Real estate investment trusts, or REITs, have many distinct advantages over regular dividend stocks. This makes them appealing for passive-income investors. For example, their sole purpose as a publicly traded stock is to pass on their earnings to shareholders. They also pay little, if any, taxes. So, as a result, compared to dividend stocks, they consistently pay out a comparatively larger portion of their earnings as dividends. Chartwell Retirement Residences (TSX:CSH.UN) is a special kind of REIT. This is because it owns and operates retirement residences — a market that’s growing along with the aging population.

Without further ado, here are the main reasons why I think that Chartwell is a stock to own for passive income for life.

Chartwell is a REIT that’s ready for post-pandemic life and an aging population

It is no secret that in North America, the biggest demographic trend at work today is the aging population. This has already shifted dollars away from certain industries and toward others and will continue to do so. In fact, this shift will accelerate in the years to come as this demographic trend increasingly takes hold. As an investor, I want to be positioned in those companies that will benefit from this shift. I want to own those companies that will see a natural uptick in demand for their products and/or services for the simple fact that they are in the right business that caters to this aging population.

Chartwell REIT is one such company. Despite the hit that it continues to take due to the pandemic, it’s chugging along, preparing for post-pandemic life. In fact, management estimates that they will achieve a 95% occupancy rate for 2025. The population is still aging, and Chartwell continues to meet this need for senior living quite well. Also, leading indications are pointing to a recovery in the business. For example, leasing activity in February was approximately 60% higher versus one year ago.

Chartwell is a REIT that provides reliable passive income

In 2021, revenue at Chartwell declined 2.4% and net income declined 32%. Costs soared, and people were scared to go into retirement homes due to COVID-19. On a brighter note, cash from operations was $156 million, and the dividend was stable. This has been a money-losing business during the pandemic, but the hope and the expectation is that this will change. For now, debt remains cheap, so Chartwell’s strategy of acquiring and renovating properties is still viable.

So, we’ve touched on the struggles that Chartwell continues to face. Essentially, falling occupancy levels combined with rising costs are hitting it hard. Occupancy has fallen to the mid-70% range, and costs are soaring due to staffing shortages and COVID-related expenses. But this has not interfered with Chartwell’s ability to pay dividends. Today, Chartwell is sitting on a history of strong dividend reliability. In fact, in the last 10 years, the annual dividend has grown 17% to the current $0.60/share.

A 4.7% dividend yield makes Chartwell attractive for passive-income investors

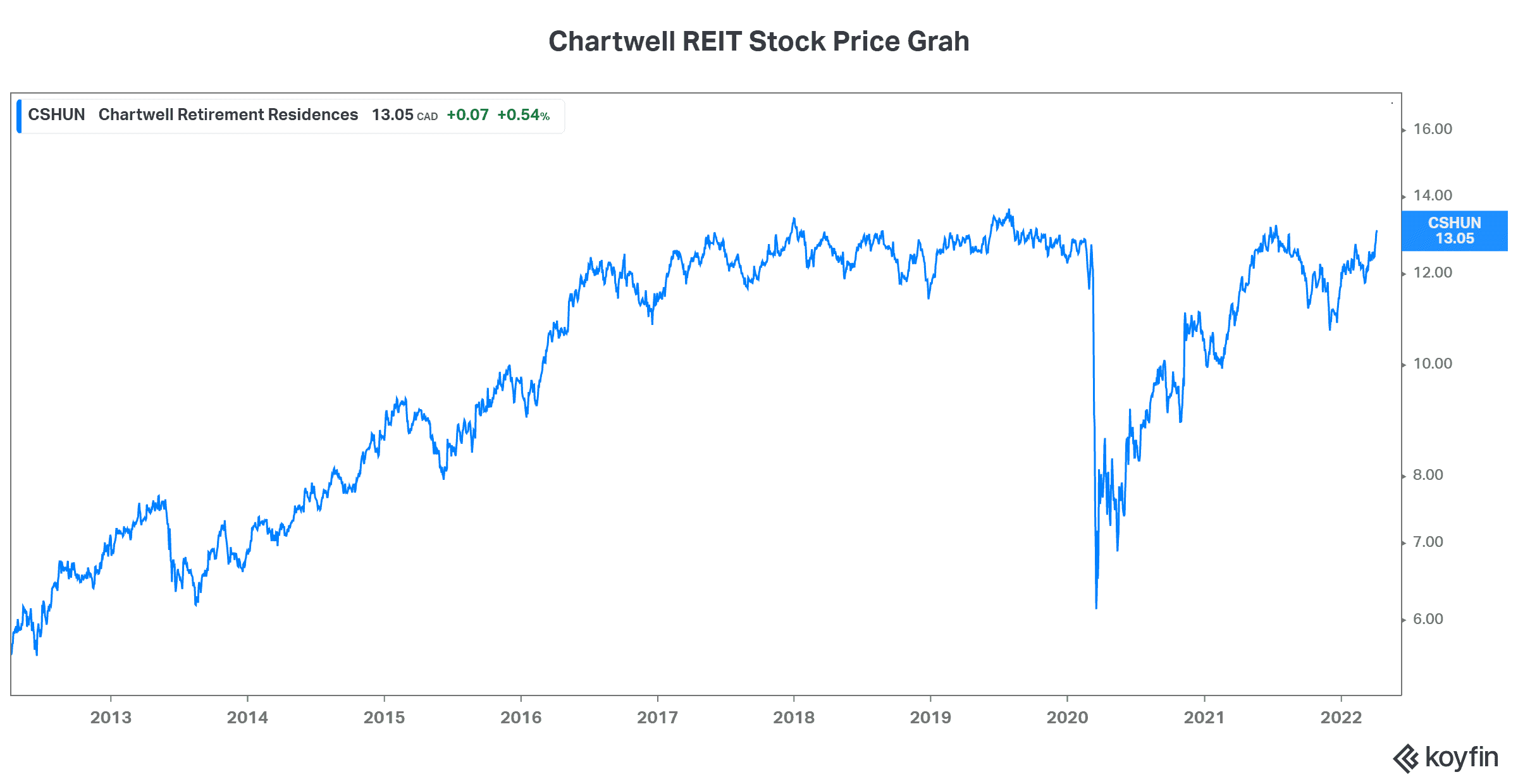

Given the size and predictability of Chartwell’s dividend, it’s clearly of interest to investors looking for passive income. Right now, Chartwell continues to trade below pre-pandemic levels, and that’s totally expected. Looking ahead, I think that the long-term thesis will play out. In particular, I believe that Chartwell will continue to expand and secure better occupancy rates, driving better income and cash flows. This makes it attractive here at these levels.

Motley Fool: The bottom line

Quality REITs/dividend stocks like Chartwell are hard to find. It has a real estate portfolio that’s benefitting from strong secular trends, and this tailwind will remain for years to come. Chartwell is the largest retirement residence in Canada with room to grow in a post-pandemic environment.