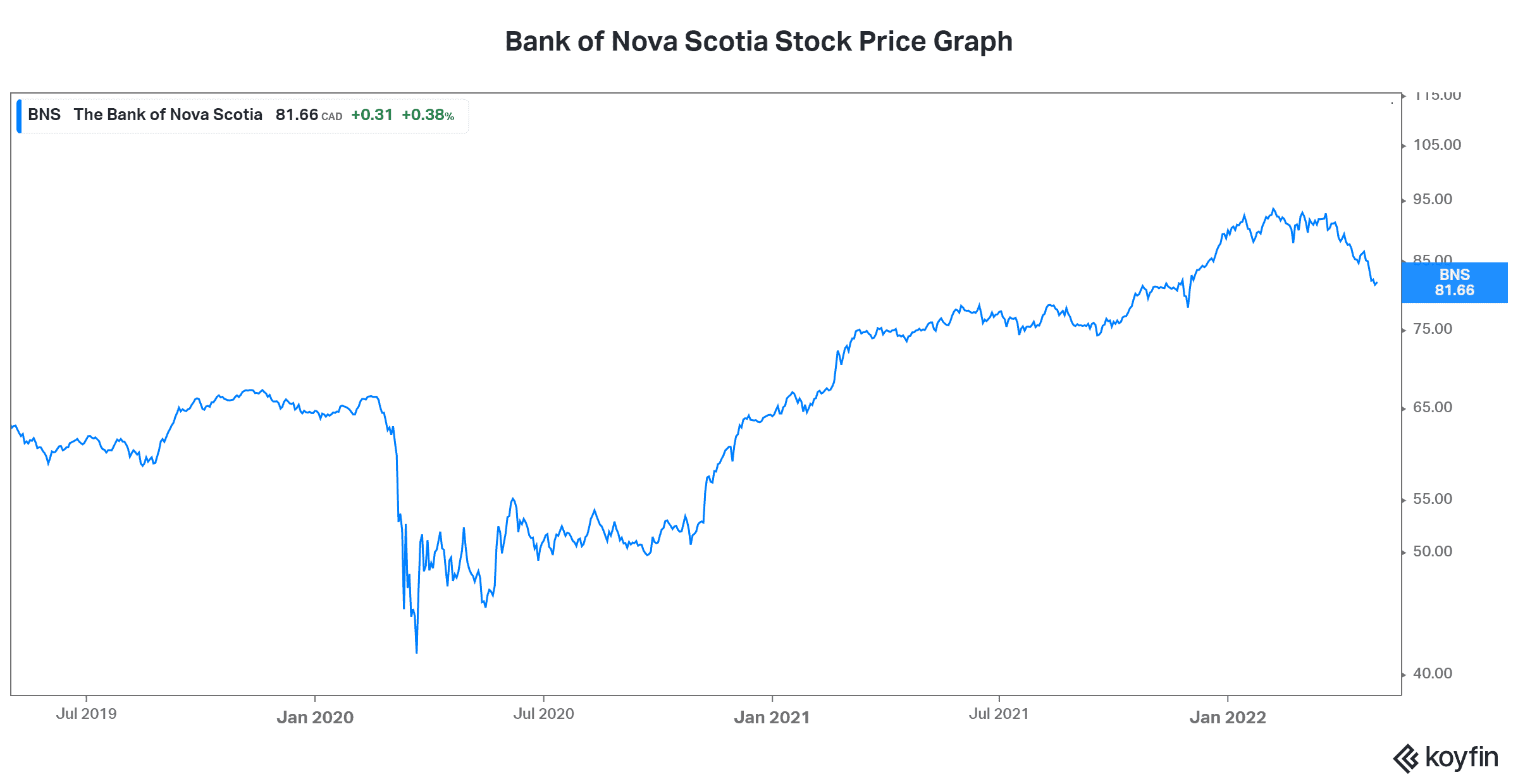

Shareholder returns at Canadian banks took a nosedive in 2020. This was true of all banks regardless of their geographic and/or business mix breakdown. But since then, banks and bank stocks have come back with a vengeance. For example, Bank of Nova Scotia (TSX:BNS)(NYSE:BNS) stock is up 63% from its 2020 lows. Today, shareholder returns are on the rise, and bank stocks are pillars of strength once again.

Here are two Canadian bank stocks that are offering tremendous value for investors. They’re both trading below peers. They’re both sitting pretty as we head into a period of rising interest rates.

Bank of Nova Scotia stock: Once Canada’s most “international” bank

Let’s get back to Bank of Nova Scotia. This bank is among the banks with the largest international exposure. In fact, 20% of its earnings comes from international banking. Obviously, these earnings have a different risk/reward profile than traditional North American earnings. At times, the relative risks can be too high. But at other times — like today — this diversification is exactly what’s needed.

In recent years, Bank of Nova Scotia repositioned its footprint in order to reduce its risk profile. This meant reducing its international exposure. Essentially, the bank narrowed its focus. Today, it has concentrated its exposure to Latin American countries. These countries offer a growth profile that’s unmatched in Canada or the United States. There are simply many key reasons to be there. According to management, Chile’s “poverty rate has dropped to single digits.” Also, “banking penetration in Mexico is only 35%.” While social unrest remains a risk, things are improving. The upside is big.

