If you are new to investing in the Canadian stock market, 2022 is a perfect time to start. With the S&P/TSX Composite Index down 4% this year (and many Canadian stocks down much, much more), you may be asking why.

Well, buying stocks in down markets is the best way to maximize long-term returns. Stock prices come down and valuations become attractive. In many instances, you can buy the same stock at nearly a quarter or even half the price of last year.

Use volatility to your advantage

As acclaimed investor Warren Buffett once said, “The true investor welcomes volatility … a wildly fluctuating market means that irrationally low prices will periodically be attached to solid businesses.” He practices what he preaches, because he has been loading up on public stocks over the past few months.

If you want to follow his charge and start building a quality investment portfolio, here are three diverse Canadian stocks I would consider picking up today.

One of the best-performing Canadian stocks

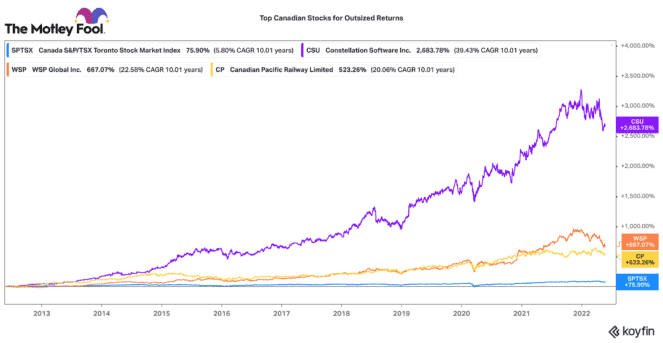

Every Canadian should own some stocks that have a long history of compounding shareholder returns. You can’t get much better than Constellation Software (TSX:CSU) in this regard. Since 2007, it has delivered an annual average return of 35%. In that time, investors have enjoyed over 8,000% total returns!

Constellation is unique for its strategy focused on acquiring small, niche software businesses across the world. The company has a de-centralized operational model that allows its business segments to nimbly deploy cash. Last year, it deployed over $1.3 billion into new businesses!

At some point, this will translate into very strong earnings and cash flow growth. This Canadian stock is down 16% in 2022. That is one of the greatest declines in its history. If you look at the chart, any major dip has been an exceptional buying opportunity for patient investors.

A recession-resilient stock

Another great Canadian compounder stock is WSP Global (TSX:WSP). Like Constellation, it has a solid history of delivering value for shareholders. Over the past 10 years, it has delivered a 20.5% annual average return. Those returns have accelerated over the past few years.

WSP is quickly becoming one of the largest engineering, design, and consulting firms in the world. It has grown by acquisition, but it also has a strong internal pipeline of growth as well.

WSP has a great balance sheet, a strong brand, and a recession-resilient business model. This year, its stock has declined 27%, making for a great long-term entry point.

A top Canadian infrastructure stock

If you are looking for a faithful Canadian blue-chip stock, Canadian Pacific Railway (TSX:CP)(NYSE:CP) should be on your radar. Canadian railroads operate in a duopoly, so competition is limited. Given Canada’s size, CP’s rail network is crucial to the economy.

CP stock is down 8% since April. It had several weather challenges in the first quarter of 2022. Likewise, supply chain issues have been a headwind. However, the second half of the year looks optimistic, and the company is confident it will see volumes and operating efficiency ratios recover to normal.

Not to mention, CP is in the works of fully integrating Kansas City Southern Railway into its network. This is subject to regulatory approval. However, it could be transformational by creating a leading North America-wide railroad.

Over the past 10 years, CP has delivered near 20% average annual returns. For a solid business with great upside, CP is a great Canadian stock to buy and hold today.