Defensive investors are likely on edge in today’s market conditions. A mixture of high inflation, pending interest rate hikes, geopolitical tensions, supply chain disruptions, and tech sector earnings misses have come together to infuse the markets with high volatility.

With the prospect of a bear market and/or stagflation on everyone’s minds, investors are on the hunt for stocks that perform well under these conditions. With that in mind, let’s take a look at my top large-cap pick: Fortis (TSX:FTS)(NYSE:FTS), a Canadian-based utility company.

Fortis: Low volatility

What makes Fortis especially appealing to defensive investors is its low beta — a measure of how much a stock moves compared to the broad market. A beta of one is considered to be as volatile as the market, while is two is twice as volatile, 0.50 is half as volatile, and negative one is inversely volatile.

Fortis has an incredibly low beta of 0.10 as of right now. This gives it great stability and downside protection from market movements. If the market crashes, Fortis will still be affected but to a much lesser degree. This makes a great anchor and smoother for the equity portion of any portfolio.

Fortis: Excellent fundamentals

Fundamentals-wise, Fortis has a healthy balance sheet, with ample cash reserves and relatively low long-term debt, which is crucial for any utility company. The company also has very good operating margins, with sustainable cash flows that should allow it to maintain profitability.

Moreover, the company pays a solid dividend yield of 3.50% and has a 48-year streak of quarterly dividend increases. These characteristics make it an excellent choice for dividend-growth portfolios. Buying Fortis after a crash can help you lock in a low yield on cost.

Fortis vs. the market

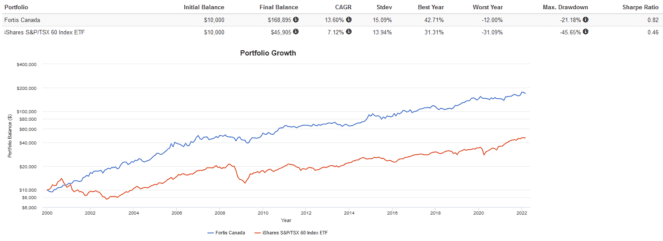

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

That being said, from 2000 to present with all dividends reinvested, Fortis significantly outperformed the S&P/TSX 60 Index in terms of total returns, best year, max drawdowns, and Sharpe ratio. It also had a much lower correlation to the U.S. market, which is a huge bonus for diversification.

Overall, a portfolio consisting of 100% Fortis had significantly better risk-adjusted returns thanks to its low volatility and dividend growth. If you’re going to buy and hold a single stock forever, you could do a lot worse than Fortis. If you’re implementing a dividend-growth strategy, Fortis should absolutely be one of your core holdings.

The Foolish takeaway

A combination of low beta, strong balance sheet, and increasing dividends makes Fortis a great defensive stock pick during volatile market conditions. Nonetheless, if you chose to actively invest in Fortis or any other single stock versus an index fund, ensure you stay up to date on the latest financial filings, earnings reports, and corporate actions. Doing so will keep you appraised of any material risks that arise.