Enbridge (TSX:ENB)(NYSE:ENB) has been a Dividend King for many decades. This has made it an ideal stock to turn to for retirement planning. Recently, Enbridge stock was downgraded, but what does this mean for investors? Can we still rely on it for our retirement planning? It is still a top RRSP stock?

Is Enbridge stock ideal for your RRSP?

Retirement planning is difficult in the best of times. Today, it’s even more so. This is because of many factors. For example, valuations are high. Also, pandemic disruptions have caused problems and uncertainties. Lastly, the prospect of rising interest rates is daunting.

In my view, Enbridge stock on the TSX is an ideal stock for your RRSP. This is because it has built-in protection from some of the biggest risks out there. For example, inflation is on the rise, but 80% of Enbridge’s EBITDA is inflation protected as its regulated. Also, rising interest rates are not a big problem for Enbridge because most of its debt is fixed interest debt. Lastly, Enbridge’s valuations are attractive, and its dividend-growth record is consistent and reliable.

This gives a clear picture on why Enbridge stock is, in fact, ideal for any investor’s RRSP portfolio. But let’s dig deeper and look at some of the recent doubt that may have been cast after it was downgraded by various sell-side analysts.

Enbridge stock price: Do recent downgrades cloud the picture?

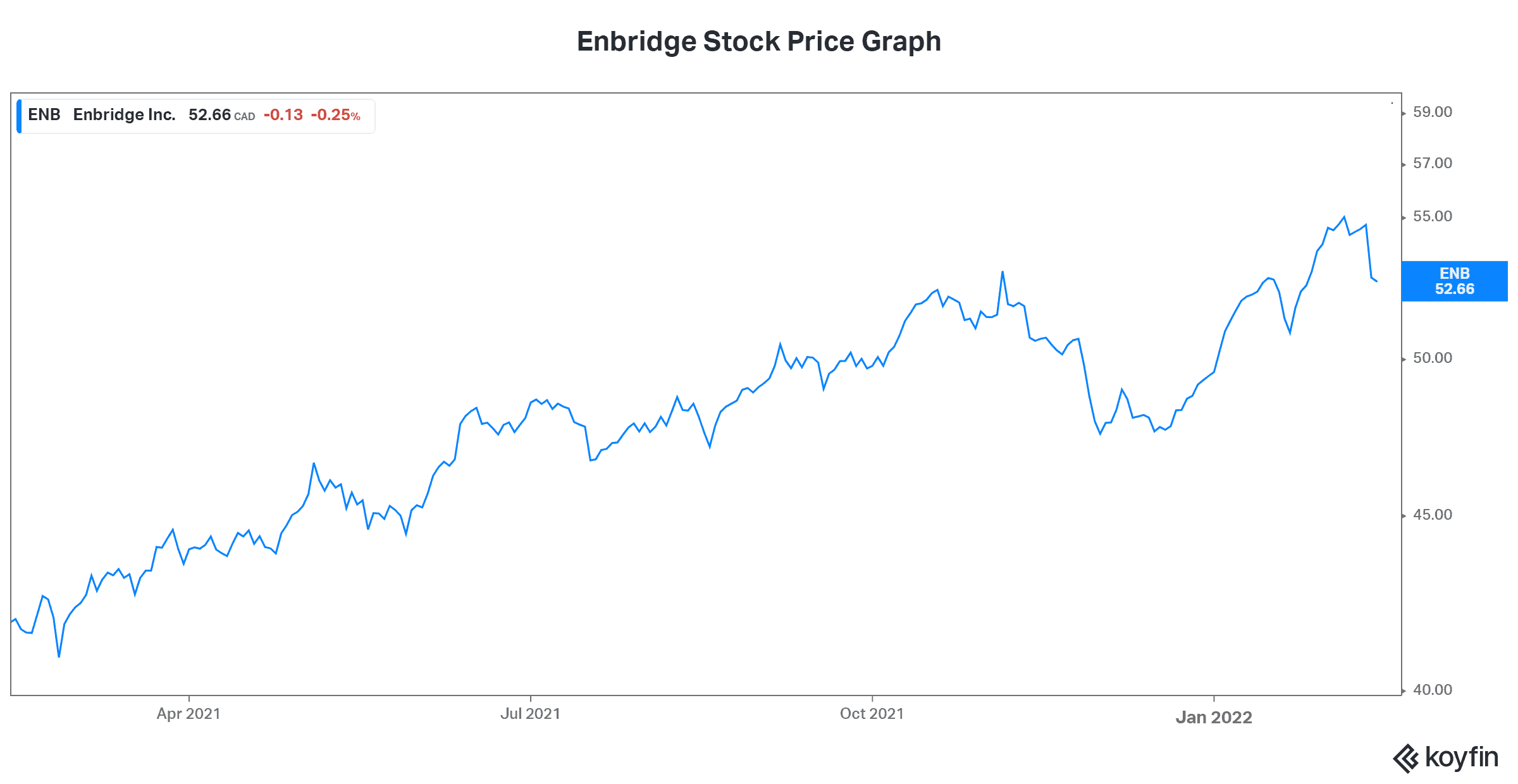

Enbridge stock has recently been subjected to multiple downgrades. For example, analysts at Scotiabank reduced its rating to sector perform from outperform. It might leave many of us wondering if this stock is still a top dividend stock for our RRSP. There are a few things to keep in mind here. The first is that this downgrade was due to valuation concerns. I guess I can see the reasoning behind this. It is quite surprising to see the performance of Enbridge and its stock price over the last year. Since Dec. 2021, Enbridge’s stock price is up almost 30%.

But looking at Enbridge stock and its valuation quickly puts me at ease. In fact, it tells me that Enbridge actually remains undervalued. Its multiples are way below its peer group. Also, its returns are way above its peer group. In short, Enbridge remains a top stock for any investor’s RRSP.

Before I move on, I would like to address some of the hesitancy around Enbridge. Enbridge’s stock price performance in the last year is an outlier. It’s not the usual performance that we should expect from energy infrastructure stocks. So, I can see why some may be nervous. But I would instead focus on the fact that Enbridge was coming off a point where it was severely undervalued.

This undervaluation was the result of the macro environment a few years ago. This environment was plagued by low energy prices and an overwhelming shunning of anything fossil fuel related. Today, we can see the compelling economics of Enbridge more clearly. And I think investors are realizing what Enbridge has been saying for many years — conventional energy will be needed for many years to come.

Enbridge stock is yielding a spectacular 6.56%, making it a top RRSP stock

So, today, things are very different. Oil and gas prices are soaring. And conventional energy companies are making a comeback. As for Enbridge, it continues to rake in billions of dollars in cash flow. And it continues to increase its dividend. In fact, it has never really stopped. Its latest 3% dividend increase was the 27th consecutive increase.

Annual dividend growth remains core to Enbridge’s value proposition. This aligns Enbridge stock really well with RRSP investors. Heck, it aligns it really well with any investor looking for income. Today, Enbridge is yielding over 6.5%. For a company that has as predictable and growing cash flows as Enbridge, this is a steal. It signals the extent to which Enbridge’s stock price is undervalued.

Motley Fool: The bottom line

Enbridge and its stock price had been on fire until a mildly disappointing quarter and a few downgrades hit. Long-term investors need not worry though; Enbridge remains a top RRSP stock, as its long-term outlook is still intact.