Bank stocks have been the soldiers of the TSX stock market. They’ve been key contributors to wealth creation. They’ve been key components of well diversified portfolios, and they’ve been super resilient. Today, they face new challenges.

So, in the interest of time, I’ll just get right to it. Here are the two Canadian bank stocks that I would buy on any future stock market weakness.

Bank stocks: Resilient money makers

Canadian investors who have bought bank stocks in the last couple of decades have certainly done well. Reliable dividends plus strong capital gains have made them among the best-performing stocks. But today, they are facing more headwinds. Firstly, they’re trading at all-time highs, which, in and of itself, warrants caution. Secondly, they’re facing a very difficult global and domestic economic environment that’s filled with many risks.

The first risk is inflation. How will the economy fare with inflation destroying the value of our dollar? How will consumers fare? It’s clear that interest rates will continue to go up. What this means for Canadian banks is complicated. On the one hand, they will benefit from an increased interest margin. On the other hand, they risk losing out on loan originations and loan growth. As money becomes more expensive, consumers spend less and borrow less.

Canadian bank stocks have been anchors to Canadian investors for many decades. They’re built on a framework of conservatism. In fact, the government demands this and through different regulations, has kept our banking system one of the best in the world. So, what we’ve seen over the last many decades is that Canadian banks are resilient. They have proved this time and time again. The environment is precarious once again. it will very likely send stocks lower in the next while. But this is nothing new. Canadian banks have weathered many storms. I expect this one to be handled as well.

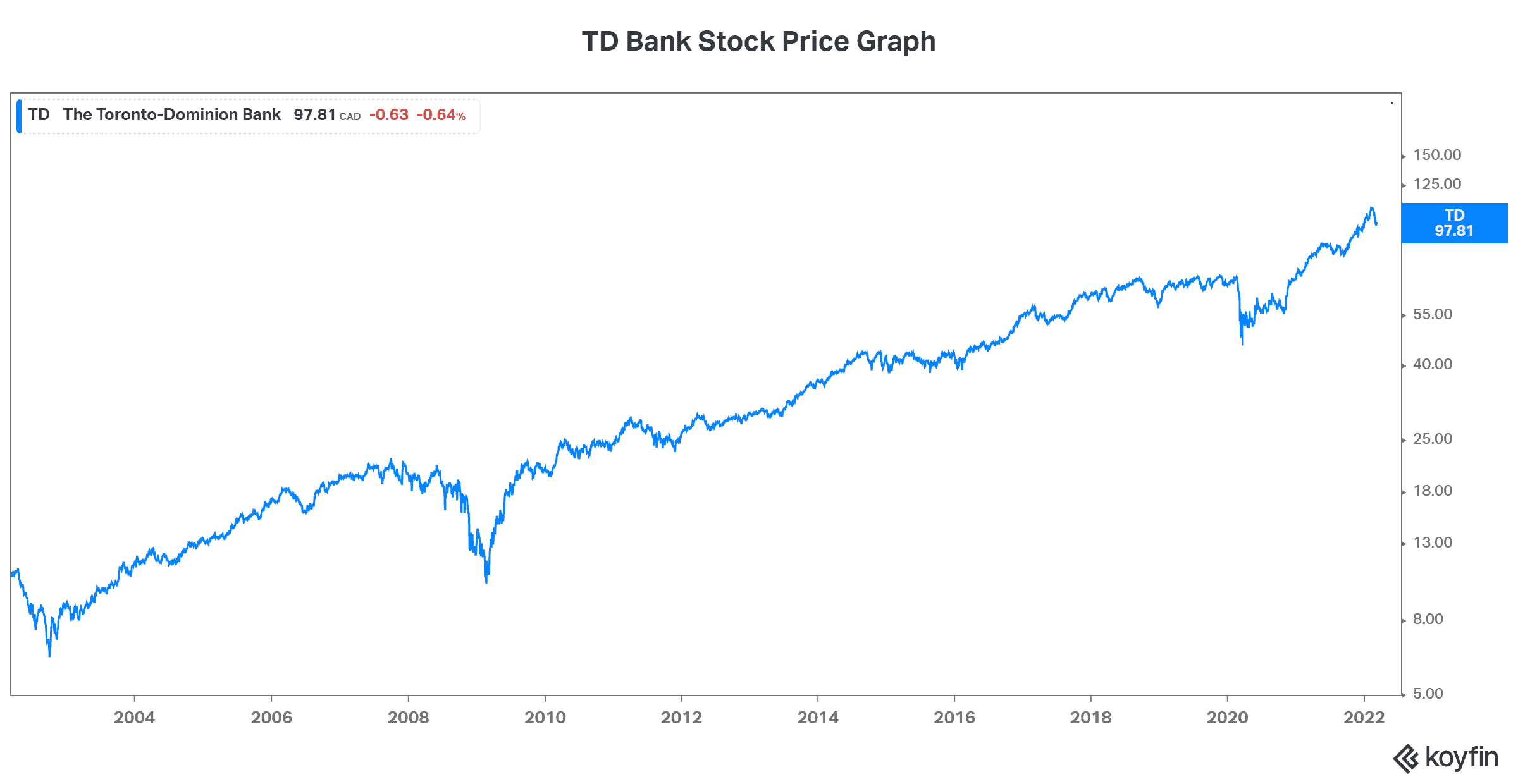

Toronto-Dominion Back stock: A top Canadian bank with unparalleled excellence

Toronto-Dominion Bank (TSX:TD)(NYSE:TD) is the first bank stock that I would keep a close eye on and add on weakness. TD is one of the largest Canadian banks. It’s also the fifth-largest North American bank. Through it all, TD Bank stands out for its strength south of the border, and for its success in driving efficiencies. TD Bank stock has a market cap of $178 billion and a 3.6% dividend yield. The stock has soared 355% in the last 20 years.

