As you all know, the energy sector has been the best-performing sector on the TSX in the last year. Still, there’s every reason to believe that this outperformance will last. Next week, we will hear from many energy companies, as they’ll be reporting their earnings results. This should bring more good news to an already very happy party. Now, the question becomes, “How much higher can these energy stocks go?”

Let’s take a look at which companies will be reporting this week and attempt to answer this question.

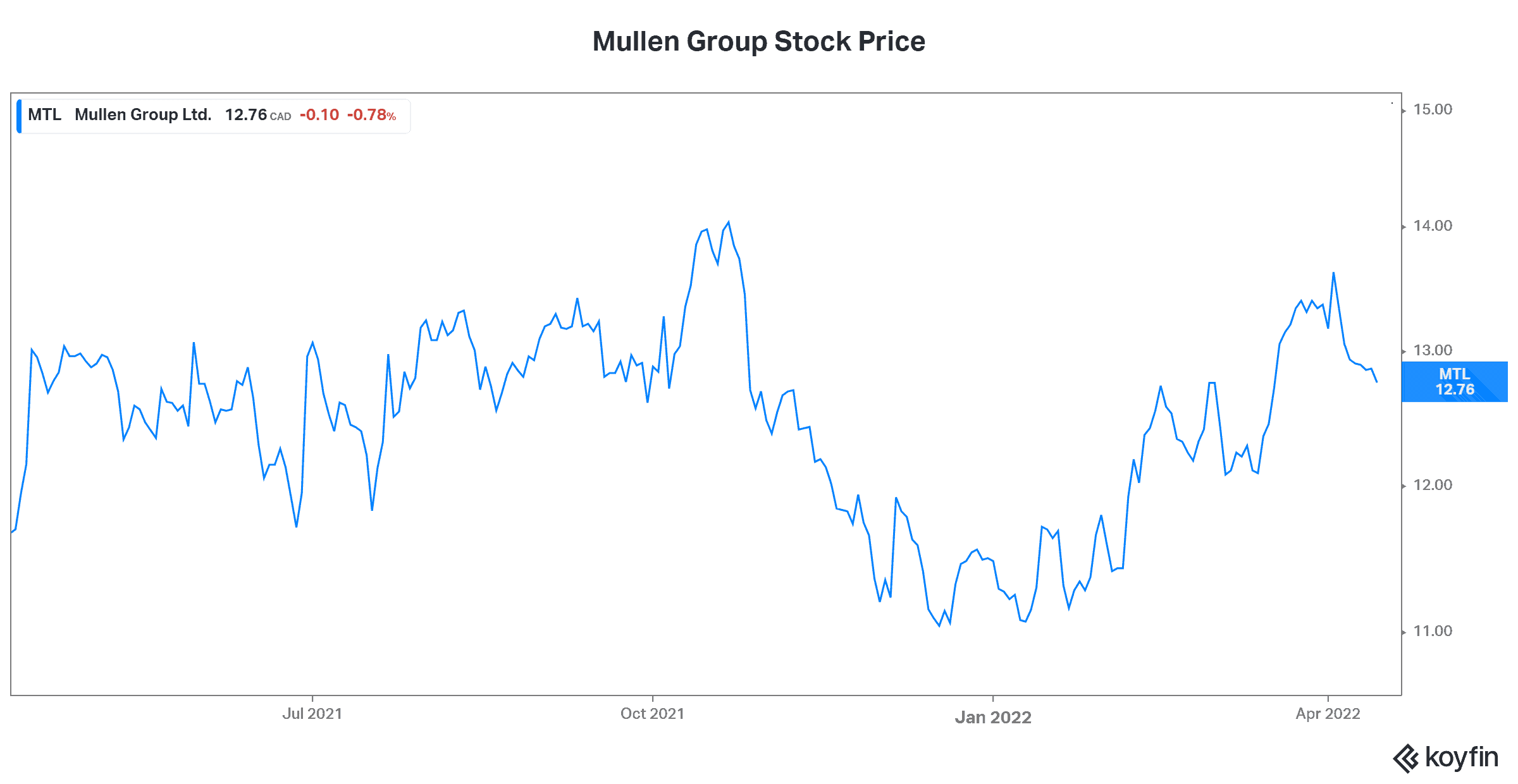

Mullen Group: Not just an energy stock

Back when the energy sector was at its lows, Mullen Group (TSX:MTL) benefitted from its diversification. In fact, to this day, Mullen is a nicely diversified company. The intention behind this diversification is clear. The oil and gas industry is a very cyclical industry. There’s a lot that’s out of the control of any individual oil and gas company.

So, Mullen made the decision to diversify into the transportation industry. In fact, last quarter, the segment that includes revenue from the energy sector, the specialized and industrial services segment, accounted for less than 20% of revenue.

Looking ahead to next week’s earnings report, consensus analyst expectations are calling for EPS of $0.17. This compares to $0.13 in the same period last year, and it reflects a healthy 30% growth rate. Mullen’s less-than-truckload segment was the strongest performing in Q4. It registered a 45% revenue growth rate. However, in next week’s report, I would expect that Mullen’s oil and gas related business will show a nice recovery and spike higher.

