When you’re building your portfolio, it’s a smart idea to keep some key things in mind. Obviously, you want to be aware of the risk you’re taking with every specific stock. But also, you want to consider the risk that you’re taking with your total portfolio. Risk is often overlooked, as investors go for the highest returns. I understand this, but it does not lead to optimal results. Don’t forget to mitigate your downside risk.

Whether you own 10 stocks or 30 stocks, diversification will help you achieve a lower risk level and more stable returns. In this article, I list one gold stock and one metals stock that should be considered in order to help diversify your portfolio of stocks.

Diversification is sound investing for everybody for a better risk/return profile

We would all like to think that we can choose the one or two stocks that will provide us with explosive returns. And sometimes we can. But other times, it becomes painfully clear that this is not an easy thing. Timing, market psychology, and unforeseen events can throw a wrench in any good stock idea. So, in order to proactively position ourselves for success, we must think about diversification.

Simply put, diversification reduces your exposure to any one stock and/or sector, thereby reducing the overall volatility of your portfolio. It mutes the highs, but it also limits the lows. This is valuable when we’re investing our hard-earned money. Really, isn’t stability what we really want from our investments?

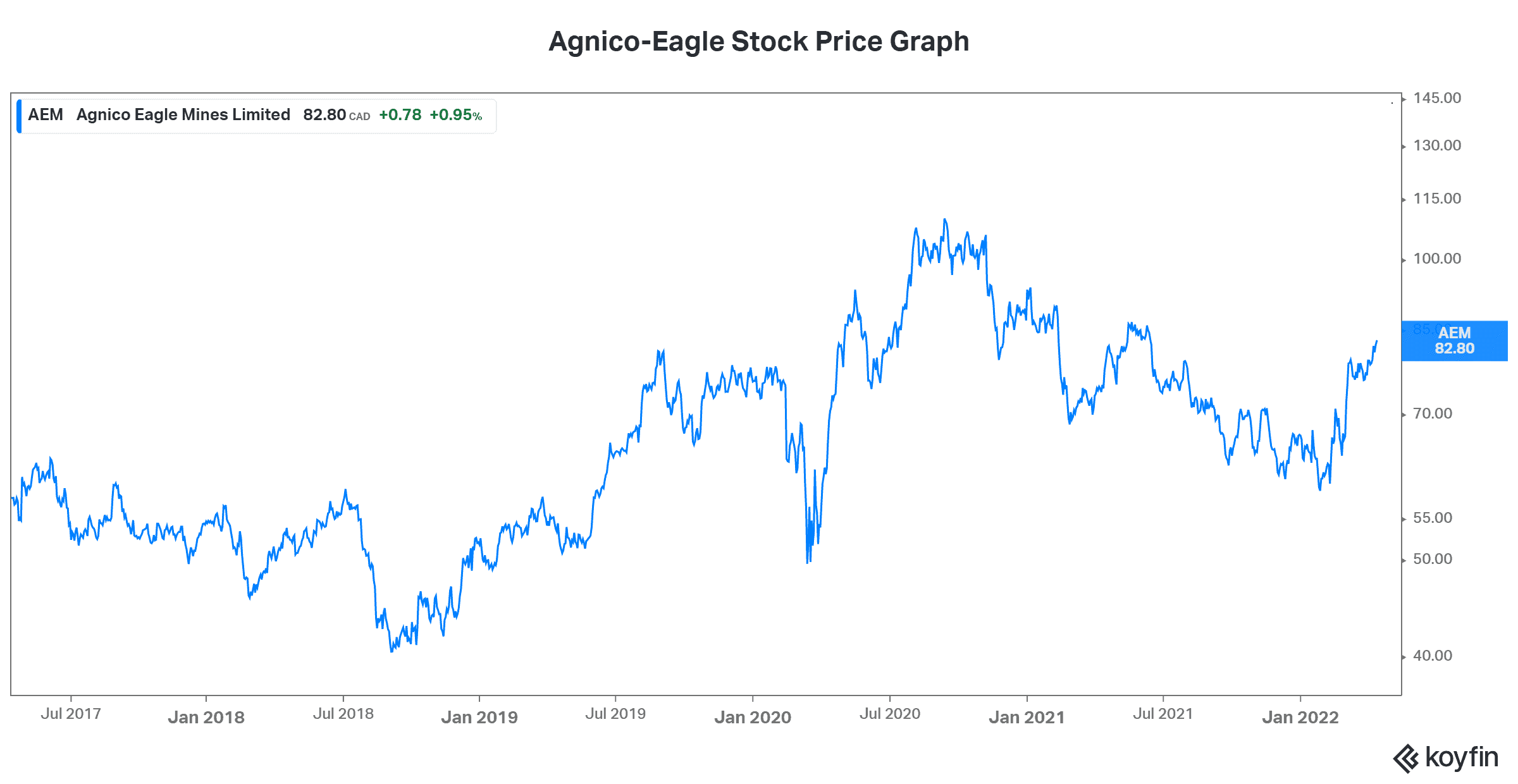

Agnico-Eagle Mines: A gold stock to combat inflation and diversify your portfolio

Gold prices are closing in on US$2,000 per ounce. This represents a 13.5% one-year increase and a 54% five-year increase. Needless to say, this is quite significant. While investors were busy making money in all of the hot sectors, many missed this. Today, I see this shifting. Inflation is rising, so we must look for those stocks that’ll provide shelter from this destruction of the value of money.

