This week, Dollarama (TSX:DOL) reported its fiscal 2022 earnings that were quite strong considering the environment. In response, Dollarama stock has rallied 5.5% off this. This earnings report is important for Dollarama, of course. But it’s also an important barometre of what’s happening and what’s to come for all retailers. We can use the findings to help inform our investment decisions going forward.

Without further ado, let’s review Dollarama’s earnings result.

Dollarama sees its stock price rise 5.5%, as fiscal 2022 results highlight its resilience

- Same-store sales rose 1.7% for the year and 5.7% in Q4, despite COVID-19 restrictions.

- Traffic rose 4%, signaling the strong demand for Dollarama’s value proposition.

- EBITDA increased 13.4% to $1.28 billion.

- Quarterly dividend was increased 10%.

What happened in FY2022 for Dollarama?

Dollarama’s fiscal 2022 was with on and off COVID-19 restrictions. Understandably, this negatively affected results, although they’re really good considering the environment. Yet these results are not reflective of the reality of the opportunity. They are, however, reflective of Dollarama’s resilience. The return to positive increases in traffic is a key trend which signifies that Dollarama’s value proposition is alive and well.

There were supply and logistical challenges that Dollarama had to deal with during the year. There were also inflationary pressures. The company is pulling all levers to successfully manage these. For example, it’s “refreshing” the stores. This means that it’s focusing more on goods that drive traffic and sales. Also, it’s optimizing packaging and reducing costs wherever it can.

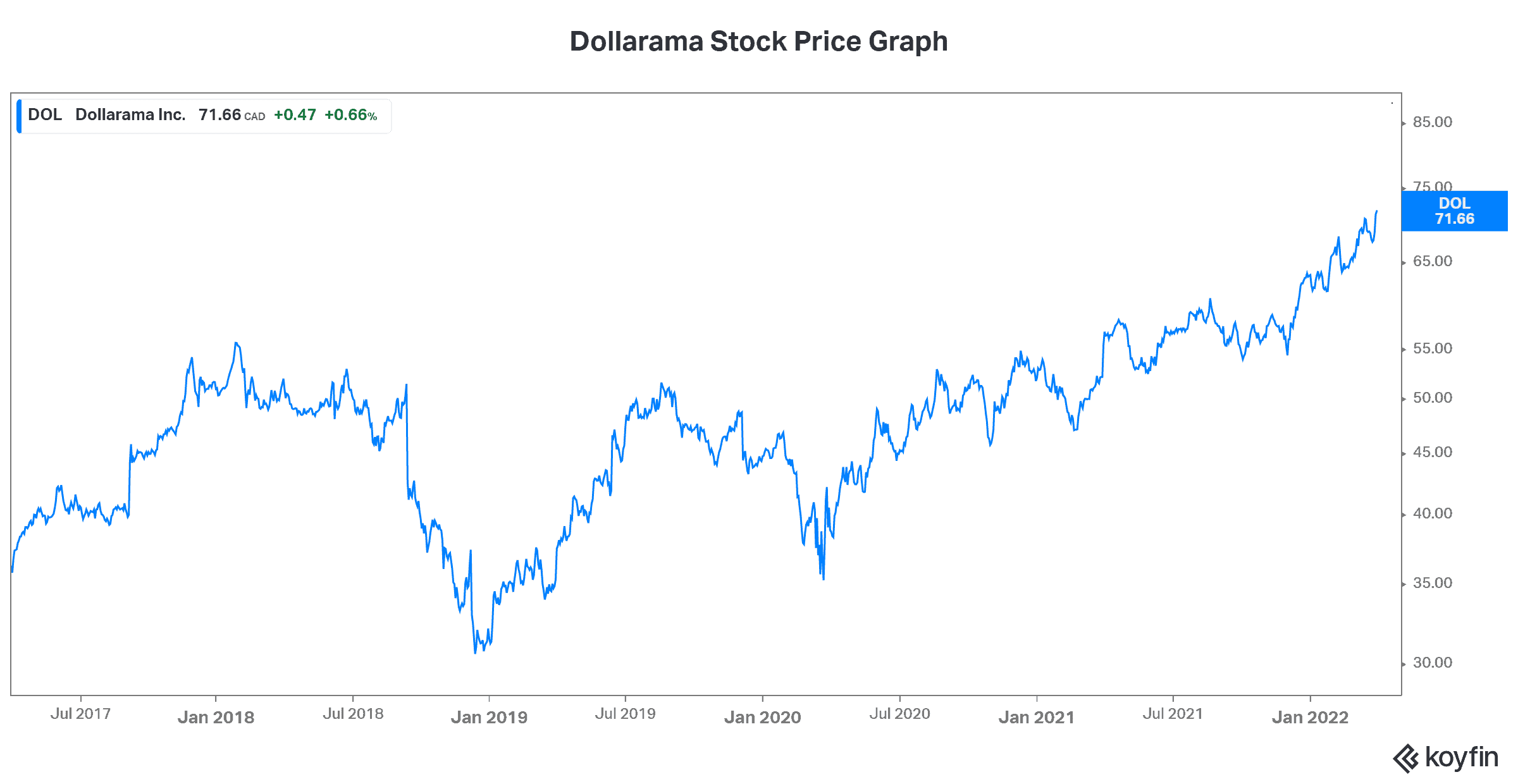

It’s no wonder that Dollarama has seen its stock price soar 5.5% this week and 90% in the last five years.

What did management say?

While Dollarama focused on the strength of its business, management also recognized the real issue of upward cost pressures.

“The issue is logistics and involves mostly overseas challenges and port challenges along with inflationary challenges. All this goes into cost of goods sold eventually and retail prices go up. There’s huge pressure on all retailers to increase prices.”

With this, we can at least be clear about the difficulties that lie ahead.

What’s next for Dollarama?

Fiscal 2023 will be a challenging year. However, Dollarama is focused on maintaining its value proposition and its strategic focus for the long term. We can expect Dollarama to introduce new price points this year, for the first time in six years. This is indicative of the real inflationary pressures out there. Price points of up to $5 will be gradually and carefully introduced this year. This will help mitigate the pressures, but it is no silver bullet. Inflationary pressures will still bite.

Despite this, Dollarama still expects to meet its target for new stores and will add 60-70 new stores this year. Rising costs will hit hard in 2023, but the company still expects same-store sales growth in the 4-5% range. Profitability and growth have definitely slowed first due to the pandemic and now due to inflationary and cost pressures.

Dollarama stock has increased 26% versus the S&P/TSX Index’s rise of 16%. Dollarama’s excellence cannot be denied.