In this age of streaming and home entertainment systems, many investors have argued that the movie theatre, and therefore Cineplex Inc. (TSX:CGX), is dead. They say that movie-watchers don’t need the theatre anymore. After all, we can access all the content from the comfort of our homes. But is this conventional “wisdom” actually accurate? Or it is missing something really important?

Please read on as I review the reasons skeptics are wrong about the death of the movie theatre, and by extension, Cineplex stock.

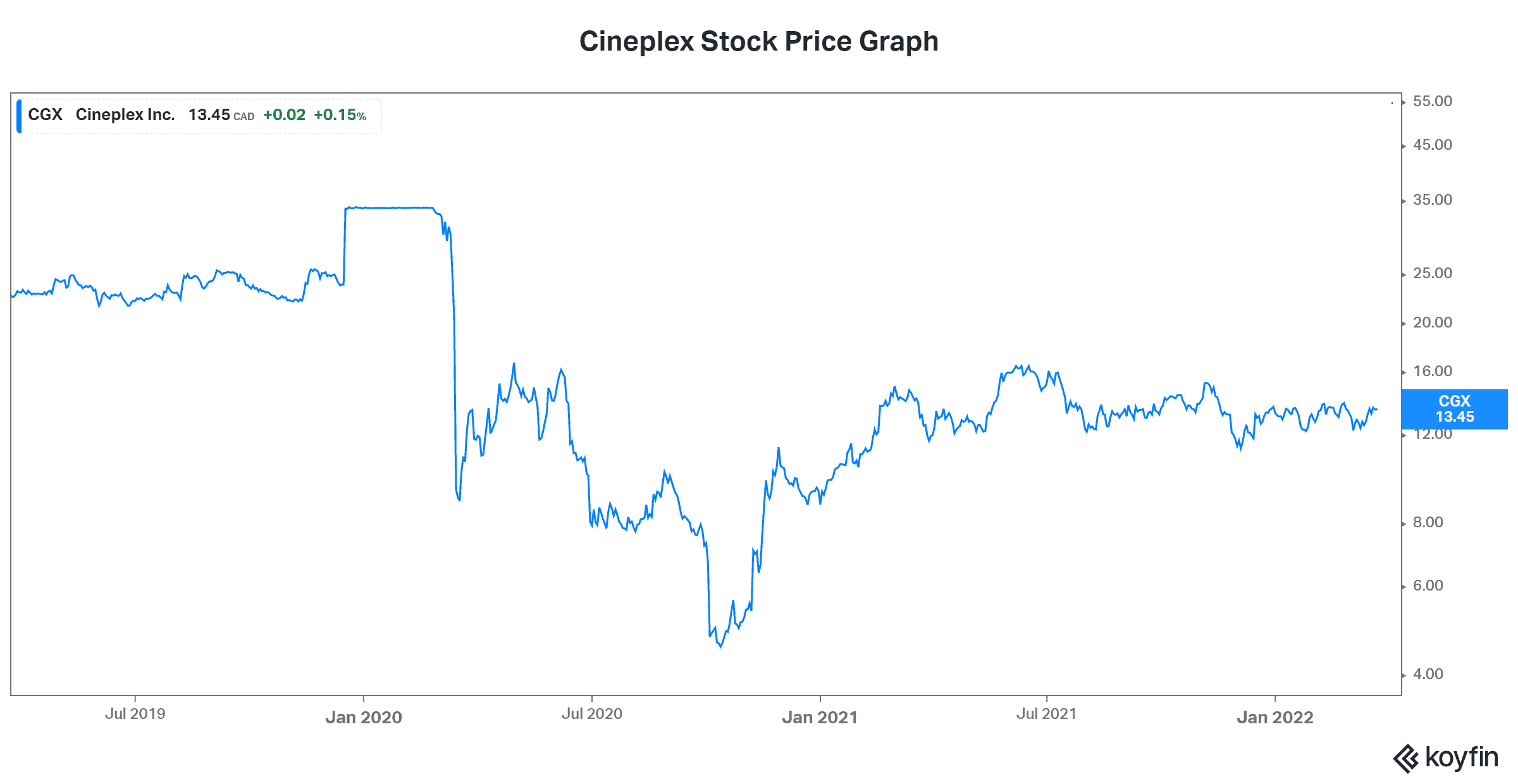

Cineplex stock gets whacked and remains DIRT cheap

Before the pandemic hit, Cineplex saw its stock price trading at almost $35. Then, news of the pandemic and lockdowns took it down to prices as low as $4.60. At that time, we were all questioning whether Cineplex could survive. But management went into crisis mode – slashing costs, rallying support, and planning for post-lockdown life.

Today, Cineplex stock is trading at over $13. It’s still a far cry from its pre-pandemic days, but it’s a sign that there’s been good progress. Yet, the shares trade at a price-to-earnings multiple of a mere 13 times the consensus earnings expectation for 2023. This dirt cheap valuation won’t be around for long, as the pent-up demand is exploding.

At this point, movie theatres are busy again. Movie watchers have returned, and Cineplex can start to dream of a prosperous future again. Yet, the skeptics are still around, saying that this company doesn’t have a place in the future of movie watching.

The demand for content is so strong that there’s room for everyone

As America’s largest movie exhibition company, AMC Entertainment Holdings Inc. (NYSE:AMC) has had its share of doubters as well. But its CEO has recently said that he “can see, taste, and feel the recovery momentum.” The conventional wisdom says that movie theatres cannot survive along with streaming. The numbers beg to differ. Over at AMC, the fourth quarter of 2021 saw a revenue increase of 53% sequentially. Also, it was more than seven times last year’s revenue. Furthermore, Spiderman was the third-highest grossing movie EVER.

Over at Cineplex, the story is similar. A strong recovery is demonstrating that there’s significant pent-up demand. People miss going to the movie theatre. Attendance was strong in the fourth quarter of 2021 and all signs point to a much stronger 2022. Conventional wisdom was wrong about oil and gas a few years ago – it said oil and gas was dead, but now it’s booming. I believe it’s wrong again.

Cineplex and others are remaking and transforming their business

Despite all of these strong indications, Cineplex is not sitting on its laurels. Management is not blind to the fact that although streaming won’t kill the movie exhibition business, it does have a negative impact. So, for the last few years, they’ve been working hard on strengthening the business. For example, Cineplex has expanded its higher priced VIP theatres. Also, they’ve introduced a membership program. Finally, Cineplex might one day even increase its pricing, charging higher prices for better seats.

Cineplex has also been working hard on diversifying the business. For example, the company has entered the gaming business, opening up gaming complexes and venues. Also, digital media and advertising have been solid add-ons to the business.

Motley Fool: the bottom line

In short, all of this points to a strong recovery that’s not priced into the stock price of Cineplex. Conventional wisdom is often wrong and this is a good example. Even a pandemic isn’t keeping movie watchers away from Cineplex’s theatres. Attendance is rebounding strongly as open theatres mean booming revenues even after two years of disruptions.