Gold stocks are those stocks. They can provide us with diversification that will benefit us greatly in the coming months and years. While the stocks that have been the winners in the last few years take a “break”, I believe that gold stocks will be on fire. There are two reasons why I believe this. The first reason is just the magnitude of the increase in gold prices in the last five years. The second reason is the fact that gold stocks have underperformed greatly during this time period, and they totally don’t reflect the fundamental picture that’s changed. Therefore, they’re severely undervalued as a group.

Agnico-Eagle Mines (TSX:AEM)(NYSE:AEM) is my favourite gold stock right now. This $37 billion company has its assets in politically safe, pro-mining jurisdictions. This means places like Canada and Europe. Also, Agnico’s cash flows are soaring, as rising gold prices make their way to the company’s bottom line.

Management has recently spoken about being very optimistic about the future. Reserves are growing, synergies are exceeding expectations, and shareholders are benefiting big. For example, at year-end 2021, management instituted another dividend increase. This time, the dividend increased 14%. In the last five years, Agnico’s dividend has grown at a compound annual growth rate of 30%.

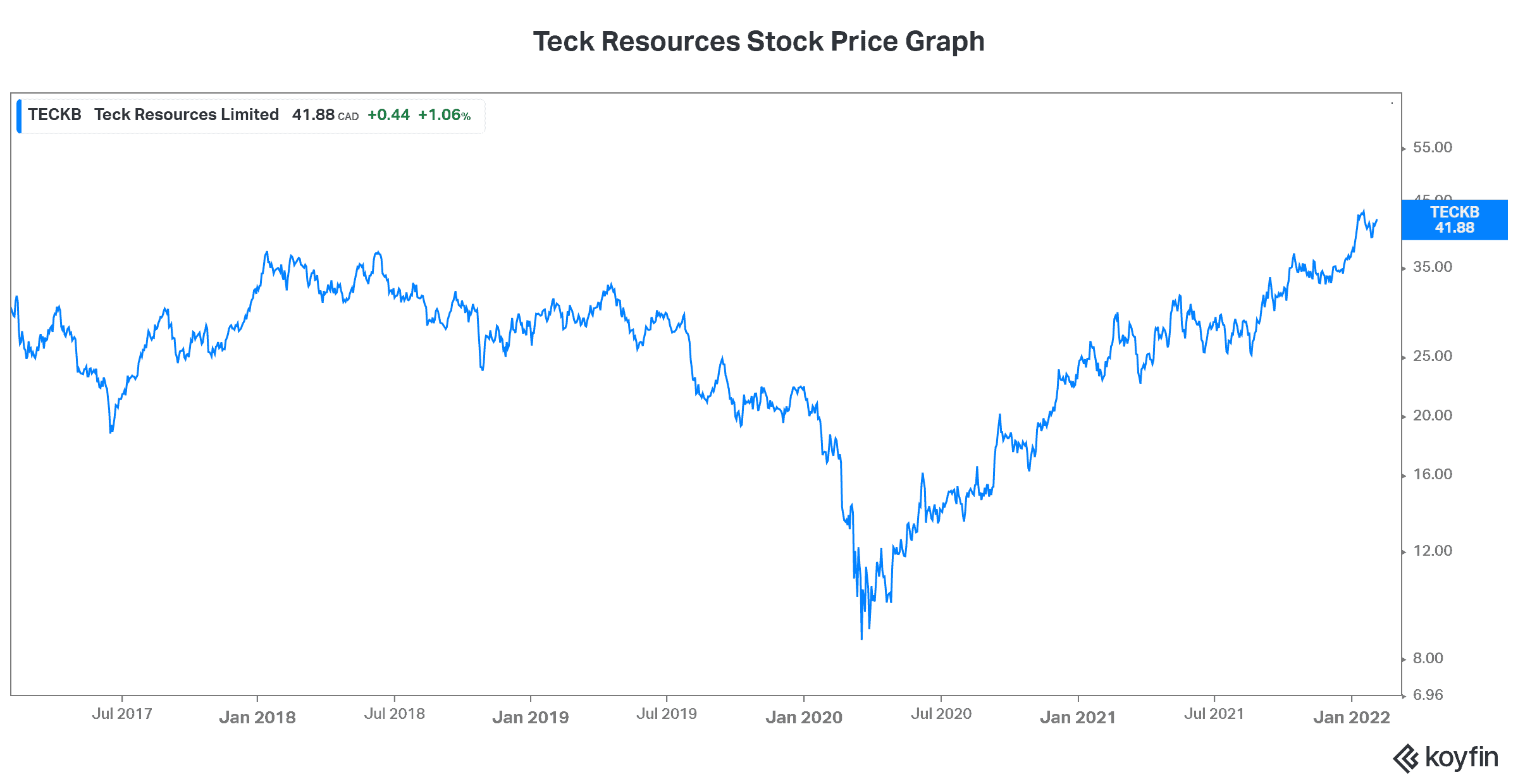

Teck stock: A metals stock that’s riding high on strong commodity prices

Teck Resources (TSX:TECK.B)(NYSE:TECK) is a $16.5 billion diversified mining, smelting, and refining giant. It has operations in Canada, the U.S., Chile, and Peru. The company has major positions in different base metals markets. It also has a 21% interest in Canada’s Fort Hills oil sands project. These are all huge assets. As a result, the firm is cranking out tonnes of cash flow.

As a commodity play, Teck stock can really diversify your portfolio to benefit from good times in commodity cycles. Today is one of those times, and Teck’s soaring cash flows are proof of this. In the latest quarter, Teck’s quarterly EBITDA increased threefold to $2.5 billion — a quarterly record. It’s no surprise that Teck stock has rallied significantly in the last year!

Motley Fool: The bottom line

In closing, diversification can offer stability, growth, and long-term success to your investing life.