When you think of energy stocks, what do you think of? Does the prolonged cyclical low of the mid-to-late 2010s scare you off? Or are you eager to gain exposure to this now booming sector? Well, wherever you sit, if it’s on the fence, read on. In this article, I discuss two leading energy stocks that provide very generous and growing dividend yields. They’re on the lower end of the scale in terms of risk, but in terms of potential reward, the upside has just begun.

Without further ado, here are two high-yielding energy dividend stocks that you should consider buying to beef up your energy exposure.

Energy stocks make an impressive comeback

There’s nothing wrong with being wary of oil and gas stocks. It’s a very cyclical industry that’s difficult to forecast. As a case in point, we have the latest cyclical boom. Prior to this boom, most opinions that I heard were negative on oil and gas. There were some voices, including mine, that were talking about the value in the sector, but they were few and far between.

Today, the energy sector is booming. And this makes sense. Lower supply combined with soaring demand has provided a big boost to the sector. Essentially, we need energy, and renewable energy is not even close to being able to replace oil and gas. So that means that oil and gas will be needed for a while longer, maybe even decades.

Freehold Royalties: a 6.5% yielding dividend stock for the risk averse, just increased its dividend by 33%

For those of you out there who are still unsure, start with Freehold Royalties Ltd. (TSX:FRU), a Canadian oil and gas company engaged in the production and development of oil and natural gas. It’s different than other energy companies because it’s a royalty. What that means is that there’s less risk involved with this name. Freehold collects royalties from other companies who are actually taking on the exploration and production risks. In turn, it becomes one of the best dividend stocks.

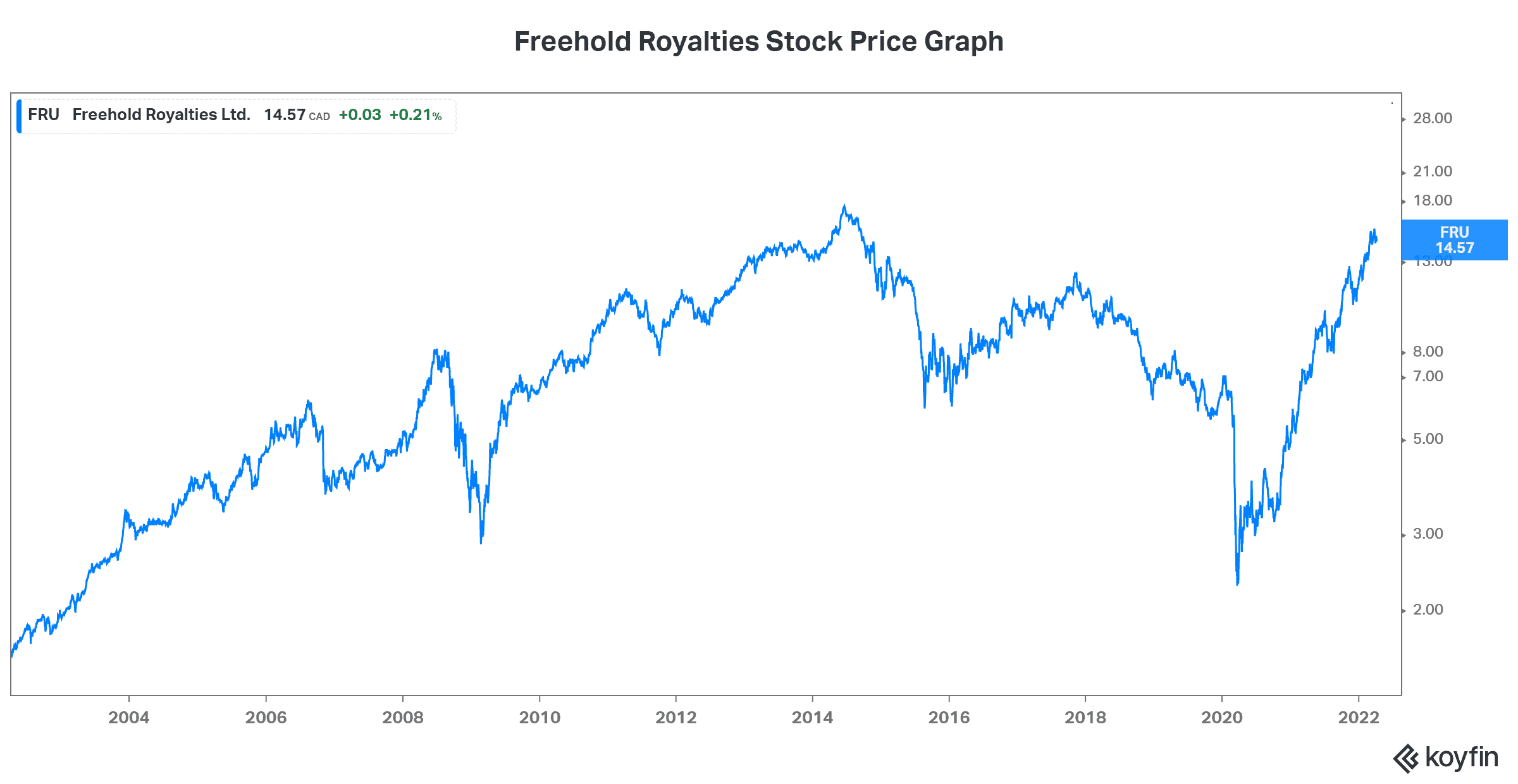

Freehold’s stock price is soaring as oil and gas prices soar. Its dividend is also soaring. This comeback has been a long time coming. Today, Freehold stock is finally on the rise again, making up for all the value it lost in the difficult years. See the chart below to get a sense of the kind of moves I’m talking about.

