You don’t need a lot of capital to start investing in the stock market. The key is to save regularly and to invest regularly. For most people, a passive-investing approach is the best place to start. Buying a market index has been a reliable way to build wealth.

Indexes are perfect for passive investors

Had you put $5,000 into the S&P 500 Index (often called the SPDR) a decade ago, it would be worth $17,738 today! No research, limited effort, and limited cost was required to buy the index, and yet the return is still attractive.

ETFs are great for sector and thematic positioning

If you wanted to take it one step up, you could consider buying exchange-traded funds (ETFs). With ETFs, you can focus on stock sectors, themes, or specific market segments such as dividend stocks or energy stocks. These can have varying level of fees, so just keep in mind how much that can eat up your overall returns.

Overall, ETF investing can be a way to be involved in the market, but with a broader focus. It can be a great way to earn solid returns over time as well.

DIY stock investing can significantly propel wealth

Lastly, investors can take a do-it-yourself (DIY) approach to picking and buying individual stocks. This involves research, due diligence, and active management of your own portfolio.

It can be a lot of work. It can also be a great educational experience and a lot of fun. Most importantly, it can be a great way to capture outsized gains and build long-term wealth.

In fact, with a DIY investing strategy, you could potentially turn $5,000 into +$45,000 in as little as 10 years. That doesn’t include regular investment contributions to stocks. Long-term returns could be significantly better if you added monthly or annual contributions to your investments. If you want to multiply $5,000 into +$45,000 or more, here is one way you could do it.

How one stock could turn $5,000 into $47,7000

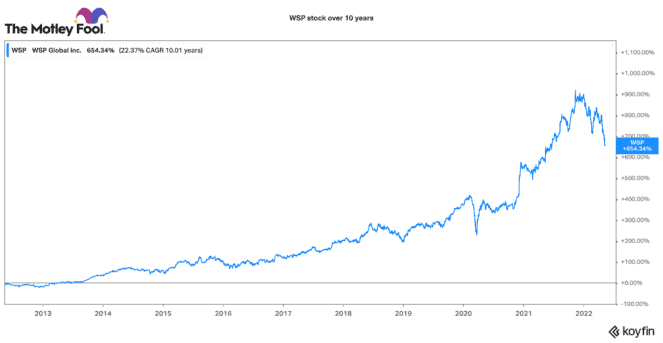

One stock you could consider putting $5,000 into today is WSP Global (TSX:WSP). It has become one of the largest design and consulting firms across the world. Based out of Montreal, it has 55,000 professionals working across the globe. WSP has grown both organically and by acquisition. It has added over 20 firms to its platform since 2012.

Since 2016, it has grown net revenues and adjusted EBITDA by 61% and 165%, respectively. That has translated into a 25.3% compounded annual total return for the stock.

The company just announced a new three-year strategic plan. It is targeting 30% revenue growth, 40% adjusted EBITDA growth, and 50% net earnings growth in that period.

That plan doesn’t factor any acquisitions either. To date, it has been very successful at acquiring and integrating acquisitions into its platform. Given that the company trades at the low end of its leverage range, chances are very high that it can afford further acquisitions in the coming years.

WSP Global stock could be a great long-term pick

If you were to apply WSP’s historical rate of return (25.3%) into the future, $5,000 could become as much as $47,700 in as little as 10 years.

Of course, this is not guaranteed. However, given the company’s scale, large market opportunity, and solid management, I think investors will be very happy they bought and held onto this stock for a very long time.