Canadian oil stocks have pleasantly enjoyed a nice rebound out of the depths of the COVID-19 pandemic. It is wild to believe that at one point in 2020, oil prices were trading at negative prices. In 2022, WTI crude oil (a good benchmark) has soared as high as US$115 per barrel. Today, WTI is trading just below US$100.

Oil stocks are gushing free cash flow

While the energy industry was essentially left for dead, it is now gushing tonnes of free cash flow. Many companies took the pandemic collapse as an opportunity to reduce operating costs, lower leverage, and consolidate the sector.

As a result, many top Canadian oil companies can produce sustainable free cash flow with oil as low as US$40 per barrel. At prices over US$100, the excess cash is all gravy to investors. Earlier this year, well-known oil fund manager Eric Nuttall tweeted, “Every day above $80WTI is a phenomenal day … Average [free cash flow] yield (to equity) at $80WTI of the energy stocks I follow in Canada? 29%!”

Geopolitical and supply risks are not likely to abate anytime soon

Certainly, today there is a significant amount of geopolitical risk factored into the price of oil. However, these risks are not likely to abate soon. That is especially true if European nations increasingly reduce their reliance on Russian oil.

As a result, Canadian oil stocks could continue to perform well in 2022 and beyond. Any day over US$80 is a good day for Canadian oil and the odds favour many good days ahead. Here are two hot Canadian stocks to consider buying on the recent pullback.

Cenovus: A top Canadian oil stock

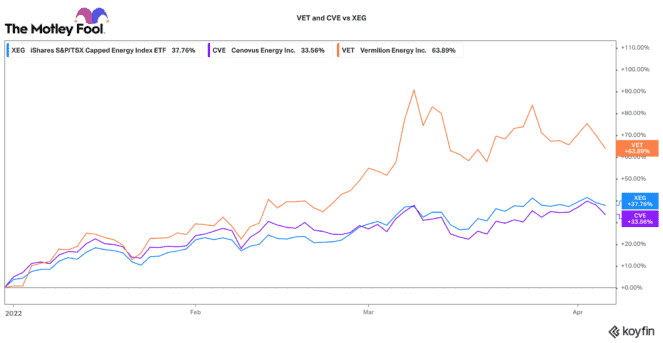

If you want a lower-risk, large-cap stock that still has ample upside, Cenovus Energy (TSX:CVE)(NYSE:CVE) looks interesting. While this oil stock is up 33% year to date, it has lagged the S&P/TSX Capped Energy Index by about four percentage points.

Over the past year, ConocoPhilips has been selling out of a 10% stake in Cenovus. This large-scale selling action has put a cap on the shares to an extent. Fortunately, Conoco should close its position in the back half of 2022.

In the meantime, Cenovus has been doing a lot of things right. It has drastically been reducing debt. In fact, given its improved financial position, the company recently closed its hedging program. Consequently, the company should have great exposure to elevated prices.

While this oil stock only pays a 0.65% dividend today, management hinted that shareholders should see cash returns in the coming quarters. That could include share buybacks and an attractive increase to the dividend.

Vermilion: A riskier turnaround stock

If you are looking for a very cheap oil stock, you can’t find much better than Vermilion Energy (TSX:VET)(NYSE:VET). This oil stock is up 63% year to date. However, at $26 per share, the stock is nearly half what it traded in 2018.

Vermilion operates a mix of oil and gas assets in Europe, Australia, and Canada. It has a large stake in a natural gas play near Ireland that has been enjoying historic gas pricing. Today, the company is trading at a near 40% free cash flow yield. It only trades for five times earnings, and the stock is very cheap.

The company is quickly paying down debt and improving its balance sheet. Likewise, it added a new oil play that should significantly increase its reserve life. This is a riskier oil stock to buy, but it could still have significant upside, even from here.