Welcome to a series where I break down and compare some of the most popular exchange-traded funds (ETFs) available to Canadian investors!

The benchmark S&P 500 Index is down over 16% year to date as a result of rising interest rates and high market volatility. The current correction could be a great buying opportunity, though. Thankfully, both Vanguard and BlackRock provide a set of low-cost, high-liquidity ETFs that offer exposure to the S&P 500.

Both of these ETFs are currency hedged to CAD. If you’re unfamiliar with how currency hedging works, give this article a read first. If you’re knowledgeable about the topic and want to invest in a currency hedged ETF, read on for the best pick.

The two tickers up for consideration today are Vanguard S&P 500 Hedged to CAD Index ETF (TSX:VSP) and iShares Core S&P 500 Hedged to CAD Index ETF (TSX:XSP). Which one is the better option? Keep reading to find out.

VSP vs. XSP: Fees

The fee charged by an ETF is expressed as the management expense ratio (MER). This is the percentage that is deducted from the ETF’s net asset value (NAV) over time and is calculated on an annual basis. For example, an MER of 0.50% means that for every $10,000 invested, the ETF charges a fee of $50 annually.

VSP has an MER of 0.09%, and XSP has an MER of 0.10%, making them virtually tied on this front. For a $10,000 portfolio, this amounts to a difference of $1 per year. Still, if we had to pick a winner, it would be VSP by a slim margin.

VSP vs. XSP: Size

The size of an ETF is very important. Funds with small assets under management (AUM) may have poor liquidity, low trading volume, high bid-ask spreads, and more risk of being delisted due to lack of interest.

VSP has attracted AUM of $1.9 billion, whereas XSP has AUM of $7.6 billion. Although both are sufficient for a buy-and-hold investor, XSP is currently the more popular ETF among Canadian investors.

VSP vs. XSP: Holdings

Both VSP and XSP track the S&P 500 Index, which is comprised of the largest 500 companies listed on U.S. exchanges, diversified across various sectors like technology, health care, financials, communications, consumer staples, consumer discretionary, industrial, and energy. The index is widely seen as a barometre for overall U.S. stock market performance.

Both ETFs therefore hold the same underlying stocks via their USD-listed ETF counterparts as a “wrapper.” The structure doesn’t make a discernible difference for investors, but it’s good to understand.

VSP vs. XSP: Historical performance

A cautionary statement before we dive in: past performance is no guarantee of future results, which can and will vary. The portfolio returns presented below are hypothetical and backtested. The returns do not reflect trading costs, transaction fees, or taxes, which can cause drag.

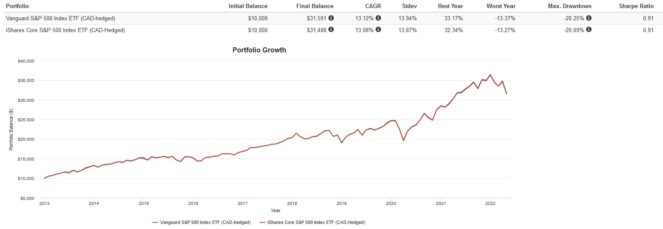

Here are the trailing returns from 2013 to present:

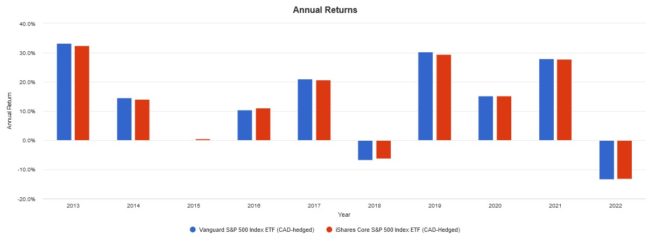

Here are the annual returns from 2013 to present:

Both ETFs had nearly identical returns, volatility, and drawdowns, and will likely do so moving forward. Your choice here really boils down to a coin toss.

The Foolish takeaway

Both ETFs have nearly identical management expense ratios and performance. The only difference here is AUM, and that gap isn’t really significant enough to choose XSP over VSP. If you’re fond of BlackRock, pick XSP. If you idolize Jack Bogle, buy VSP.