Over the last year, and especially these last few months, there has been a significant divergence in the performance of stocks across industries. Some top Canadian stocks have been rallying rapidly, while others have fallen out of favour with investors.

This isn’t necessarily that unusual. And for investors with a well-diversified portfolio, it allows some stocks to perform well. You can use this opportunity to buy stocks that aren’t performing well at a discount and increase your position today.

Whenever you look to buy stocks at a discount, patience will surely be required before these stocks start to rally. So, often the best-performing stocks today will be investments you made back when these stocks were cheap.

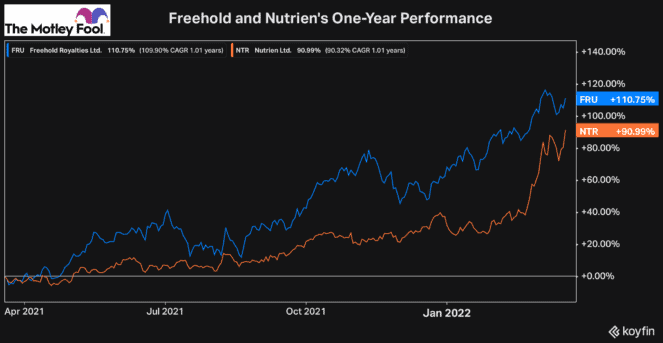

While these two top Canadian stocks below have been my top performers over the last year, the majority of the investments I’ve made in these stocks had come over the last couple of years when they were out of favour.

A top Canadian agriculture stock

One of the best large-cap and core stocks you can own for your portfolio is a company like Nutrien (TSX:NTR)(NYSE:NTR). Nutrien is an excellent investment, because it’s a massive and dominant business in the agriculture industry, which is essential and has a long runway for growth.

Lately, though, Nutrien has been one of the top Canadian stocks to own. The reason Nutrien has had such a strong performance lately is thanks to several tailwinds. First, inflation was pushing fertilizer prices higher, but now with the war in Ukraine and more sanctions on Belarus, Nutrien is increasing its production to meet global demand.

I bought Nutrien a couple of years ago. It goes without saying that I had no idea Nutrien would realize these tailwinds. So, in that way, I’ve gotten lucky. However, there are ways to create your own luck and set yourself up for success.

While I had no idea Belarus would be sanctioned so severely or how bad inflation would be post-pandemic, I did know that Nutrien was a dominant stock. I knew that the agriculture industry is crucial in our economy and that it will only continue to grow long term, as we look to eat healthier and as the population continues to grow.

Due to the fact that Nutrien was the largest potash producer in the world and in such an important industry, it’s an excellent stock to buy and hold forever. And as you would expect from a dominant business, when the time comes to take advantage of the current market environment, Nutrien continues to execute to perfection.

So, any time you can buy Nutrien or high-quality Canadian stocks like it at a discount, it’s one of the top investments you can make.

A top Canadian energy stock

One of the industries that was badly impacted to start the pandemic and offered investors a tonne of value and potential was energy. Energy prices fell considerably, as global demand dropped significantly during the initial shutdowns. However, production curtailments were also put in, impacting these stocks severely.

But long-term investors who recognized that this was only temporary had the opportunity to buy top energy stocks for cheap. I elected to buy Freehold (TSX:FRU), one of the lowest-risk energy stocks in the industry.

Its business model of receiving a royalty from production on its land rather than producing energy itself was highly appealing. In addition, its strong balance sheet and potential to return growing passive income was also a reason to buy.

The most compelling reason, though, was Freehold’s price. Like many other Canadian energy stocks, it had sold off considerably, so as it’s naturally rebounded, it’s gained a tonne of value.

And now, because it’s such a high-quality business, it’s taking advantage of the current environment — just another reminder that if you buy top Canadian stocks while they’re cheap and have the patience to hold them for years, you can see some major rewards.

Bottom line

The best investments to make are those high-quality stocks you find trading at prices you know are undervalued. Then all that’s left to do is exercise some patience, as you wait for your investments to rally back to fair value.