At this time, revenue, income, and cash flows are soaring. In fact, in the fourth quarter, funds from operations rose 211% to $68.8 million, the highest amount in the company’s 25-year history. It’s a similar tale everywhere in the oil and gas sector. Soaring commodity prices are leading to soaring cash flows, which is leading to spikes in dividends. It’s payday for these company and for the holders of energy stocks. It won’t last forever, cycles never do, but right now it looks like there’s more good times to come.

Peyto Exploration: an energy stock that’s soaring on strong natural gas fundamentals

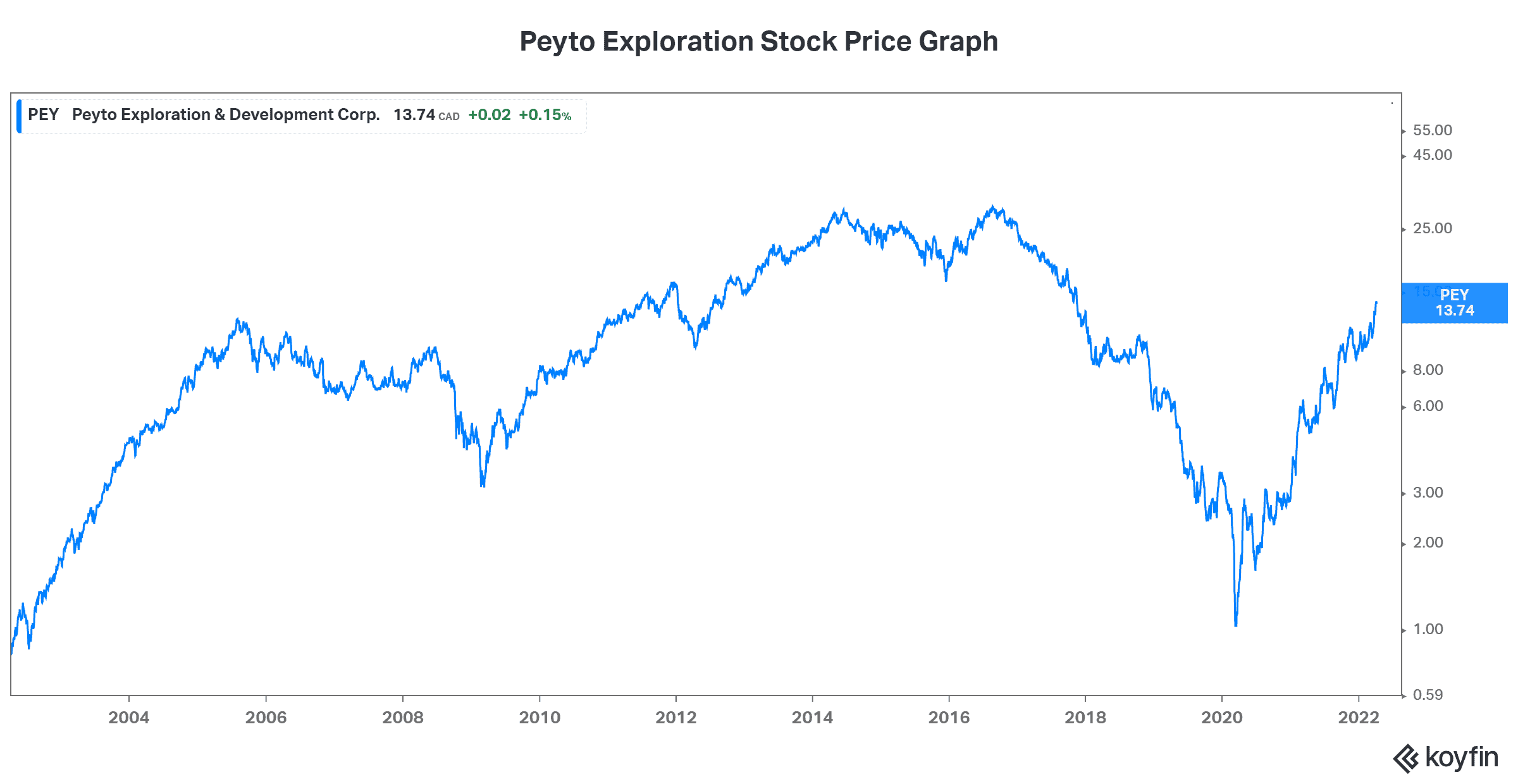

This natural gas producer is in an even better position. As I see it, natural gas has a longer runway for growth. This fuel is in high demand right now, not only on our continent but also globally. Essentially, developing countries are still relying heavily on coal. Yet, many of them are eager to move away from this harmful energy source. Natural gas is an affordable solution for them. Canadian natural gas is among the cheapest and cleanest out there so it’s a natural choice. LNG capacity is ramping up and this means that the future looks very bright for Canadian natural gas producers like Peyto Exploration and Development Corp. (TSX:PEY).

Peyto Exploration was always a high quality, operationally sound natural gas producer. Today, it’s booming. It’s a dividend stock that’s yielding 4.3% and this is rising rapidly as cash flows are soaring. Natural gas will almost certainly be part of the global energy solution. Peyto is extremely well positioned.

Motley Fool: the bottom line

The energy stocks discussed in this article are not only high yielding, but also financially stable companies. Consider buying them today for exposure to the energy boom and for strong, growing dividends.