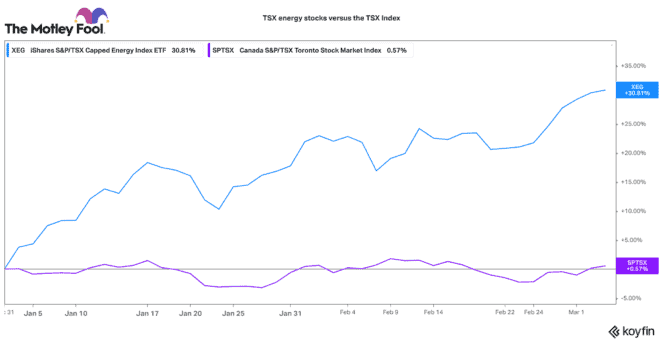

TSX energy stocks are vastly outperforming almost every other asset class in 2022. To give you an example, the S&P/TSX Capped Energy Index is up 31% this year alone. That is compared to the S&P/TSX Composite Index, which has only delivered a 0.57% return. Over the past year, the TSX Energy Index outperformed the TSX by 80 percentage points.

TSX energy stocks are still very cheap

With WTI oil price soaring to over US$100 per barrel, many Canadian energy stocks are more profitable than ever. Likewise, they are yielding tonnes of excess free cash flow that can be deployed to shareholders. Despite their strong performance in 2022, many of these TSX stocks are still astoundingly cheap. Here are three of my favourite TSX energy stocks today.

One of the cheapest TSX energy stocks today

Vermilion Energy (TSX:VET)(NYSE:VET) is up 53% in 2022 alone. The company has gas and oil operations in both Europe and Canada. The conflict between Russia and Ukraine is exacerbating power prices across Europe. Consequently, Vermilion is garnering incredibly high prices for its natural gas. Likewise, North American gas and oil are still near seven-year high prices.

Despite the quick rise in its stock, Vermilion is still very cheap. In 2018, this was a $47 stock. Vermilion trades with a near 40% free cash flow yield and is amongst the cheapest mid-cap TSX stocks. It trades with a price-to-earnings ratio of 5.3.

The company does have a lot of debt. However, given its high cash yield, it expects to reduce debt to sub $1 billion (or 0.5 times funds from operation) by the end of the year. Vermilion plans to reinstate a $0.06 per share quarterly dividend. However, as debt quickly decreases that payout could quickly rise.

An undervalued integrated energy stock

Cenovus Energy (TSX:CVE)(NYSE:CVE) has underperformed the TSX Energy Index by around 3% in 2022. Yet there are reasons to be bullish on this TSX stock. First, as one of Canada’s largest integrated energy players, it should start to attract the attention of institutional money managers. This is especially true if it keeps trading for only eight times earnings. That is a discount to both Suncor and Canadian Natural Resources.

Cenovus has done a great job integrating Husky Energy’s refining assets into its portfolio. At current oil prices, the company should be close to hitting its 2022 debt targets. As a result, further dividend increases and share buybacks could be in store for shareholders.

A natural gas top dog

Tourmaline Oil (TSX:TOU) is one of the best-managed TSX energy stocks in Canada. It operates some the highest-quality and most efficient natural gas assets in Western Canada. Likewise, it is positioned to sell into some of North America’s highest priced gas markets (California, LNG exports on the U.S. Gulf Coast, etc.).

Tourmaline already has an excellent balance sheet with essentially no net debt (after considering its stake in Topaz Energy). As a result, it is returning a tonne of its free cash flow to shareholders.

Last year, it increased its base dividend three times and paid a $0.75 per share special dividend. In 2022, it has already declared another $1.25 per share special dividend and increased its base quarterly dividend by 11%.

The Foolish takeaway

Tourmaline is ahead of the pack in hitting its debt and operational targets. I believe this a picture for where the remaining TSX energy stocks are heading. All this means more dividends, share buybacks, and strong total returns are on their way for patient energy investors.