During this time, investors have also benefitted from a strong, predictable, and growing dividend from TD Bank. In fact, its 20-year compound annual growth rate (CGAR) in dividends is a very impressive 10%. Its annual dividend has grown from $0.56 in 2002 to $3.56 today for a 536% rise.

Going forward, TD Bank will probably struggle, as inflation continues to heat up. It will have to navigate a lot. But at the end of the day, TD is well capitalized, diversified, and has a proven track record. Investors who have stuck with the bank through thick and thin have come out ahead.

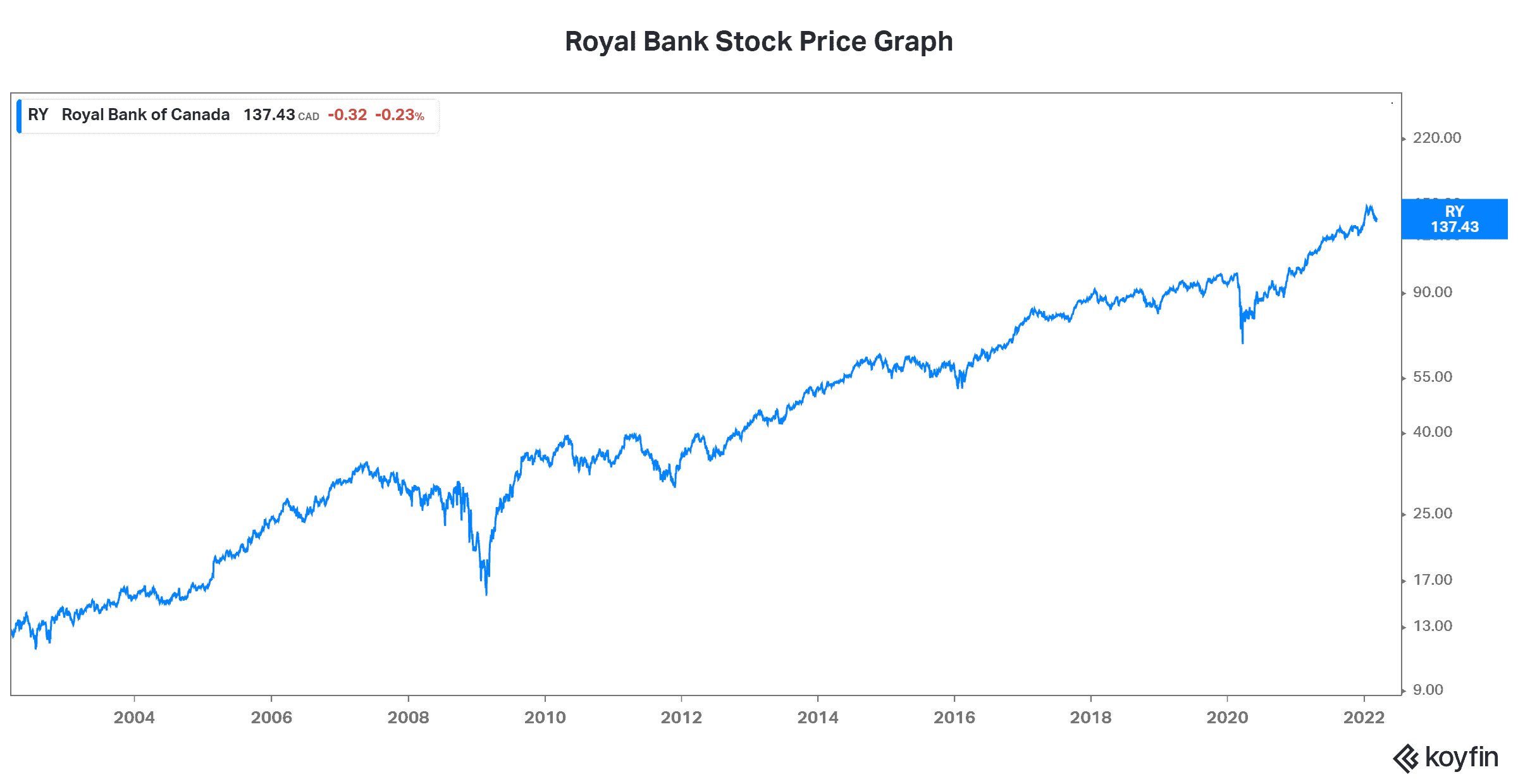

Royal Bank stock: The largest Canadian bank with an unbeatable advantage

Royal Bank of Canada (TSX:RY)(NYSE:RY) is Canada’s largest bank, with a market capitalization of $194 billion. Its stock price has risen 430% in the last 20 years, a top-notch performance that is among the best in its peer group. This is well justified, as this Canadian bank enjoys leading operating efficiency and a dominant market share in many segments.

Like TD Bank, Royal Bank also has a solid history of dividend growth. This bank has grown its dividend at a CAGR of 9% in the last 20 years. Its annual dividend has grown from $0.72 in 2002 to $4.80 today — a 567% rise.

Motley Fool: The bottom line

Canadian banks are set up to be extremely resilient. Use the likely upcoming stock market weakness as a buying opportunity for TD Bank and Royal Bank stocks.