It’s not every day that the idea of a lifetime comes along. Granted, we have had a few in the last five years. Still, these ideas are not easy to come by. In this Motley Fool article, I’ll discuss one such idea. It’s one of the best stocks to buy right now, because it’s a company that will be relevant for a very long time. In fact, if everything works out as planned, this company will disrupt the energy market that powers vehicles. The disruptor I’m referring to is Ballard Power Systems (TSX:BLDP)(NASDAQ:BLDP).

Here are the three reasons to buy and hold Ballard Power stock forever.

Ballard Power stock: This disruption takes time, patience, and energy

Ballard Power is a leading global provider of innovative clean energy and fuel cell solutions. These fuel cells already power transportation vehicles such as buses and trucks with zero emissions. So, you can see the growth potential here. The move toward clean energy is gaining steam, and Ballard is benefiting with a leading presence in this market. In fact, more and more countries and companies are choosing Ballard’s fuel cells to power their buses, trains, trucks, and even ships.

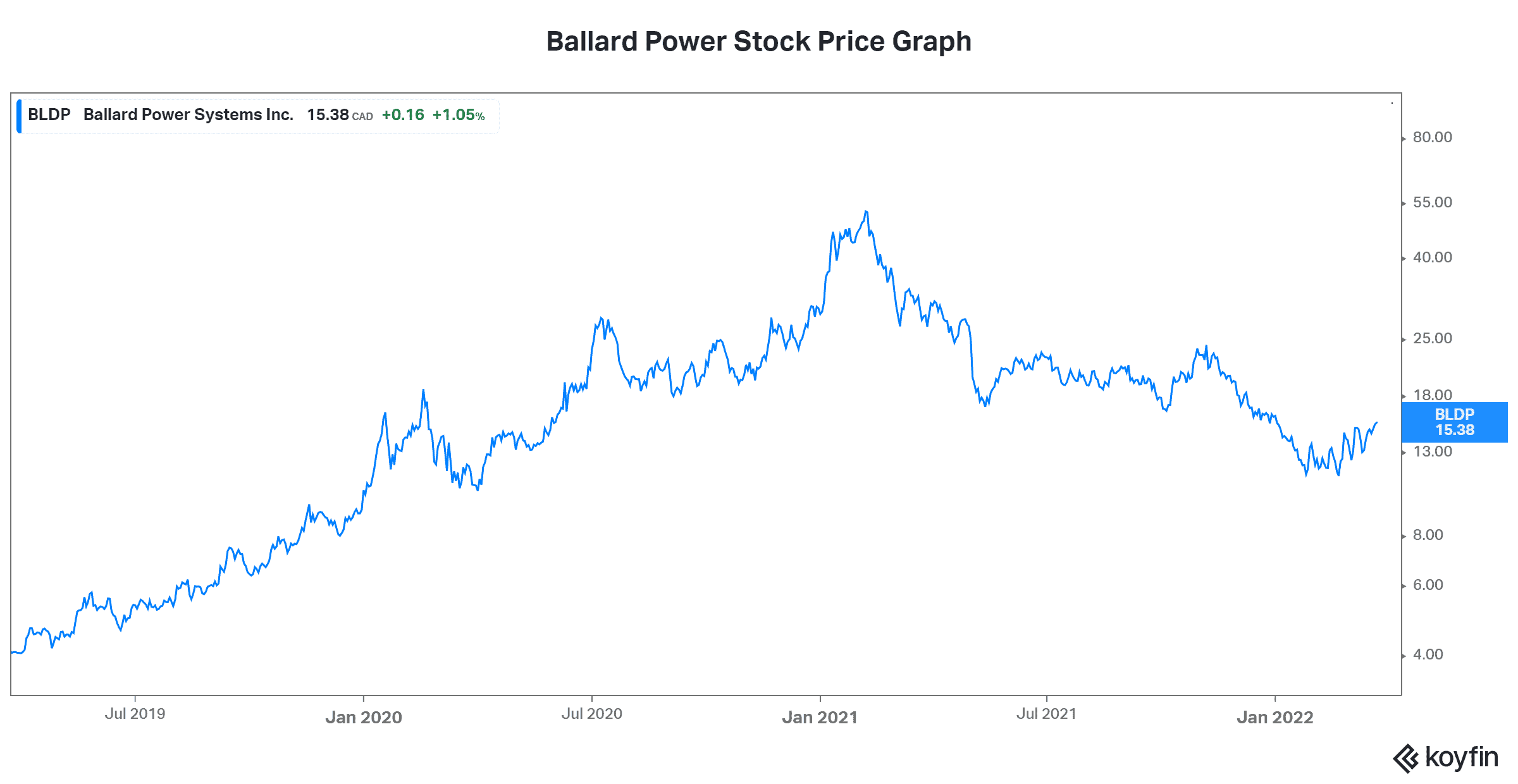

I would like to draw your attention to some good news for those of us looking to build a position: Ballard Power stock has fallen 71% from its 2021 highs. That’s part of what makes it one of the best stocks to buy right now. Now, let’s get to the more difficult part. The reality is that Ballard Power is a company that’s just beginning its journey of success. The fuel cell industry remains in its infancy, and this means that there’ll be lots of volatility ahead.

But don’t fear this, because the evidence supporting fuel cells keeps building. Also, the evidence supporting Ballard Power continues to build. So, we really need patience if we want to participate in this potential. Because while the evidence keeps building, at times, it can feel painstaking. For example, after many years of negative, erratic, and unimpressive revenue growth, many shareholders might have been tempted to give up. But patience was warranted, and the latest quarter was very promising. In fact, revenue increased 28%, with heavy duty motive revenue (61% of total revenue) increasing a spectacular 89%.

Ballard Power wins more customers from everywhere

It seems that all over, there’s increasing interest in Ballard’s fuel cells. Whether we’re talking bus, rail, or truck operators, interest and deployments are growing. Similarly, whether we’re talking Europe, China, or North America, leaders have expressed their interest in fuel cells and, increasingly, their belief in Ballard.

For example, Canada’s CP Rail has embarked on a pilot program to test Ballard’s fuel cells for its trains. Also, looking at Ballard’s backlog, we can see a marked improvement in its quality. While it declined versus last year, it shows a marked shift. It shows a diversification by region and, by vertical, that demonstrates the increasing acceptance of Ballard and its fuel cells.

In fact, in 2020, Ballard’s backlog was made up of only 20 customers with meaningful orders. In 2021, its backlog had over 30 customers with meaningful orders. Also, North America and Europe now make up a more significant portion of backlog (60% versus 40% in 2020).

Ballard Power increases its market size forecast

Last year, Ballard’s management provided us with a forecasted market size for bus, rail, truck and marine fuel cells. The estimated market size at that time was calculated to be $130 billion. In early March, Ballard updated its forecast. The estimated market size is now over $250 billion. This almost 100% increase in the market size estimate is a reflection of the interest and orders that are flowing in at this point. It has pleasantly surprised many.

Motley Fool: The bottom line

The bottom line here is that Ballard Power has a huge growth runway ahead. While there will be setbacks and volatility, this company is on a mission to decarbonize the heavy-duty mobility market now, with more to come in the future. This is one of the best stocks to buy right now — this disruption will take time, but the reward has the potential to be astronomical.