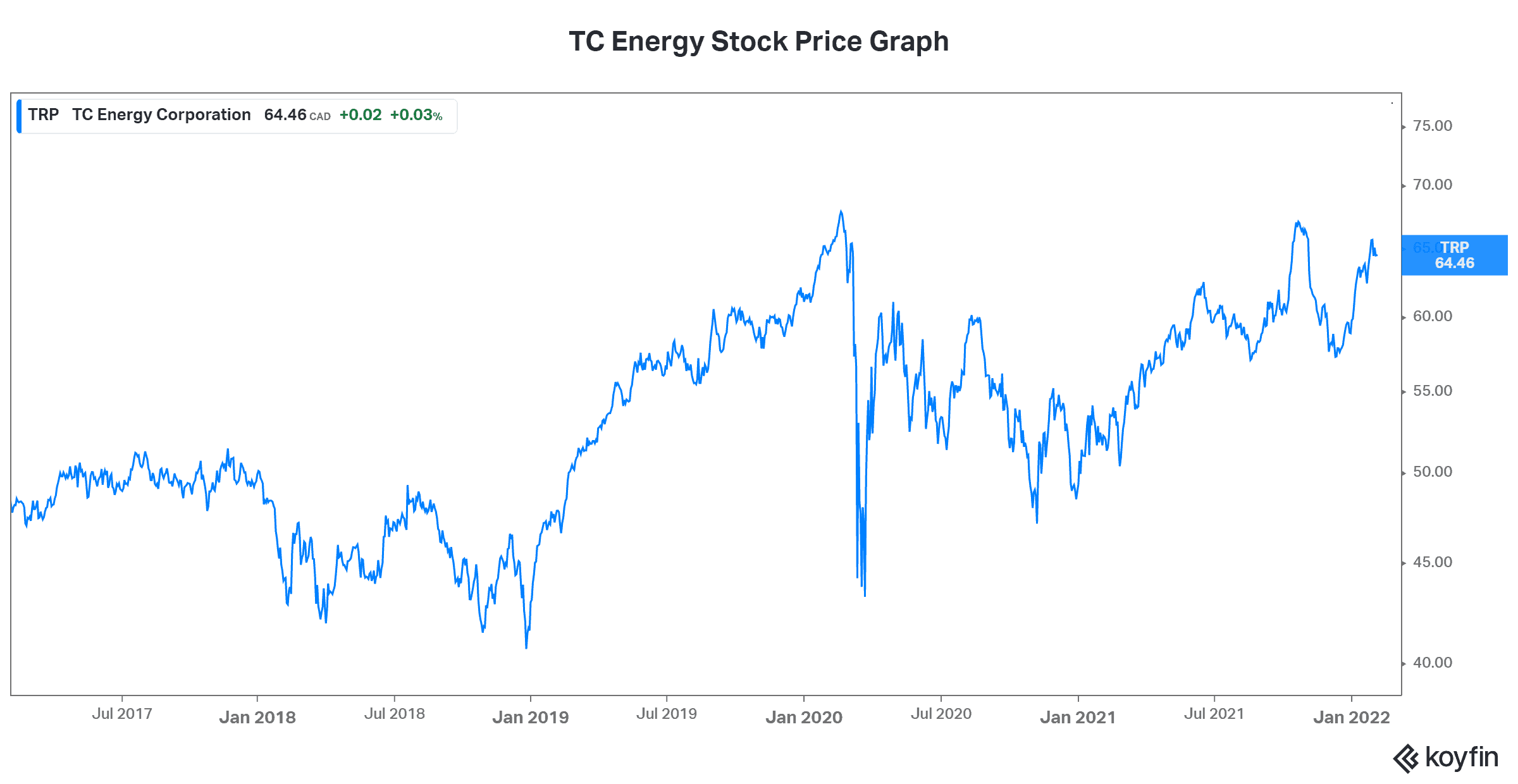

TC Energy: Invest $19,000 (300 shares) in this Canadian dividend stock for passive income of $87/month

TC Energy (TSX:TRP)(NYSE:TRP) is another tried and tested energy infrastructure stock. It’s also one of the best Canadian dividend stocks. Today, it’s yielding 5.3%. The pipeline industry is still a booming one. Just look at TC Energy’s soaring cash flows generated over the last many years, and you will see clear evidence of this. TC Energy is essentially the backbone of Canada’s energy industry.

This has been an exceptional dividend stocks for the last few decades. Today, it’s still a top passive-income idea. Since 2000, TC Energy stock has appreciated almost 500%. Also, its dividend has grown at a CAGR of well over 7%. In short, this dividend stock a top choice for passive income.

Motley Fool: The bottom line

The bottom line here is that as long as you have some money to invest, consider investing for passive income. The income builds and compounds over time, leaving you with extra cash as your investments work for you. No amount is too little; just start getting your money to work for you. Three of the best Canadian dividend stocks, AltaGas, BCE, and TC Energy, are stocks to help you get started.