So, Bank of Nova Scotia stock is trading at multiples well below its peers — by almost a full point. Similarly, the bank’s dividend yield is higher than its peers — 4.9% versus the industry average of 4%. In my view, this reflects the past — a time when the bank was involved in very high-risk countries, including Egypt and Turkey. Today, the “international” focus is on four Latin American nations, Mexico, Peru, Colombia, and Chile. These countries have democracies that are enabling a growing middle class. Therefore, they’re attractive for the banking business.

Bank of Montreal: The underdog Canadian bank

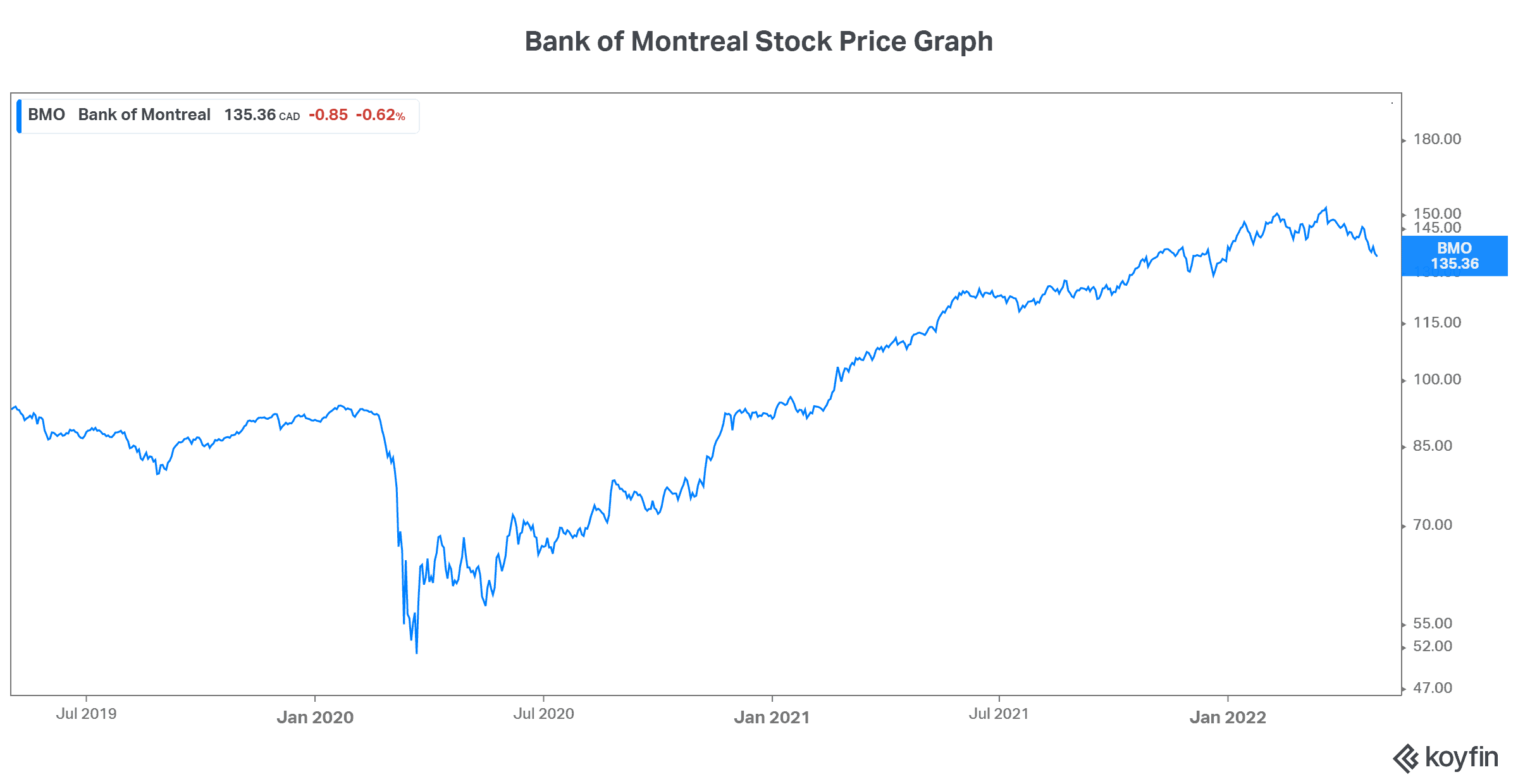

Bank of Montreal (TSX:BMO)(NYSE:BMO) is the fourth-largest Canadian bank by market capitalization. It’s also the eighth-largest bank by assets.

Like all banks, BMO is set to benefit from rising interest rates. As rates rise, banks make more money. This happens as the banks take advantage of the difference between how much they pay to consumers and the rate they can achieve through their own investing. The increase of the interest rate spread falls straight to the bottom line, and net interest income rises.

But unlike other Canadian banks, Bank of Montreal has one of the least significant exposures to the Canadian personal and commercial banking (P&C) industry. And this makes it even more interesting. Rising interest rates will invariably cause credit challenges. BMO will be less susceptible here, which is a definite positive.

Today, Bank of Montreal stock is also trading below its peer group. Yet, returns are rising fast, as BMO continues to execute well. All banks, including Bank of Montreal, have had a great move in the last year. Bank of Montreal looks attractive here. I would look for its discounted valuation versus its peers to narrow going forward.

Motley Fool: The bottom line

Canadian banks have really performed phenomenally well over the last couple of years. Today, rising interest rates and continued growth promise to keep the good times coming. Bank of Montreal and Bank of Nova Scotia, in particular, are looking good. They’re trading below their peer group, yet they’re performing well and have strong outlooks.