Mullen remains a very well-managed company. It has strong cash flow generation, and it’s attractively valued.

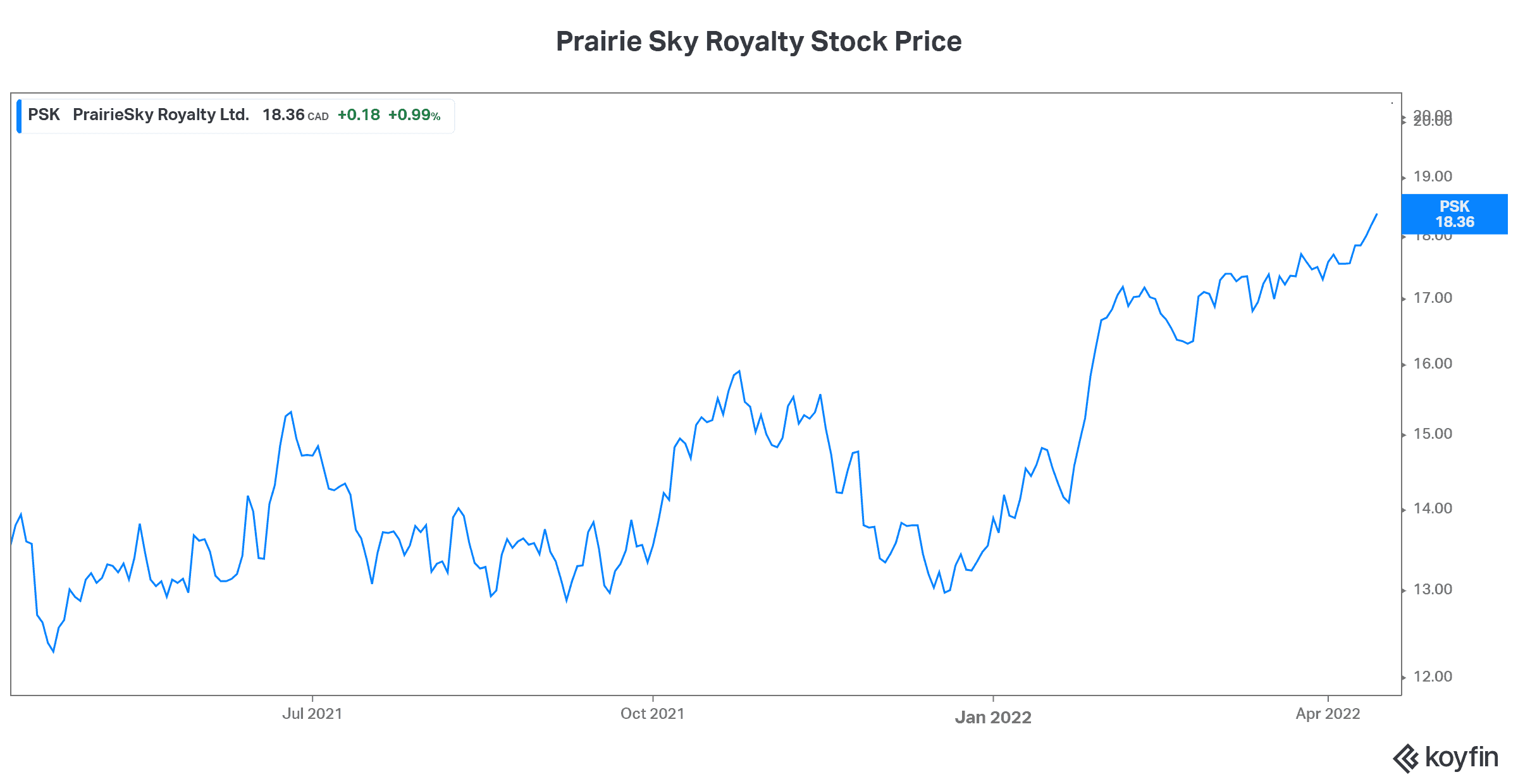

Prairie Sky Royalties: Lower-risk play on the energy sector

Kicking off the week, we have Prairie Sky Royalty (TSX:PSK) reporting on Monday. Prairie Sky has a diverse portfolio of oil and gas royalty lands. The stock has been strong lately, as the oil and gas sector has been booming. As a royalty company, its stock is relatively less volatile versus other energy stocks.

So, Prairie Sky is scheduled to report on Monday. Analysts are calling for EPS of $0.26 versus $0.08 in the same period last year. This represents a more than doubling of its earnings. The company’s dividend yield is only 2.6% and its payout ratio is low at only 57%. Could we possibly be due for a nice dividend increase next week from Prairie Sky? I think so.

Profitability is high at Prairie Sky, and risk is relatively low. This is the beauty of its royalty business model. I think we can expect good things from Prairie Sky next week, as the oil and gas sector continues to impress.

Motley Fool: The bottom line

After reading this article, it may be glaringly obvious that any company involved in the energy sector is booming these days. Oil and gas prices have continued to surpass expectations and show strength as we progress through 2022. Therefore, I think it’s safe to say that these companies will continue to beat expectations.